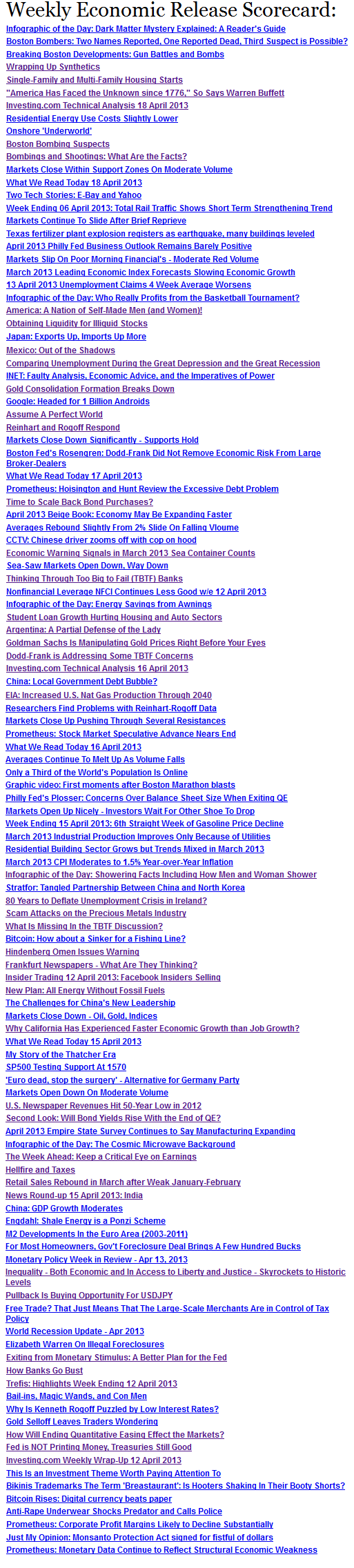

The inordinate growth of student loans – and its effect on the economy – is killing consumption (autos) and the housing sector. This is no short term dynamic, but will effect the economy for decades.

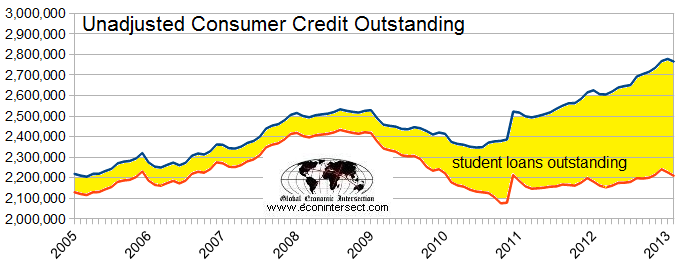

The USA is a consumer driven economy. A study released this week authored by Meta Brown and Sydnee Caldwell stated:

As a result of tighter underwriting standards, higher delinquency rates, and lower credit scores, consumers with educational debt may have more limited access to housing and auto debt and, as a result, more limited options in the housing and vehicle markets, despite their comparatively high earning potential.

Both these factors—lowered expectations of future earnings and more limited access to credit—may have broad implications for the ongoing recovery of the housing and vehicle markets, and of U.S. consumer spending more generally. While highly skilled young workers have traditionally provided a vital influx of new, affluent consumers to U.S. housing and auto markets, unprecedented student debt may dampen their influence in today’s marketplace.

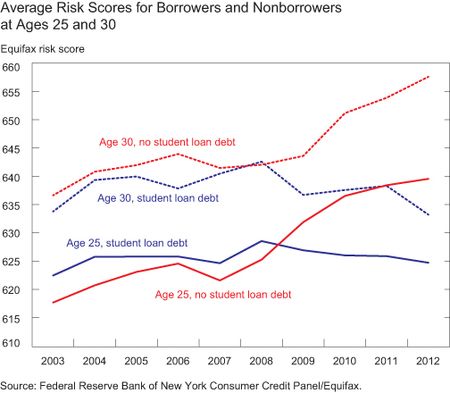

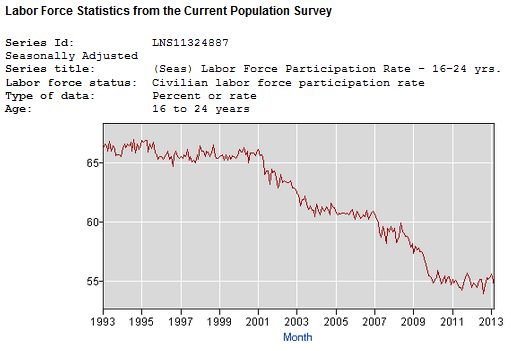

Some believe the lack of jobs is causing a higher than normal attendance in schools – but historical data from the BLS shows attendance appears moderating.

