Scandi Standard AB reports preliminary financial results for the quarter ended December 31, 2014.

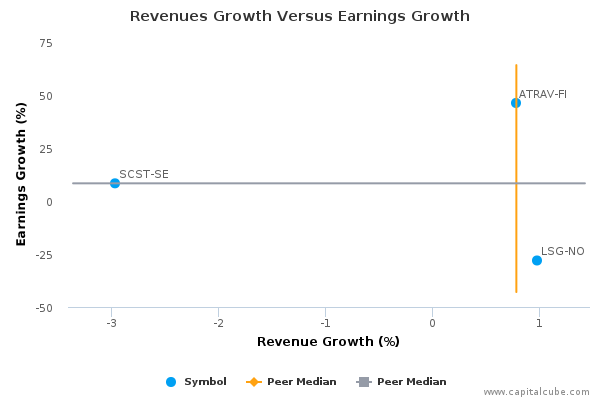

This earnings release follows the earnings announcements from the following peers of Scandi Standard AB – Atria Oyj A (HEL:ATRAV) and Leroy Seafood Group ASA (ATRAV-FI and LSG-NO).

Highlights

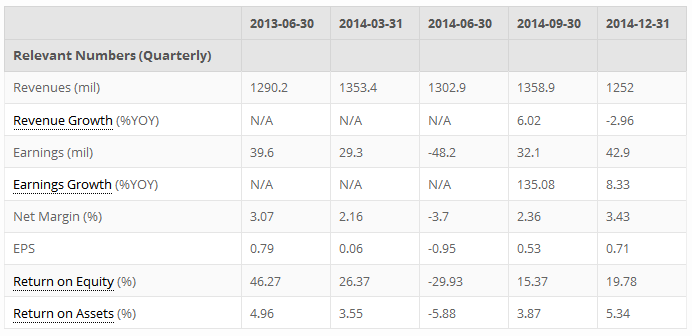

- Summary numbers: Revenues of SEK 1.25 billion, Net Earnings of SEK 42.90 million, and Earnings per Share (EPS) of SEK 0.71.

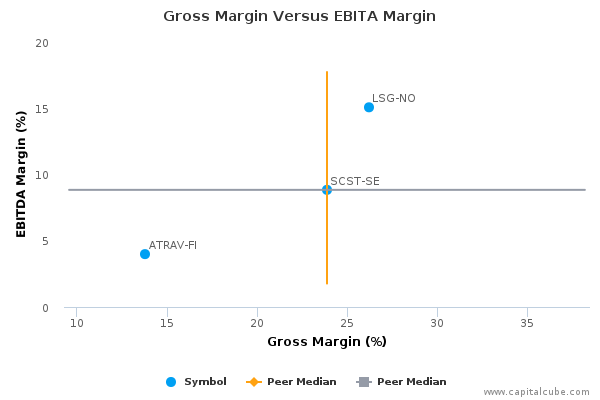

- Gross margins narrowed from 25.24% to 23.85% compared to the same quarter last year, operating (EBITDA) margins now 8.84% from 10.53%.

- Earnings rose compared to same quarter last year, despite decline in operating and pretax margins.

The table below shows the preliminary results and recent trends for key metrics such as revenues and net income growth:

Market Share Versus Profits

Companies sometimes focus on market share at the expense of profits or earnings growth.

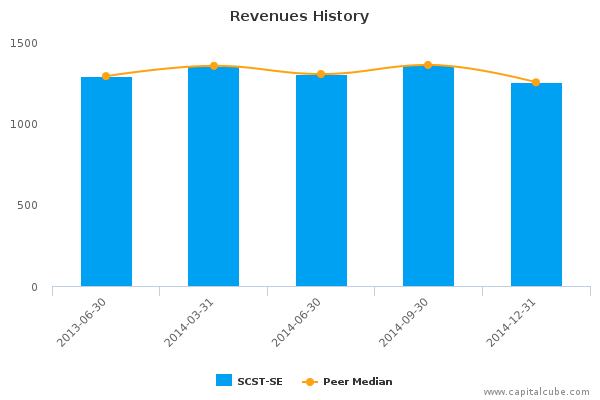

SCST-SE's change in revenue compared to the same period last year of -2.96% lagged its change in earnings which was 8.33%. The company's performance this period suggests an effort to boost profitability. While this is good to a point, the fact that the company's revenue performance is lower than the average of the results announced to date by its peers does not bode well from a long-term market share perspective. Also, for comparison purposes, revenues changed by -7.87% and earnings by 33.64% compared to the immediate last quarter.

