In an attempt to reduce investor bias and to get a different view of patterns, I invert charts (turn them upside down).

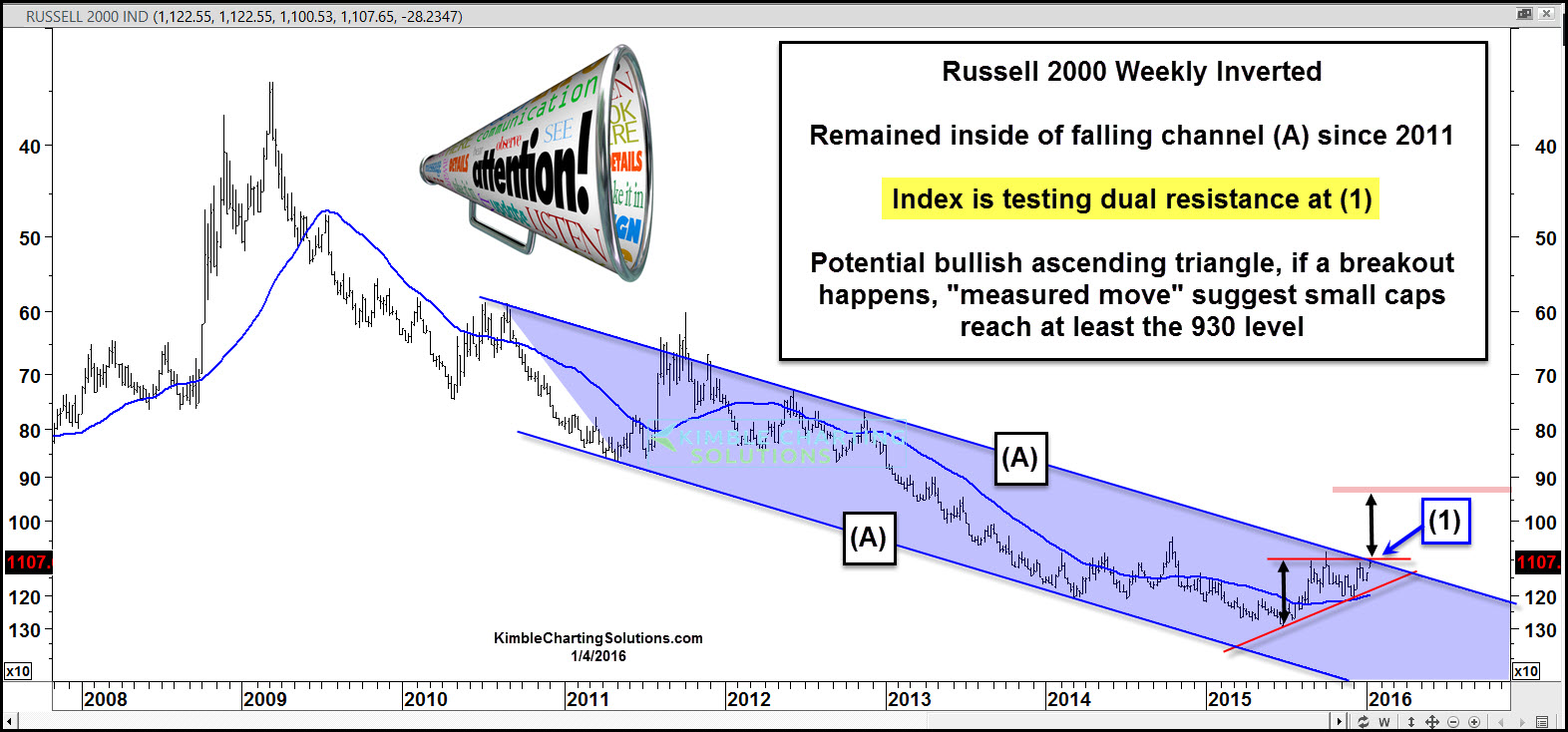

Two weeks, ago the Power of the Pattern shared the chart below, noting that the Russell 2000 inverted (same pattern for the inverse Russell ETF (N:RWM), was testing dual resistance in the chart below. We shared at the time that if a breakout would take place, it would be a 5-year falling trend breakout for the inverse play (RWM).

This post was originally published on January 6. At the time, the Russell Index stood at 1,107. The measured move suggested that upon a breakout, the Russell 2000 index could reach the 930 level.

