According to our earnings preview report, 17.1% of consumer discretionary companies have already reported third-quarter 2016 results. Of these, 83.3% have surpassed earnings estimates while 83.3% beat revenue expectations. Total earnings of these consumer discretionary companies increased 7% on 8.6% higher revenues.

Coming to the school industry within the consumer discretionary sector, enrollments have been sluggish, due to regulatory challenges, changes and competition in the higher education industry.

Therefore, the U.S. education companies are implementing various initiatives to attract students. For instance, DeVry Education Group Inc. (NYSE:DV) recently introduced more technology-focused, stackable programs. Meanwhile, Universal Technical Institute, Inc. (NYSE:UTI) has decided to implement cost-saving initiatives and reorganize its business processes.

These are focused on improving the affordability of the programs, upgrading the programs to improve their enrollments and ensuring that the students complete their graduation. Companies are reaching out to students with new campuses and online programs to improve accessibility. The focus remains on training students to be part of a workforce that enjoys strong demand in the employment market.

However, there is reluctance among students to enroll in academic programs and take loans to fund them. They would rather accept whatever job they are offered for their present qualifications. It will take some time for students to realize that better education and skills will improve their career prospects in the years to come, compared to the low skill or no skill jobs that they are currently engaged in. In the current scenario, while some education companies are doing well, things are not as bright for the others.

Two companies from the school industry are set to report their third-quarter results on Oct 26. Let's see how things are shaping up for their respective announcements.

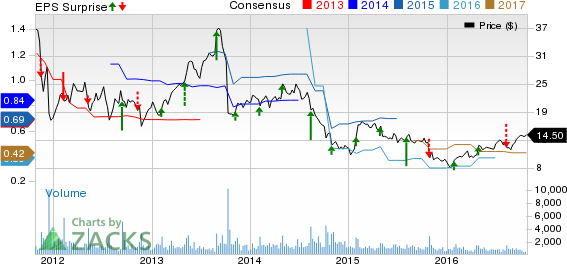

K12, Inc. (NYSE:LRN)

K12 Inc., a technology-based education company, is a leading national provider of proprietary curriculum and educational services created for online delivery to students.

The company posted a negative surprise of 30.77% in the last reported quarter. The company has beaten estimates in two of the past four quarters, resulting in an average negative surprise of 9.34%.

The company has an Earnings ESP of 0.00% and a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for fourth-quarter fiscal 2016 earnings is pegged at 28 cents.

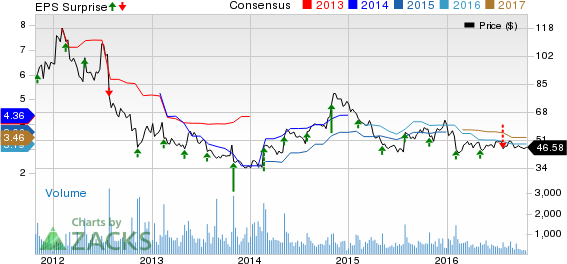

Strayer Education Inc. (NASDAQ:STRA)

Strayer Education is a regional proprietary institution of higher education offering undergraduate and graduate degree programs.

The company posted a negative surprise of 30.77% in the last reported quarter.

The company has beaten estimates in three of the past four quarters, resulting in an average negative surprise of 3.13%.

The Zacks Consensus Estimate for fourth-quarter fiscal 2016 earnings is pegged at $1.16. The company has an earnings ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

Confidential from Zacks

This week, Zacks researchers have named 7 other stocks that look to break out even sooner than today's Bull of the Day. You can see these time-sensitive tickers free, and access additional trades that are not available to the public. Simply click here>>.

STRAYER EDUC (STRA): Free Stock Analysis Report

DEVRY EDUCATION (DV): Free Stock Analysis Report

UNIVL TECH INST (UTI): Free Stock Analysis Report

K12 INC (LRN): Free Stock Analysis Report

Original post

Zacks Investment Research