The Bank of Nova Scotia (TO:BNS) reported third-quarter fiscal 2017 (ended Jul 31) results before the opening bell. Net income for the quarter came in at C$2.1 billion ($1.59 billion), jumping 7.1% year over year.

A rise in revenues largely drove the improved results. These were partially offset by elevated expenses and an increase in provisions. Improvement in capital and profitability ratios was impressive.

Revenues Rise, Partially Offset by Higher Provisions & Expenses

Total revenue was C$6.89 billion ($5.22 billion), up 3.8% year over year. A rise in net interest, as well as non-interest income led to the upswing.

Net interest income came in at C$3.83 billion ($2.9 billion), up 6.4% from the prior-year quarter. Non-interest income increased slightly from the year-ago quarter to C$3.06 billion ($2.32 billion).

Non-interest expenses were C$3.67 billion ($2.78 billion), rising 4.6% year over year. Higher salaries and employee benefits, along with elevated premises and technology expenses, led to the rise.

Total provision for credit losses was C$573 million ($434.2 million), slightly up year over year. The rise was mainly stemmed by higher provisions in retails, mostly offset by reduced non-retail provisions across all business units.

Improving Balance Sheet

As of Jul 31, 2017, Scotia Bank’s total assets were C$906.3 billion ($728.1 billion), almost in line with the prior-year quarter. Net Customer Loans and Acceptances were up 5.6% from the year-ago quarter to C$510.4 billion ($410.1 billion). Deposits came in at C$618.1 billion ($496.6 billion), decreasing 2.1% year over year.

Healthy Capital and Profitability Ratios

As of Jul 31, 2017, Common Equity Tier 1 ratio came in at 11.3% compared with 10.5% as of Jul 31, 2016. Further, total capital ratio came in at 14.8% compared with 14.1% in the prior-year quarter.

Return on equity for the reported quarter came in at 14.8%, in line with the year-earlier quarter.

Steady Capital Deployment

Concurrent with the earnings release, Scotia Bank announced a quarterly dividend of 79 cents per share, up 3 cents. The dividend will be paid on Oct 27 to shareholders on record as of Oct 3.

Our Viewpoint

A diversified product mix and strong capital position will help Scotia Bank grow organically, as well as through acquisitions. Though mounting expenses remains a concern, the export-driven economy of Canada is likely to benefit from gradual recovery of the U.S. economy, in turn aiding the company’s sustainable growth over the long run.

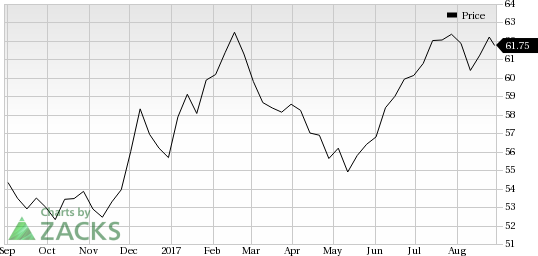

Scotia Bank currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Competitive Landscape

Deutsche Bank AG (NYSE:DB) reported net income of €466 million ($512.4 million) in second-quarter 2017, significantly up on a year-over-year basis. Income before income taxes more than doubled to €822 million ($903.9 million) on a year-over-year basis. Cost management and reduction in provisions were positive factors. However, lower revenues due to the trading slump were an undermining factor. Notably, net new money inflows were recorded during the quarter.

UBS Group AG (NYSE:UBS) reported second-quarter 2017 pre-tax operating profit of CHF 1.68 billion ($1.71 billion) on an adjusted basis, up around 1% from the prior-year quarter. Results displayed increase in net interest income (up 22% year over year), along with net fee and commission income (up 5% year over year), partially offset by lower trading income (down 23% year over year). Notably, the quarter benefited from the company’s consistent focus on expense management.

Itau Unibanco Holding S.A. (NYSE:ITUB) posted recurring earnings of R$6.2 billion ($1.9 billion) in second-quarter 2017, up 10.7% year over year. Including non-recurring items, net income came in at R$6.0 billion ($1.87 billion), up 9.1% year over year. Results displayed a decrease in revenues and a solid balance-sheet position. Higher expenses and lower managerial financial margin were headwinds.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

See Stocks Now>>

UBS AG (UBS): Free Stock Analysis Report

Deutsche Bank AG (DB): Free Stock Analysis Report

Itau Unibanco Banco Holding SA (ITUB): Free Stock Analysis Report

Bank of Nova Scotia (The) (BNS): Free Stock Analysis Report

Original post

Zacks Investment Research