On Aug 15, steel manufacturer Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) was upgraded to a Zacks Rank #1 (Strong Buy). Going by the Zacks model, companies sporting a Zacks Rank #1 have higher chances of outperforming the broader market.

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Schnitzer Steel Industries, Inc. (SCHN): Free Stock Analysis Report

Original post

Why the Upgrade?

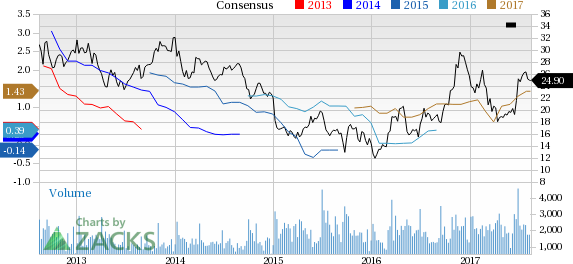

Estimates for Schnitzer have been moving north over the last 60 days. The Zacks Consensus Estimate for the current fiscal has increased 57.1% to $1.43 per share over this period. Moreover, the Zacks Consensus Estimate for fiscal 2018 has moved up 19.4% over the same time frame to $1.60.

Schnitzer has also delivered a positive average earnings surprise of 16.13% over the trailing four quarters.

Moreover, Schnitzer has significantly outperformed the industry over the last three months. The company’s shares have moved up around 30% over this period, compared with roughly 11% gain recorded by the industry.

Schnitzer reported a net income of $17 million or 60 cents per share in the third quarter of fiscal 2017, higher than earnings of $11 million or 40 cents recorded a year ago. The company’s adjusted earnings came in at 56 cents per share, in line with the Zacks Consensus Estimate. Revenues rose roughly 36% year over year to $477 million in the third quarter, on the back of higher sales volumes and average net selling prices.

According to Schnitzer, results in the reported quarter can be attributed to continued focus on profitable growth while operating income were driven by multi-year productivity initiatives. The company continued to strengthen the balance sheet by generating robust operating cash flows that enabled it to reduce debt, invest in operations and return capital to shareholders.

Notably, Schnitzer has integrated the operations of Auto and Metals Recycling (AMR) unit's Oregon metals recycling with the Steel Manufacturing Business (SMB) segment, forming a new division, Cascade Steel and Scrap (CSS). The move is aimed at enhancing its flexibility, generating internal synergies, improving customer service and to more effectively respond to changes across recycling and steel production market. Moving ahead, the company expects to report the results of CSS operations as a single reportable segment starting in the fourth quarter of fiscal 2017.

Schnitzer Steel Industries, Inc. Price and Consensus

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Schnitzer Steel Industries, Inc. (SCHN): Free Stock Analysis Report

Original post