According to the latest Earnings Preview, 69.4% of consumer discretionary companies have reported their quarterly results. Of these, 68% have surpassed earnings estimates while 56% have beat revenue expectations. Total earnings of these consumer discretionary companies increased 9% on 10.5% higher revenues.

Coming to the school companies from the consumer discretionary sector, enrollments have been sluggish due to regulatory challenges, changes and competition in the higher education industry.

Among the school stocks that have already reported results, Capella University under Capella Education Company (NASDAQ:CPLA) reported a 1.7% decline in total active enrollment and 9.6% drop in new enrollment in the second quarter of 2017. Also, Universal Technical Institute, Inc. (NYSE:UTI) reported a nearly 10% drop in average undergraduate full-time enrollments in the third quarter of fiscal 2017.

Nonetheless, the U.S. education companies are implementing various initiatives to attract students. These are focused on improving the affordability of the programs, upgrading the programs and ensuring that students complete their graduation. Companies are reaching out to students with new campuses and online programs to improve accessibility. The focus remains on training students to be part of a workforce that enjoys strong demand in the employment market.

Also, the Trump administration is set to revise for-profit education industry regulations, as announced by the U.S. Department of Education on Jun 14. The department intends to form committees to bring about changes to the Borrower Defense to Repayment and Gainful Employment system, introduced during Obama’s reign. U.S. Secretary of Education Betsy DeVos is of the view that the current regulation “is a muddled process that's unfair to students and schools, and puts taxpayers on the hook for significant costs.” The revised regulations are expected to be fair and balanced for educational companies and are likely to protect students from fraudulent practices and misleading claims.

Three companies from the school industry are set to report their quarterly results on Aug 8. Let's see how things are shaping up for their respective announcements.

Laureate Education, Inc. (NASDAQ:LAUR) , the largest global network of degree-granting higher education institutions, is set to release second-quarter 2017 results after market close.

As per our model, a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to beat earnings.

Thus, we predict a beat for the company as it has a Zacks Rank #3 and an Earnings ESP of +7.55% (Most Accurate estimate is 57 cents, while the Zacks Consensus Estimate is pegged at 53 cents). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

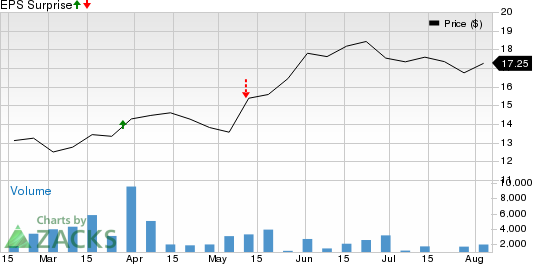

Laureate Education Inc. Price and EPS Surprise

Meanwhile, the company missed earnings estimates in the first quarter of 2017 by 26.8% but had surpassed estimates by 13.8% in the fourth quarter of 2016.

K12 Inc (NYSE:LRN) , a leading national provider of proprietary curriculum and educational services, will report fourth-quarter fiscal 2017 results after market close.

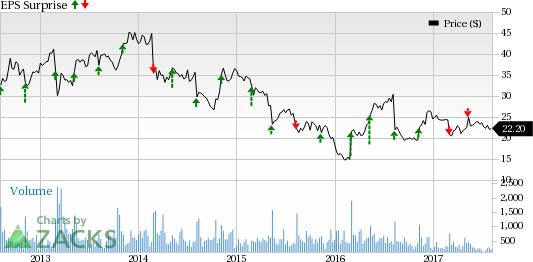

The company posted a positive surprise of 61.5% in the last reported quarter. The company has beaten estimates in two of the past four quarters, resulting in an average positive surprise of 6.35%.

Our proven model does not show an earnings beat for this company this quarter as it has an Earnings ESP of 0.00% and a Zacks Rank #3.

K12 Inc Price and EPS Surprise

Notably, for the quarter, the Zacks Consensus Estimate for earnings is pegged at 5 cents, reflecting a decrease of 38.9% year over year, while the consensus for revenues is at $217.78 million, implying a 1.6% year-over-year decline.

American Public Education, Inc. (NASDAQ:APEI) , an online provider of higher education focused primarily on serving the military and public service communities, will release second-quarter 2017 results after market close.

The possibilities of a beat for this company are slim as it has an Earnings ESP of 0.00% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

American Public Education, Inc. Price and EPS Surprise

The company posted a negative surprise of 3.5% in the last reported quarter. It has beaten estimates in two of the past four quarters, resulting in an average positive surprise of 2.51%.

The Zacks Consensus Estimate for second-quarter earnings is pegged at 23 cents, down 43.1% year over year, while the consensus for revenues is at $70.0 million, reflecting an 8.8% year-over-year decrease.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

American Public Education, Inc. (APEI): Free Stock Analysis Report

Capella Education Company (CPLA): Free Stock Analysis Report

Universal Technical Institute Inc (UTI): Free Stock Analysis Report

K12 Inc (LRN): Free Stock Analysis Report

Laureate Education Inc. (LAUR): Free Stock Analysis Report

Original post

Zacks Investment Research