Saudi Basic Industries Corp. ((SE:2010)) strengthens after earnings - showing signs of going higher

Saudi Basic Industries Corp. (SABIC) was the second best performer on Sunday in the Saudi Stock Exchange (Tadawul), rising 8.55 or 9.81% to close at 95.75. The move came on the back of its 1Q15 earnings announcement, which saw net income drop less than anticipated by analysts.

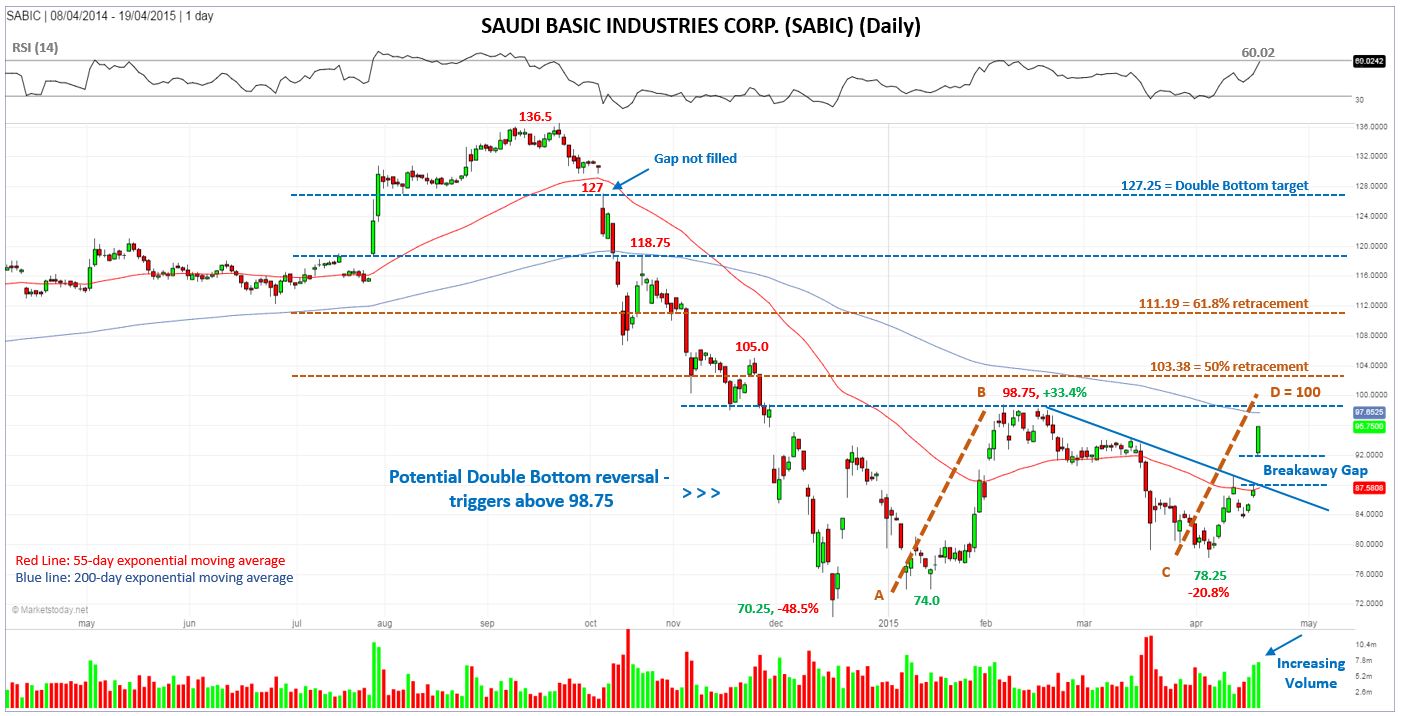

The stock gapped open creating a breakaway gap, closed above its 55-day exponential moving average for the first time since March 15, while volume increased to a 22-day high. These are all bullish signs which should lead to further upward momentum and likely a break above the 98.75 peak from early-February.

A decisive rally above the February peak and daily close above it will signal both a bullish breakout of a double bottom reversal pattern and a trend continuation (begun from the December 2014 low). Further, SABIC would have risen above the 200-day ema for the first time since mid-October 2014.

An AB=CD pattern completes at 100, with higher targets at the 50% retracement of the September to December 2014 correction at 103.8, and the 61.8% Fibonacci retracement at 111.19.

The target derived from measuring the double bottom is 127.25. That’s right near the lower half (127) of an unfilled gap. Gaps have a tendency to eventually fill, increasing the odds that SABIC may eventually reach the area of the double bottom target, assuming the wider market environment stays bullish. (www.marketstoday.net/en/)