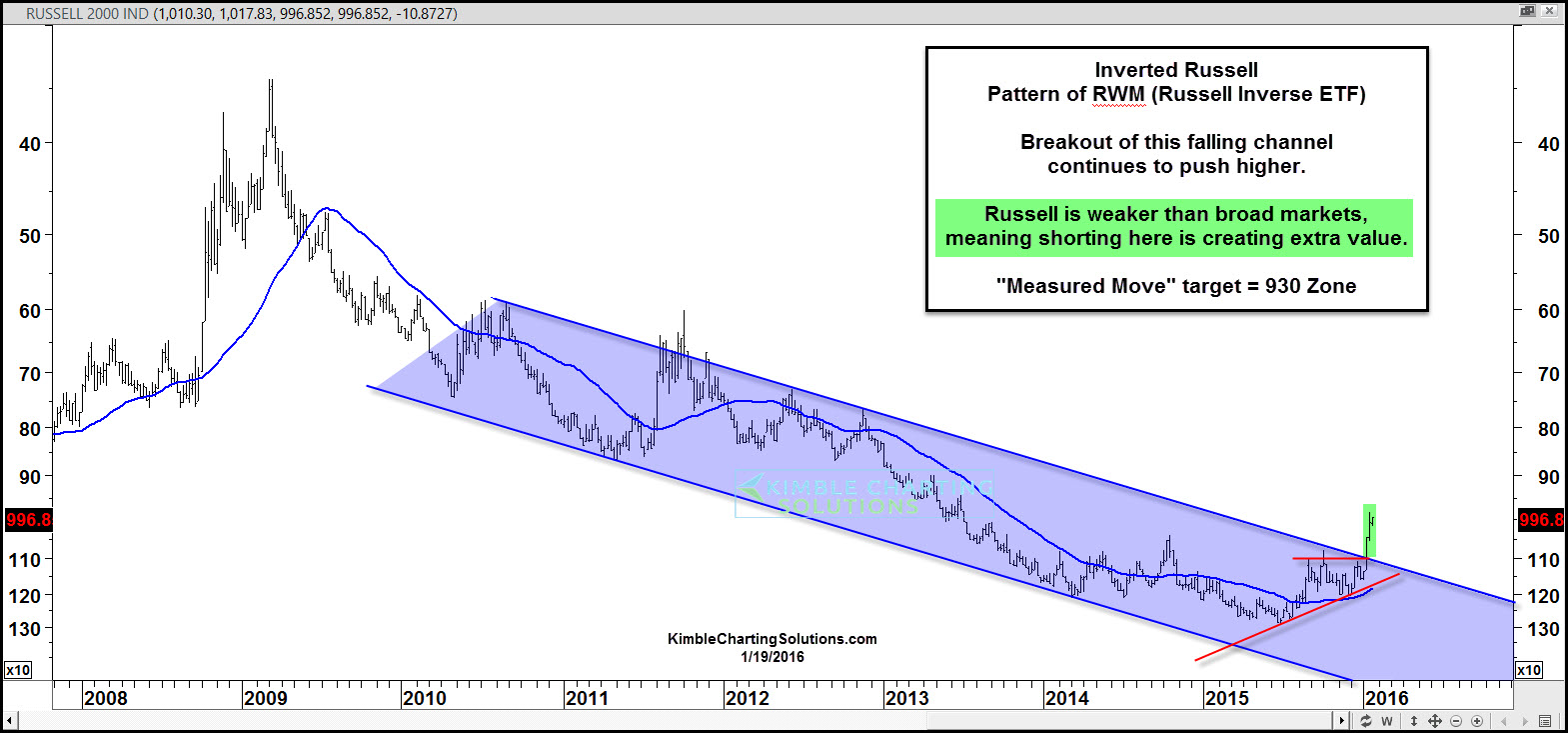

Below is an update to the pattern, which was first published on Tuesday.

Full Disclosure…Premium Members and Sector Members have been short this index for the past couple of weeks, due to the breakout above.

Below is a long-term pattern on the Russell, dating back 20 years.

This chart takes a look at the Russell over the past 25 years. Rising channel support broke in 2007, as it was hitting resistance and we all know what followed in 2007 and 2008.

Now the Russell is attempting to break down from its 5-year rising channel at (1) above. Long-term channel support (A) is a long way below current prices, if this channel breaks down at (1) above.

Some say the market is “Mis-behaving.” We believe that if you hear this from someone, it means they are on the “wrong side” of the trade. In our humble opinion, the markets are behaving like the patterns have suggested they would months ago.