SBA Communications Corp. (NASDAQ:SBAC) reported strong financial results in the third quarter of 2017, wherein both the top line and the bottom line outpaced the Zacks Consensus Estimates.

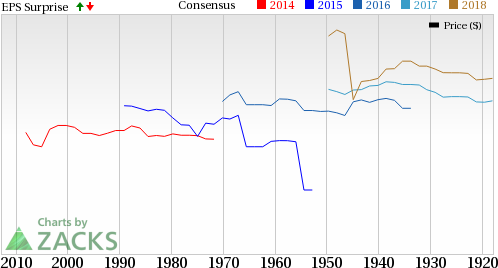

Net income for the third quarter of 2017 was $49.2 million or 41 cents per share compared with a net loss of $15.4 million or a loss of 12 cents per share in the year-ago quarter. After adjusting for non-recurring gains, earnings per share (EPS) in the reported quarter were 26 cents, a penny better than the Zacks Consensus Estimate.

Total revenues of approximately $434 million increased 5.5% year over year, outpacing the Zacks Consensus Estimate of $431.4 million. At the end of the reported quarter, SBA Communications owned total sites of 26,764. Of the total, 15,959 were domestic and 10,815 were international sites.

Total operating expenses increased to $316.9 million from $303.1 million in the year-ago quarter. Adjusted EBITDA in the reported quarter was $303.1 million, increasing 7% year over year. Adjusted EBITDA margin was 70.6% in the third quarter of 2017 compared with 70.1% in the year-ago quarter.

In the first three quarters of 2017, SBA Communications generated $187.3 million of cash from operations compared with $172.5 million in the prior-year period. Free cash flow, in the reported quarter was $150.4 million compared with $138.8 million in the year-ago period.

At the end of the third quarter of 2017, the company had $139.7 million in cash and cash equivalents and around $8,958.8 million of outstanding long-term debt compared with $146.11 million and $8,483.42 million, respectively, at the end of 2016.

During the third quarter of 2017, the company repurchased 2.7 million shares of its Class A common stock for $383.9 million, at an average price per share of $141.17. Subsequent to Sep 30, 2017, the company repurchased 0.8 million shares of its Class A common stock for $111.1 million, at an average price per share of $147.19.

Site Leasing Segment

Quarterly revenues came in at $408.5 million compared with $388.2 million in the year-ago quarter. Domestic Site Leasing revenues totaled $328.4 million, increasing 2.9% year over year. International Site Leasing revenues came in at $80.1 million, reflecting an increase of 16.1% year over year. Segment operating profit was $318.2 million and operating profit margin came at 77.9% in the reported quarter.

Site Development Segment

Quarterly revenues totaled $25.4 million compared with $23.2 million in the year-ago quarter. Operating profit was $4.3 million and operating profit margin was 16.9%.

Full-Year 2017 Outlook

SBA Communications has updated its full-year guidance. The company expects Site leasing revenues in the range of $1,613-$1,623 million. Site development revenues are projected in the $95-$105 million band. Total revenues are expected between $1,708 million and $1,728 million. Adjusted EBITDA is anticipated between $1,195 million and $1,205 million. Net interest expense is estimated in the range of $310-$315 million. AFFO (adjusted fund flow from operations) is projected at $825-$850 million. AFFO per share is expected between $6.82 million and $7.01 million. Discretionary cash capital expenditures are anticipated between $395 million and $415 million.

Zacks Rank

SBA Communications competes with large tower operators and REITs such as American Tower Corp. (NYSE:AMT) , Crown Castle International Corp. (NYSE:CCI) and Equinix Inc. (NASDAQ:EQIX) . The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

American Tower Corporation (REIT) (AMT): Free Stock Analysis Report

Equinix, Inc. (EQIX): Free Stock Analysis Report

Crown Castle International Corporation (CCI): Free Stock Analysis Report

SBA Communications Corporation (SBAC): Free Stock Analysis Report

Original post

Zacks Investment Research