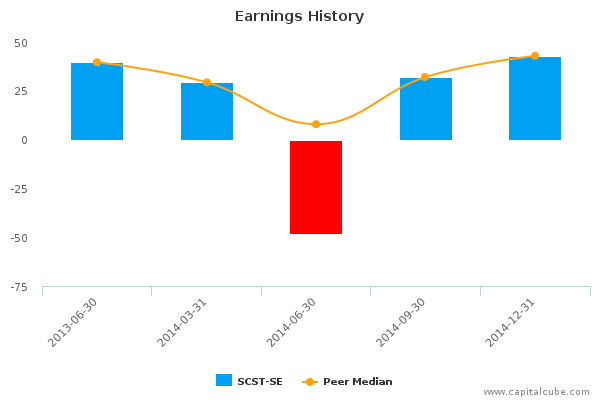

Earnings Growth Analysis

The company's earnings rose year-on-year. But this growth has not come as a result of improvement in gross margins or any cost control activities in its operations. Gross margins went from 23.85% to 25.24% for the same period last year, while operating margins (EBITDA margins) went from 8.84% to 10.53% over the same time frame.

Gross Margin Trend

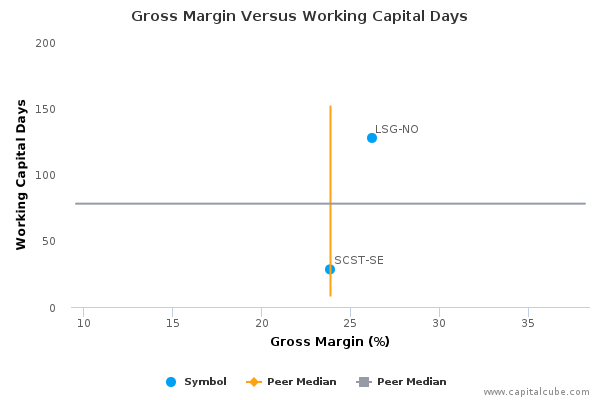

Companies sometimes sacrifice improvements in revenues and margins in order to extend friendlier terms to customers and vendors. Capital Cube probes for such activity by comparing the changes in gross margins with any changes in working capital. If the gross margins improved without a worsening of working capital, it is possible that the company's performance is a result of truly delivering in the marketplace and not simply an accounting prop-up using the balance sheet.

SCST-SE's decline in gross margins is compounded by issues on the balance sheet side. There has been deterioration in working capital levels. The company's working capital days have risen to 28.39 days from 15.33 days for the same period last year.

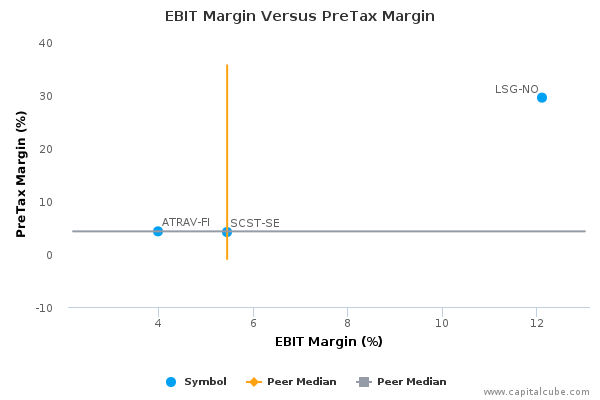

Margins

Despite a decline in operating (EBIT) margins as well as a decline in pretax margins, the company's earnings rose.

Company Profile

Scandi Standard AB is a holding company which produces, sells, and markets refrigerated, frozen, and processed chicken. Its brands include Kronfgel, Kronfgel Stinas chicken, Danpo, Ivars, Chicky World, and Den Stolte Hane. The company was founded in 1950 and is headquartered in Stockholm, Sweden.

CapitalCube does not own any shares in the stocks mentioned and focuses solely on providing unique fundamental research and analysis on approximately 50,000 stocks and ETFs globally. Try any of our analysis, screener or portfolio premium services free for 7 days. To get a quick preview of our services, check out our free quick summary analysis of SCST-SE.