And there seems little correlation between the ability of the young to get jobs and enrollment in colleges / universities.

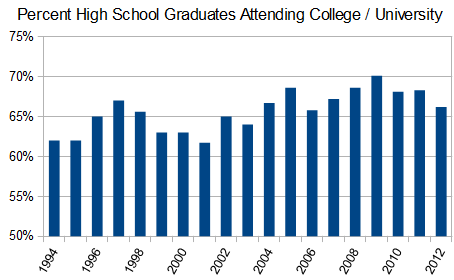

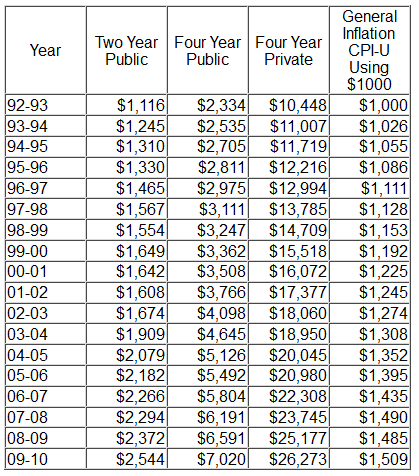

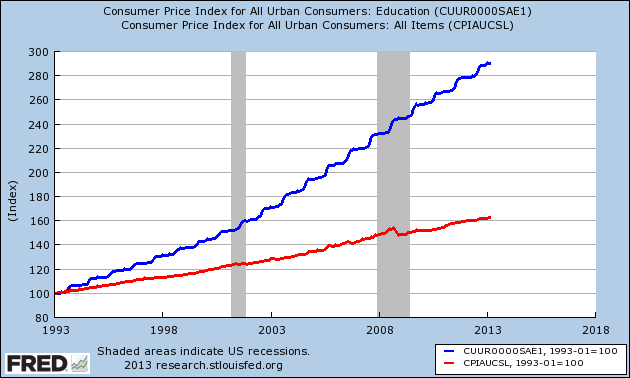

The student loan growth phenomenon seems to be directly related to cost inflation of education outstripping the general rate of inflation by significant multiples. The following table is from a study by Jordan Bowersox and Jonathan Breazeale.

Yearly Cost of Colleges / Universities

This study appears to correlate well with the associated BLS education cost index.

It is interesting to this author that economists talk about the economic drag by the baby boomers on the economy, but yet ignore the built in drag of higher education on the economy. The young are historically higher consumers than the old – yet the cost of education is weakening the ability of the young to consume.

As youth (especially educated / skilled youth) are a country’s future, the solution may be for the government to pay for education taking the burden off of the individual and giving it to society. The payback, instead of money, can be a period of government service as a thank you for their education.

Other Economic News this Week:

The Econintersect economic forecast for April 2012 improved marginally, and is now in a zone which says the economy is beginning to grow normally. There are some warning signs that our interpretation is not correct – but we will see how these play out in the coming months. Not to end on a negative note, the majority of pulse points are improving.

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

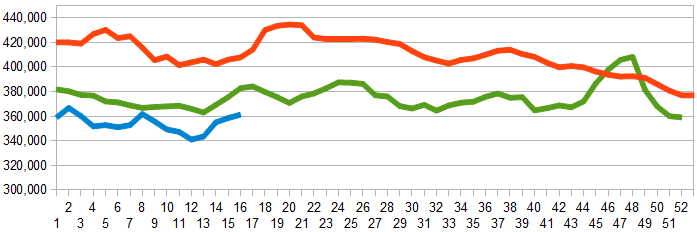

Initial unemployment claims increased from 346,000 (reported last week) to 352,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here).

The real gauge – the 4 week moving average – slightly worsened from 358,000 (reported last week) to 361,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: none

Data released this week which contained economically intuitive components(forward looking) were:

- Rail movements remain mixed.

- Industrial Production manufacturing subindex declined. One month is not a trend, but taken with other unusual data declines demands attention.

- Container counts dropped unexpectedly – with exports now contracting year-to-date. This tells you the global economy is contracting. Imports, which contracted year-over-year, is still positive year-to-date. Imports are intuitive for main street consumption.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks