SB Financial Group, Inc. SBFG is rewarding shareholders with an enhanced capital-deployment plan. The company’s board of directors has authorized the repurchase of 750,000 shares, which accounts for nearly 10% of its common shares. The authorization expires on Mar 31, 2022.

Following the announcement last week, shares of SB Financial have declined 1%.

Earlier in June 2019, the company had announced a share-repurchase program to buy back 400,000 common shares. The plan expired on Dec 31, 2020.

In addition to share repurchases, the company pays cash dividends on a quarterly basis. In May, SB Financial paid a quarterly cash dividend of 11 cents per share, marking a hike of 4.8% from the prior payout. Considering last day’s closing price of $19.80, the dividend yield currently stands at 2.2%. This yield seems quite attractive to income investors.

Notably, SB Financial has been increasing its quarterly dividend on a regular basis. Prior to the current hike, the company had announced a 5% hike to 10.5 cents per share in November 2020.

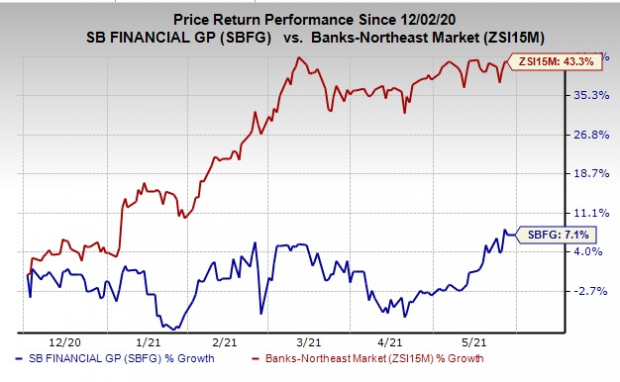

Over the past six months, shares of SB Financial have rallied 7.1%, underperforming the industry’s rally of 43.3%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Banks Making Similar Moves

Several banks have announced new share-repurchase programs in recent months. Some of these are City Holding Company (NASDAQ:CHCO) CHCO, Cathay General Bancorp (NASDAQ:CATY) CATY and Civista Bancshares (NASDAQ:CIVB), Inc. CIVB.

City Holding authorized the buyback of up to 1 million shares or 6% of its outstanding shares, with no expiration date. Cathay General’s board of directors has authorized the repurchase of up to $75 million worth of shares with no expiration date. Further, Civista Bancshares’ board of directors has authorized buyback of up to $13.5 million of its outstanding shares.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cathay General Bancorp (CATY): Free Stock Analysis Report

City Holding Company (CHCO): Free Stock Analysis Report

Civista Bancshares, Inc. (CIVB): Free Stock Analysis Report

SB Financial Group, Inc. (SBFG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research