- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

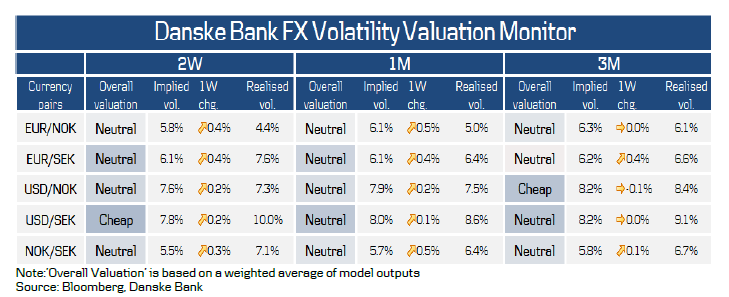

Scandi FX Volatility Monitor - Sell 1M EUR/SEK Call

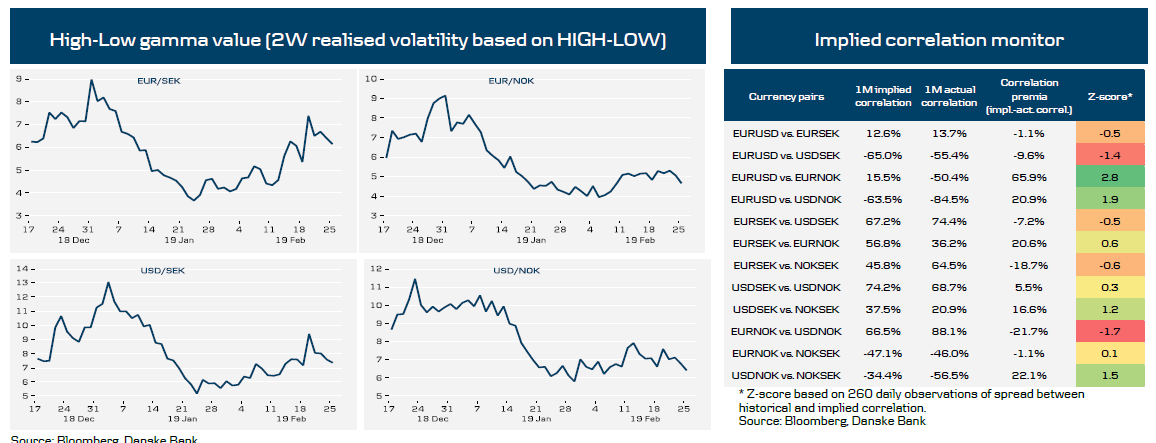

Implied volatility increased substantially in the Scandi FX sphere towards the end of last week after EUR/SEK broke above 10.60.

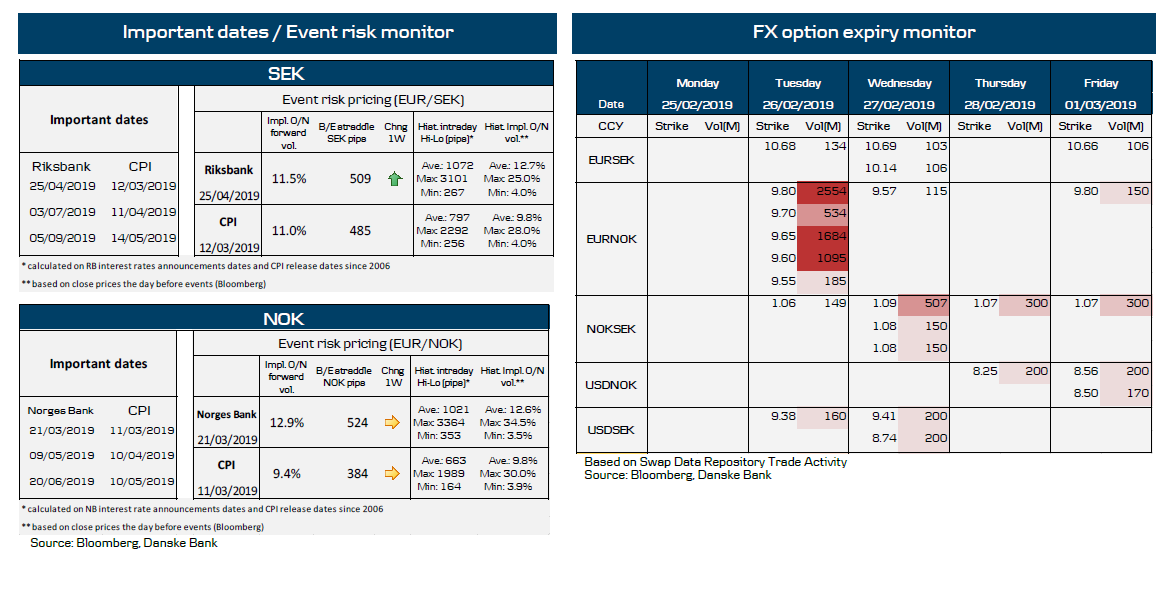

Given the current relatively constructive risk environment (globally), we see a case for renewed downward pressure on implied vol. In this environment, both NOK and SEK should find some support vis-à-vis EUR and USD. Moreover, note that our economists are more bullish than consensus on the Swedish Q4 GDP release (due on Thursday). See Reading the Markets Sweden , 22 February 2019, for details. If we are right, it could curb EUR/SEK upside risks in the short term.

Hence, given the current spot and vol. levels, we see value in selling 1M EUR/SEK calls (we recommend selling 20-35 delta calls).

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

For every trader, choosing a reliable broker is a cornerstone of success. Achieving consistent gains in trading is not a walk in the park as it is, and you don't want any extra...

Tariff talk and weak US data fueled a risk-off reaction Nvidia earnings may test market’s risk appetite More Fed rate cuts priced in; a “Fed put” reaction expected? Both dollar...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.