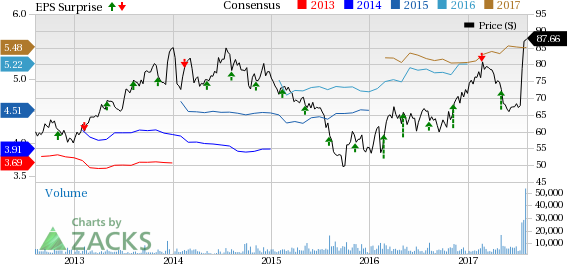

Scripps Networks Interactive Inc. (NASDAQ:SNI) , which is scheduled to be acquired by Discovery Communications (NASDAQ:DISCA) early next year, reported mixed results in the second quarter of 2017. The company’s earnings (excluding special items) of $1.79 per share surpassed the Zacks Consensus Estimate of $1.62. Also, the bottom line improved 26.06% on a year-over-year basis.

The company’s second-quarter operating revenues of $925 million fell short of the Zacks Consensus Estimate of $936 million. Revenues were up 3.6% year over year on strong TV advertising and distribution revenues in the U.S. Advertising revenues came in at $663.0 million, up 2.5% year over year, while Distribution revenues rose 7.3% to $239.7 million. On the other hand, Other revenues declined 1.5% year over year.

Second-quarter consolidated segment profits (on an adjusted basis) totaled $412.8 million, down 1.6% year over year. Quarterly operating income (on a reported basis) rose marginally to $374.08 million.

At the end of the second quarter of 2017, Scripps Networks had $131.6 million in cash & cash equivalents and $3.0 billion of debt on its balance sheet, compared with $122.9 million and $3.2 billion respectively, at the end of 2016.

Segmental Performance

U.S. Networks

Quarterly revenues came in at $779.0 million, up 3.6% year over year. Advertising revenues inched up 2.2% year over year to $552.7 million on continued strength in pricing in the U.S. advertising market for the company’s lifestyle offerings. Distribution revenues also increased 8.1% year over year to $211.9 million, driven by a rise in negotiated annual rate and revenues from new over-the-top distribution platforms.

Segmental (adjusted) profits came in at $398.7 million, down 1.5% year over year, driven by increase in expenses.

International Networks

Quarterly total revenue of $153.3 million was up 4.2% year over year. Segmental adjusted profits totaled $38.8 millioncompared with $37.4 million in the prior-year quarter.

Conversely, loss (adjusted) from the Corporate and Other segment widened to $24.7 million from $22.9 million a year ago.

Guidance for 2017

Revenues are expected to grow around 4% in 2017, down from the previous guidance of 6%, due to the softness in the U.S. market. Segmental profit for the year is anticipated to be flat, owing to increased programming, selling, general and administrative expenses. Previous guidance had called for a rise of approximately 3%.

Zacks Rank & Key Picks

Scripps Networks currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the broader Consumer Discretionary sector are Gray Television, Inc. (NYSE:GTN) and Sky plc (OTC:SKYAY) . Both stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Gray Television and Sky have gained 25% and 2% respectively on a year-to-date basis.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Gray Television, Inc. (GTN): Free Stock Analysis Report

British Sky Broadcasting Group (LON:SKYB) PLC (SKYAY): Free Stock Analysis Report

Scripps Networks Interactive, Inc (SNI): Free Stock Analysis Report

Discovery Communications, Inc. (DISCA): Free Stock Analysis Report

Original post

Zacks Investment Research