FY15 results reveal that the difficult H1 is firmly behind it, as Scisys (LON:SSY) bounced back with a strong H2. In H1, Scisys was hit by difficulties in a major fixed-price development project, but this was fully resolved in October. The group has a healthy order book of £37.2m, c 23% ahead of a year earlier, of which £25.8m is scheduled for delivery in FY16. Hence 69% of FY16 revenues are already in the bag and the group has a healthy pipeline of new business. Scisys has a medium-term goal to return the business to 8%+ operating margins, which leaves the shares looking attractive trading on c 9x our FY17e earnings (based on a 6.6% margin).

Final results: Poor H1 partly offset by strong H2

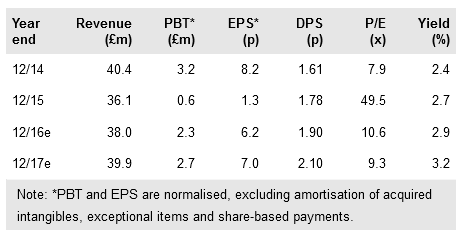

FY15 revenue slipped by 11% to £36.1m (we forecast £36.0m) while adjusted operating profit fell by 76% to £0.8m (we had £0.4m). Having reported a £1.2m loss in H1, the group recorded its strongest H2 ever, although this was partly explained by the conservative H1 provisioning that unwound in H2, after the problem project was resolved. Scisys was also hit by the strength of sterling against the euro, but this has swung in the other direction in 2016. FY15 adjusted EPS tumbled by 84% to 1.3p (vs our forecast 0.9p loss) and the group ended the year with £1.0m of net debt, which was in line with the January trading update. While the interim dividend was suspended to conserve cash, the company has reinstated dividends with a final payment of 1.78p, which is 11% ahead of the previous year’s total payout.

To read the entire report, please click on the PDF file below: