SAP SE (DE:SAPG) (TO:SAP) recently boosted its SAP Hybris portfolio with the launch of SAP Hybris Commerce solution.

SAP Hybris Commerce Solution

The latest omnichannel solution will particularly help business-to-business (“B2B”) and business-to-consumer (“B2C”) companies engage with their customers in an efficient manner. SAP Hybris Commerce offers a comprehensive commerce platform that allows integration of digital and physical customer interactions across multiple platforms including online, mobile, point-of-sale, call center, social media and print.

Few of the notable upgrades in the solution include new promotions engine, augmented customer support & back-office tools and redesigned content management system. SAP Hybris Commerce solution has a “single-stack architecture” at its core which enables rapid deployment on “on premise”, private cloud and software-as-a-service platforms.

SAP believes that omnichannel commerce and state-of-the-art experiences are the future of digital commerce. The company believes that the latest launch will fortify its hold in the digital commerce platform by offering services beyond commerce. SAP Hybris has been a popular offering, earning accolades like Gartner’s 2016 Magic Quadrant Report for Digital Commerce and The Forrester Wave: B2B Order Management, Q4 2015.

Meanwhile, market research reports reveal more than 90% of marketers are focusing on improving customer experience through personalization. Currently, an average of 11 siloed channels are being deployed by the marketers, which is resulting in below-par results.

Plights

Despite the product launches and thriving cloud business, SAP’s prospects looks gloomy. A host of factors like stiff competition in the IT services industry, persistent weakness in multiple end-markets like Latin America and Brazil along with escalating research and development expenses pose significant headwinds. Also, there is an inherent seasonality in client’s technology spending, which exposes the company’s sales to risks of quarterly fluctuations.

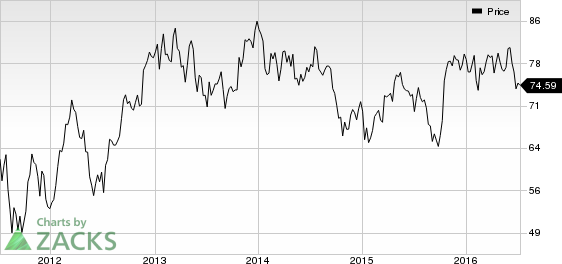

As a matter of fact, earnings estimates of the company have been going down prior to its second-quarter release. Over the past 30 days, brokers have revised earnings estimates downward from $3.61 to $3.52, reflecting a bearish outlook.

SAP currently holds a Zacks Rank #4 (Sell). Better-ranked stocks in the same industry include Nuance Communications, Inc. (NASDAQ:NUAN) , Citrix Systems, Inc. (NASDAQ:CTXS) and Exa Corp. (NASDAQ:EXA) , each sporting a Zacks Rank #1 (Strong Buy).

CITRIX SYS INC (CTXS): Free Stock Analysis Report

NUANCE COMM INC (NUAN): Free Stock Analysis Report

SAP AG ADR (SAP): Free Stock Analysis Report

EXA CORP (EXA): Free Stock Analysis Report

Original post