Each week currency scalpers must decide which pairs are best suited for trading. Today we will review how to make this determination using y using both trend and momentum based analysis. Lets begin with this weeks example on the AUD/USD.

When deciding on a pair for trading, first scalpers are tasked with finding a strong market trend. Below we can see the AUD/USD making a quick descent declining over 1054 pips. Currently the pair is making a fresh montly low at .9527. As the market continues to make lower lows, this provides prime opportunites for short scalpers to then institue their term trading trading strategies.

(Created using FXCM’s Marketscope 2.0 charts)

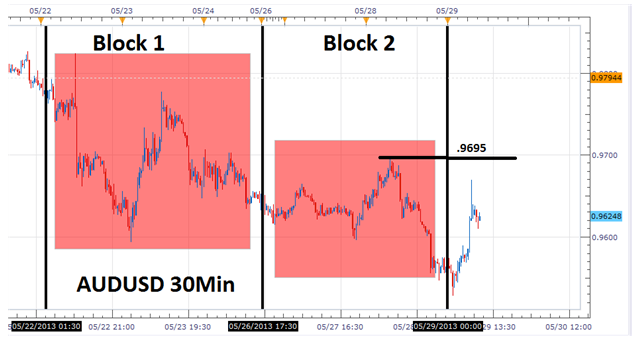

The next step that should be taken is to identify short term market momentum. This step is necessary to avoid moments where a currency pair is moving against its primary trend. To identify the optimal trading scenario, traders should look for a series of lower lows and lower highs in a downtrend for at least one full trading week. This can be found as shown using the method below.

The blocking method for identifying short term momentum is intended to divide a trading week in half to ensure short term momentum is in line with a longer trend. We can see the AUD/USD being blocked off below by identifying the previous Wednesdays and Sundays on our chart. The key to a this analysis falls in a currency pair making a lower low and lower highs, which is in line with our existing downtrend. In the event that price breaks the previous high, which currently stands at .9695, traders would contend that short term momentum is turning and should look for other trading opportunities.

(Created using FXCM’s Marketscope 2.0 charts)

Now that both trend and momentum have been identified, traders can then look to implement the scalping strategy of their choosing. It is important to remember that even though this analysis has vetted a pair for trading, the trend may turn at any given point in time. Knowing this all scalpers should always set stop orders on each new open position.

Written by Walker England, Trading Instructor

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Scalping This Week's Forex Trends

Published 05/29/2013, 02:53 PM

Updated 07/09/2023, 06:31 AM

Scalping This Week's Forex Trends

Article Summary: Identifying a currency pair for scalping is an important skill for short term traders to master. Today we will identify one of this week’s opportunities in the Forex market.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.