Forex News and Events

SARB decision in focus

Later today, the South African central bank is expected to hike interest rate by 50bps to 6.75% as the deanchoring of inflation expectations, together with renewed pressure on the rand have left the SARB with little choice. CPI inflation rose to 5.20% in December from 4.80% in the previous month. Looking beyond, Governor Kganyago will find himself in a similar situation to Governor Tombini where he will have to choose between trying to anchor inflation expectations, at the risk of accelerating the recession, and supporting the economy by staying sidelined.

On the currency side, we think that despite the SARB’s best efforts to curb inflation, rand weakness will likely persist in 2016. The main reason being that the central bank will eventually run out of options and just like the BCB, it will have to give up on containing inflation in order to let the economy breathe. This morning, USD/ZAR is trading around 16.3125, down 0.80%, ahead of the SARB decision.

New Zealand: back to policy divergence

As expected by the market, the Reserve Bank of New Zealand has kept its Official Cash Rate unchanged at 2.50%. This follows the rate cut of 25 basis points at last December’s meeting. The central bank is in a dovish mood and hinted that the door is wide open for further easing.

The current low inflation is weighing on the RBNZ monetary policy, which printed for the fourth quarter 2015 well below forecasts (0.1% y/y vs 0.4 y/y). The central bank remains confident for 2016 as inflation is expected to increase. Yet, core inflation (excluding food and energy) is in line with the target.

Therefore, global turmoil is also largely affecting the New Zealand economy, especially China's slowdown. Boosting exports for New Zealand is a key goal and we should see continued weakness in the kiwi despite policymakers being optimistic regarding the domestic economy and growth in tourism and construction (amongst others).

The next rate decision is due March 10th. In the meanwhile we assume that the central bank will be gathering more data in order to remove the dovish stance towards further easing. It is obvious that inflation will be the key driver for another rate cut in 2016. Over the medium term we remain bullish on the USD/NZD and target 1.6000.

The Risk Today

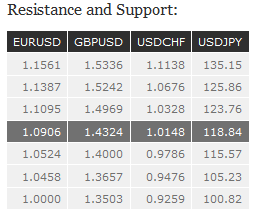

EUR/USD EUR/USD lies in a short-term downtrend channel. Hourly resistance may be found at 1.1096 (28/10/2015 low) while hourly support can be found at 1.0524 (03/12/2015). Expected to show further very short-term increase. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD GBP/USD has exited the downtrend channel. Hourly resistance at 1.4367 (26/01/2016 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Expected to show further monitoring around 1.4350. The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY USD/JPY is increasing. The pair is trading slightly below 119.00. Hourly resistance lies at 123.76 (18/11/2015 high). Hourly support lies can be found at 115.98 (20/01/2016 low). Expected to show further weakness. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF USD/CHF's uptrend momentum is still lively. Hourly support is located at 0.9876 (14/12/2015 low) and hourly resistance can be found at 1.0199 (26/01/2015 high) and at 1.0328 (27/11/2015 high). Expected to show continued strength. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.