London Forex Report: Saudi decision not to cut oil production pares oil gains, unnerving investors again and sending major equities into the red. On top of that, varying views from Fed top officials in their speeches suggest a still uncertain rate tightening path. Kansas City Fed President George (voting member this year) said that March hike should be considered by the committee amid firm US fundamentals, but Dallas Fed Kaplan (voting member next year) called for leaving rates on hold for an extended period if necessary. Data flow from the US remained mixed, with more positive housing data this time but consumer confidence and manufacturing prints remained a tad negative, reaffirming our view that growth traction in the US remained very uneven. USD strengthened the USD Index inched 0.11% higher to 97.48, gaining on renewed weakness in commodity majors.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR dropped further against the USD, fell below 1.1000 handle for the first time in three weeks due to the drop of German business climate and Brexit issue. German Gross Domestic Product rose 0.3 percent in the fourth quarter, as higher public spending and investment compensated the weakness in exports.

Technical: While prior pivotal support at 1.1050/30 acts as intra day resistance bears target prior range support at 1.08. Only a close over 1.1150 eases immediate downside pressure.

Interbank Flows: Bids 1.0950 stops below. Offers 1.1150 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Traders focus remained on Sterling due to the controversial Brexit issue. GBP/USD fell to 1.4010 at the end of European markets close. The pair dropped further in early Wednesday session to as low as 1.3983, breaking through the 1.4000 handle. Carney, the Governor of BoE, said there is considerable room for further stimulus if needed. However, he underlined that UK’s economic growth has remained stronger than many other rich economies since 2013.

Technical: While 1.4040/60 acts as resistance expect a continued grind lower for a test of the next major monthly downside objective at 1.37. Only a close over 1.4450 eases immediate downside pressure.

Interbank Flows: Bids 1.39 stops below. Offers 1.4040 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/JPY dropped to a two-week low at 111.75 as market’s risk appetite has turned down again. BoJ governor Kuroda said what monetary policy can do was limited. He also said accelerating the pace of money printing alone would not boost expectations of future price rises.

Technical: The failure at 112 opens retest of 111 bids. Only a close over 113.40 eases immediate downside pressure.

Interbank Flows: Bids 111.50 offers below. Offers 113.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/JPY touched 123.07, the lowest since April 2013. Risk aversion following the Chinese moves to fix the yuan at its lowest in six weeks as well as comments by BOJ governor Kuroda on the limits of its present approach to

Technical: While 123.70 offers intraday resistance expect a continued grind lower to print fresh lows and test bids at the psychological 120 en route to a weekly downside objective at 118/117

Interbank Flows: Bids 122 stops below. Offers 124 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

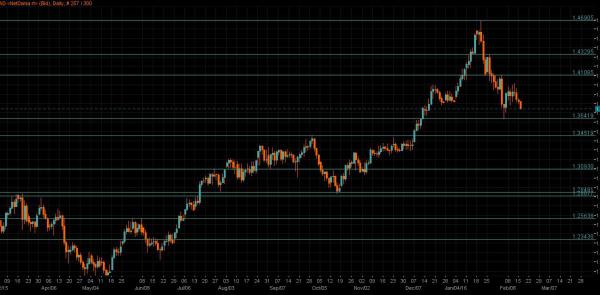

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD held near multi-week highs against the pound on worries that Britain could exit the European Union but retreated against the USD after probing offers over .7250. The Australian dollar stood firm on a sustained rally in iron ore prices. The price of iron ore has risen 17 percent so far this year

Technical: Expected retest of offers above .7240 attracts near term profit taking. While .7150 supports intraday expect a test of range resistance at .7300. Only a failure at.7050 pivotal support threatens bullish bias

Interbank Flows: Bids .7150 stops below. Offers .7300 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: CAD lost ground against the USD as oil prices fell and risk appetite faded. Oil prices lost four percent after Saudi and Iranian oil ministers ended hopes for a coordinated move to limit production amid a global supply glut. Weaker stock markets was also an additional headwind for the risk-sensitive commodity currency

Technical: While USDCAD trades sub 1.3850 downside pressure remains the driver with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3630 stops below. Offers 1.3850 stops above

Retail Sentiment: Bullish

Trading Take-away: Neutral