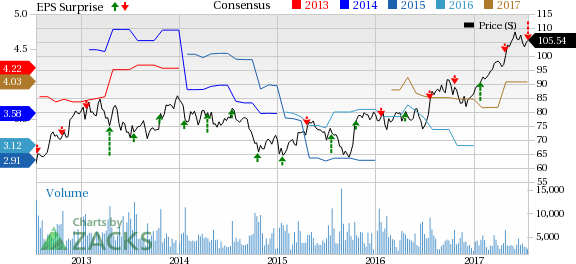

SAP SE (DE:SAPG) (NYSE:SAP) reported second-quarter 2017 IFRS earnings per share of €0.56 (62 cents), which reflects a decline of 17.7% on a year-over-year basis. An increase in the share-based compensation expenses and restructuring related expenses proved to be a drag on the bottom line.

Total IFRS revenues for the first quarter were €5,782 million ($6,358.1 million), up 10% year over year. However, the figure fell short of the Zacks Consensus Estimate of $6,175 million. Robust performance of both the company’s segments, namely, Cloud and Software and Services, drove top-line growth.

Also, new cloud bookings – a key indicator of sales success in cloud business – were significantly up 33% to €340 million ($373.9 million) in the reported quarter.

Inside the Headlines

Cloud and Software business, which includes Cloud Subscriptions & Support, and Software licenses & support, reported revenues of €4,757 million ($5,230.9 million), up 9% year over year. Individually, Cloud Subscriptions & Support garnered revenues of €932 million ($1024.9 million) in the quarter, up 29% year over year. Software licenses and support reported revenues of €3,826 million ($4,207.2 million), up 5% on a year-over-year basis.

In addition, for the reported quarter, Services revenues rose 17% year over year to €1,024 million ($1,126.0 million). Overall, IFRS Cloud and software revenues witnessed the highest increase in APJ (up 52%), followed by EMEA region (up 48%) and the Americas (up 20%). This was mainly driven by IFRS Cloud Subscriptions & Support strength.

In the EMEA region, Cloud subscriptions and support revenue growth was driven by strong performance of Germany and Russia. Also, stellar growth in software revenue in Germany and MENA (Middle East and North Africa) proved conducive to overall performance in the EMEA region.

For the Americas, impressive software revenue growth in Canada, Mexico and Chile acted as tailwinds. For the APJ region, impressive cloud subscriptions and software revenue growth in China, along with that in Japan and Australia, acted as catalysts.

SAP reported IFRS operating margin of 16.0%, down 820 basis points from the figure recorded a year ago. Additionally, the company recorded an almost 27% drop in its operating profit, which came in at €926 million ($1,018.3 million).

Quarterly Highlights

SAP’s human capital management (HCM) applications continue to drive growth, with SuccessFactors Employee Central surpassing the 1,800-customer mark at the end of second-quarter 2017. Also, SAP’s Customer Engagement and Commerce solutions witnessed double-digit growth in cloud bookings and software revenue during the quarter.

Moreover, consistent market traction of the SAP S/4HANA platform is proving to be the highest profit churner. To date, S/4HANA has earned 6,300 customers. The company gained 500 customers in the reported quarter, of which 30% are new. This has fueled the company’s revenues to a great extent.

This apart, SAP’s business networks (which it manages through three main players – namely Ariba, Fieldglass and Concur) experienced 22% growth during the reported quarter. Currently, the Ariba network handles trading of 2.8 million connected companies, which is worth over $1 trillion. Meanwhile Concur manages travel and expenses of more than 49 million end users, and Fieldglass helps in managing 3.5 million flexible workers.

SAP’s latest digital innovation system – SAP Leonardo – is also off to a decent start, gaining clients. Carrying efforts forward, last month, the company expanded its SAP Leonardo, which can now integrate machine learning, Internet of Things (IoT), Big Data, analytics and blockchain on SAP Cloud Platform. During the reported quarter, the company gained CITIC Pacific Mining among other clients.

Other Financial Details

For the quarter ended Jun 30, 2017, the company’s operating cash flow came in at €642 million (approximately $733.3 million), up 46.2% on a year-over-year basis, while free cash flow generated by the company came in at €322 million ($367.8 million), up 59.4% from the year-ago figure.

As of Jun 30, 2017, SAP had cash and cash equivalents of €4,236 million ($4,838.4 million), compared with €4,206 million recorded at the end of Jun 30, 2016.

Guidance Reiterated

SAP is highly optimistic about its solid backlog coupled with a robust pipeline, which positions it for profitable growth in 2017. The company raised its view for full-year 2017 non-IFRS total revenue projection from €23.2–€23.6 billion to €23.3–€23.7 billion at constant currency (cc).

Fueled by continued strong momentum of the cloud business, the company believes the non-IFRS cloud subscriptions and support revenue to lie in the range of €3.8 billion to €4.0 billion at constant currencies. Considering the upper end of the range, this reflects a 34% improvement compared with the year-over-year improvement.

Also, buoyed by the adoption of S/4HANA and digital business platforms, non-IFRS cloud & software revenues are projected to grow in the range of 6.5–8.5% at constant currencies for full year 2017.

The non-IFRS operating profit guidance for 2017 has been reiterated at the €6.8–€7.0 billion (at cc) band. We are optimistic about the company’s strong momentum in its cloud business as well.

Concurrent with the earnings release, SAP announced a share buyback of up to €500 million in 2017. After evaluating the expected cash flow development for the second half of 2017, SAP believes it can commence the program shortly. It will be executed in several tranches.

Our Take

Though SAP’s earnings figures have declined, its thriving cloud business look strongly positioned to drive growth in the quarters to come. The company’s resilient Cloud and Software business, an enviable business network spread and dominance over critical client demand areas continue to act as staple growth drivers. The company’s S/4HANA has proved to be a solid profit churner, fueled by increase in cloud subscriptions and support-revenue increase in recent times.

Also, SAP’s renewed focus on bolstering its IoT foothold is expected to result in significant client wins, stoking top-line rise. SAP’s intention to fortify its IoT foothold became quite clear when it announced an investment of a whopping $2.2 billion for the expansion of its IoT portfolio.

Despite these positives, the company’s fall in operating profit and rise in operational expenses remains a concern. These are likely to exert pressure on the margins and top line. Also, SAP has to fend off stiff competition from technology biggies, including Microsoft Corporation (NASDAQ:MSFT) and International Business Machines Corporation (NYSE:IBM) , in the cloud domain.

Broadcom Ltd. (NASDAQ:AVGO) has an average earnings surprise of 6.7%, beating estimates all through, over the trailing four quarters. It sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

SAP SE (SAP): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Original post

Zacks Investment Research