Focused on total returns over the long term

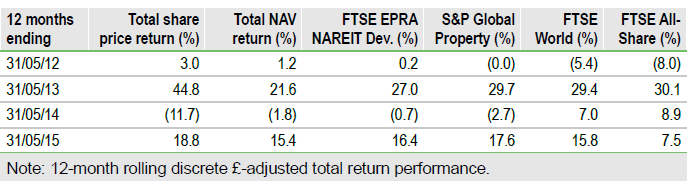

Schroder Global Real Estate Securities (SGRE) is an actively managed closed-ended fund providing exposure to global real estate through investing in a concentrated but diverse portfolio of listed securities. Following the appointment of Schroders (LONDON:SDR) as investment manager in July 2014, a total return strategy was adopted, the portfolio repositioned and the dividend re-based to a sustainable level. Subsequent performance has been ahead of the FTSE EPRA/NAREIT Developed index and one-year performance is comparable to open-ended peers. The manager follows a disciplined approach, focusing on higher-quality assets, aiming to maintain a portfolio resilient to changes in the economic environment and capable of delivering sustainable returns over the long term.

Investment strategy: Selecting for the long term

SGRE aims to provide investors with an attractive total return from a portfolio of listed global real estate securities measured against the FTSE EPRA/NAREITDeveloped Global Real Estate index on a rolling three-year basis. The manager seeks to identify real estate companies with the best quality assets, in the strongest markets, with the strongest balance sheets and management teams aligned with shareholders’ interests, investing subject to a detailed risk/return assessment. The low gearing, sustainable pay-out ratios and strong earnings growth potential that typify these holdings should provide resilience to changes in the economic environment and enable them to deliver sustainable compound returns.

Market outlook: Potential for further recovery

The global real estate market has performed strongly in recent years, with listed investment returns ahead of bonds and equities in the five years to end-2014 (see Exhibit 2). Although the US and UK, two of the largest real estate markets, appear to be well into their cyclical recoveries, many other countries are yet to see any significant recovery from the 2008 downturn. While concerns exist over the effect of rising interest rates on the US market, current income returns compare favourably with bond yields suggesting pricing levels are not overly stretched and market fundamentals are supported by the improving economy.

To Read the Entire Report Please Click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.