Energy-based holding company SCANA Corporation's (NYSE:SCG) principal subsidiary, South Carolina Electric & Gas Company ("SCE&G") and state-owned Santee Cooper have reached an agreement with Japan’s Toshiba Corporation. Per the agreement, Toshiba will pay them $2.168 billion as guaranty of obligations for Westinghouse Electric Company, LLC, under the parent company guarantee obligation agreement of 2008. Westinghouse, which is presently constructing a nuclear plant for SCANA, filed for bankruptcy recently.

Of the total payable amount, Toshiba, the former parent company of Westinghouse, will pay $1.192 billion to SCE&G for its 55% project ownership, under the engineering, procurement, and construction (EPC) contract. The remaining amount of $0.976 billion will be given to Santee Cooper for its 45% project ownership in Westinghouse. The payment by Toshiba for the two new nuclear units at the V.C. Summer Nuclear Station in Jenkinsville, SC will be made in installments between Oct 2017 and Sep 2022.

SCE&G and Santee Cooper will receive some portion of the payments from the bankruptcy court process of Westinghouse. Per the agreement, the payment process will take place if both or either of the two nuclear units is developed. Toshiba will be liable to pay even if the project is discontinued. If the actual cost of construction of the two units is lesser than the amount paid by Toshiba, which is the maximum amount payable under the EPC contract, Toshiba will receive a portion of the difference.

We would like to remind investors that a similar deal was struck by The Southern Company (NYSE:SO) with Toshiba for its $20 billion Vogtle plant in Georgia.

SCANA acknowledges the project completion date of Jan 1, 2021, after which the owners of the units will not be able to avail the production tax credits, under current tax rules. SCE&G and Santee Cooper are keeping this fact in mind along with the needs of the future generation and their stakeholders while evaluating the project status. Based on these concerns and their alternative choices, the owners will declare their decision regarding the Westinghouse project.

Investors should know that we are concerned about SCANA’s heavy debt level and the overall business risk associated with the nuclear generation construction project. The last nuclear generation construction cycle affected the numerous electric utility stocks. This fact generates a legitimate level of investor anxiety.

About the Company

Columbia, South Carolina-based SCANA's operations include generation, transmission, distribution, and sale of electricity to retail and wholesale customers in South Carolina. The company also purchases, sells, and transports natural gas to retail customers in South Carolina and southeastern Georgia; provides energy-related risk management services; and acquires, owns, and provides financing for nuclear fuel, fossil fuel, and emission allowances. In addition, it offers fiber optic communications, Ethernet services, and data center facilities. SCANA also builds, manages, and leases communications towers in South Carolina, North Carolina, and Georgia; and services contracts on home appliances, and heating and air conditioning units.

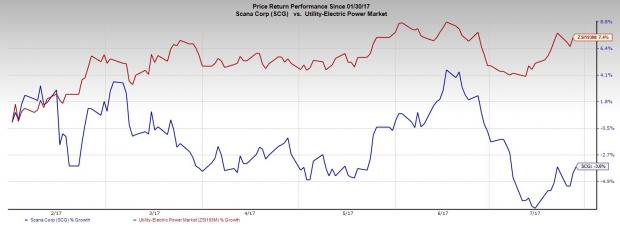

Price Performance

SCANA has lost 3.7% of its value in the last six months while its industry witnessed 7.4% growth.

Zacks Rank and Stocks to Consider

SCANA presently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the oil and energy sector include Braskem S.A. (NYSE:BAK) and TransCanada Corporation (TO:TRP) . Both these companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Braskem’s sales for 2017 are expected to increase 11% year over year. The company’s earnings for the second quarter of 2017 are expected to increase 197%.

TransCanada’s earnings for the second quarter of 2017 are expected to increase 25.6% year over year. The partnership delivered an average positive earnings surprise of 1.06% in the last four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Southern Company (The) (SO): Free Stock Analysis Report

Scana Corporation (SCG): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Original post

Zacks Investment Research