Russia and Saudi Arabia refuse to cut oil supplies!

The global commodities markets received a resounding rejection of calls to cut oil supply from major oil producing countries like Saudi Arabia and Russia. On Wednesday, 26 November in Vienna, Austria, OPEC leader Saudi Arabia announced that it would not be looking to substantially reduce oil supply in an effort to boost the price of oil on global markets. This news comes hot on the heels of an announcement made by Russia a day earlier that Moscow would not commit itself to prop up the price of oil by reducing output. Of the 12 Organisation of Petroleum Exporting Countries (OPEC), only Iraq and Venezuela have called for cuts in oil supply.

In Iran, the Oil Minister accused several members of OPEC from trying to retain market share, and has called upon Non-OPEC oil producers to heed the calls of a production cut by OPEC. The general consensus among industry analysts is that the market is saturated with an oversupply of oil, and the only way to raise prices is to cut supply. Saudi Arabia has in the past unilaterally reduced its supply, to its own detriment. For that reason, it is reluctant to forego its dominant market share in an effort to raise the price of oil well above its current lows.

As it stands, the latter part of 2014 has seen a deluge of oil flooding the markets, and 2015 is projected to be much the same. A big part of the reason why Russia and Saudi Arabia are unlikely to push for cuts to production is the current US oil boom. If the global oil price can be maintained at a level below $80 per barrel for a sustained period of time, the fledgling US oil industry will be unable to operate at current prices. In other words, this strategic move on the part of Russia and OPEC countries is an effort to force the US out of the oil markets by making production costs unsustainable.

Falling Oil Prices Raise Concerns since June 2014, the price of oil per barrel has dropped by over 30%. Analysts largely attribute the falling oil prices to slow economic growth on a global scale, recessionary fears in Japan and Europe and a flourishing US shale oil market. Talks on a resolution to the uranium nuclear problem failed to pay dividends on Monday, 24 November, and this reassured many OPEC producing nations that the price of oil would not be hit by an increase in Iranian oil on the global markets. Even Russia which is responsible for an estimated 11% of global oil production – 10.5 million barrels per day – announced that it would not cut production even if the price drops below $60 per barrel. The announcement was made by Rosneft’s top brass, Igor Sechin, much to the chagrin of commodities brokers looking to prop up the price of oil.

East Versus West: An Oil Price WarIn terms of global output, OPEC is responsible for 30% of supply, and studies conducted by the group estimate that supply will continue to exceed global demand by up to 1,000,000 barrels per day between January and June 2015. It is unclear what sort of policy steps need to be taken to walk the fine line between raising oil prices (by cutting production) and pushing the US out of the oil market by keeping supply at its current levels. The problem is that OPEC countries cannot seem to come to agreement on precisely how much of an oil supply cut should be introduced. Saudi Arabia meanwhile has intimated that they would continue producing oil at current levels even if the price drops to $70 per barrel. As a result of the uncertainty in the oil market, various conspiracy theories have emerged ranging from the Saudis wanting to punish Russia and Iran for supporting Syria, to the Saudis wanted to push the US out of the oil market. It is clear that a cut to oil production would be beneficial to the US oil industry – something that everyone is looking to avoid.

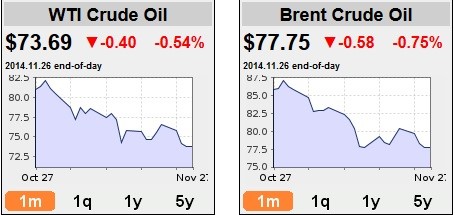

The current price of West Texas Intermediate (WTI) crude oil is $73.69 and the current price of Brent crude oil is $77.75 – both at short-term historical lows. The declining energy prices have led the declines in other commodities: natural gas $4.36, gasoline $2.04, heating oil $2.40, gold $1196.60 per ounce, silver at $16.55, and copper at $2.96. The one year forecast for oil is $84 per barrel according to oil-price.net. Analysts believe that by cutting output, Saudi Arabia risks losing market share in the short to medium term. It is clear that the Saudis want to protect their global share at all costs – even if it means reduced profits. With an output cut of less than half a million barrels per day, the oil price will likely remain very close to its current levels, so it is contingent upon the big oil producing countries to cut their production substantially. At present levels, the oil price has dropped to a 50-month low price. Any oil production cut is likely to see a short-term spike in production, but there would have to be a sharp reduction in output for any major impact on the oil price over the long term.

US Crude Oil Inventories RiseIt is clear that the crude oil market is bearish, even as US production is at an all-time high. Banc De Binary analysts are expecting the OPEC oil cartel to rough it out for the medium to long term in an effort to oust the US from the market. Oil futures for settlement in January declined to $74.36 per barrel on the ICE Futures Europe Exchange. West Texas Intermediate declined to $70.81 per barrel on the New York Mercantile Exchange for January delivery. Meanwhile, US crude oil inventories increased by 1.95 million barrels through 21 November 2014 according to the EIA. This marks the seventh straight gain in 8 weeks. Oil stockpiles in Cushing, Oklahoma for WTI contracts increased by 1.3 million barrels and production increased by 73,000 barrels to 9.08 million barrels p/day.