SAP SE (DE:SAPG)’s (NYSE:SAP) operating arm, SAP Ariba, and technology giant, International Business Machines Corporation (NYSE:IBM) , announced a strategic alliance to create cognitive procurement solutions that will significantly improve the “source-to-settle process”. Going forward, the companies have a plan to launch Cognitive Procurement hub to foster the development of intelligent procurement solutions and services.

The jointly-developed solutions will be able to read complex procurement transactions, unstructured data and cumbersome pricing structures. The Germany-based enterprise-application software provider’s innovation platform, Leonardo, and business network, Ariba, will be integrated with IBM Watson technologies to create a state-of-the-art solution.

The cognitive procurement solution co-developed by the companies will come with predictive insights that can improve decision making across the entire supply chain. It would simplify the entire procurement process — from improving spend visibility to assisting buyers. SAP Ariba will work closely with IBM Global Business Services to provide existing as well as new customers the benefit of this expanded functionality.

According to the latest research report from Markets and Markets, “Retail Sourcing and Procurement Market” is anticipated to grow from $2.58 billion to $4.83 billion at an estimated Compound Annual Growth Rate of 13.4% from 2016 to 2021. Factors, including the need for better visibility in sourcing related data and centralization of procurement processes, are expected to drive growth of this market.

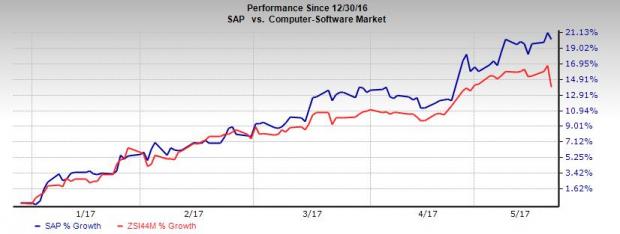

Year to date, shares of the Zacks Rank #3 (Hold) company have appreciated 20.2%, outperforming the Zacks categorized Computer-Software industry's average gain of 13.9%. Recently, the stock witnessed an upward estimate revision, which reflects bullish sentiment. In the past 60 days, the Zacks Consensus Estimate for full-year 2017 earnings per share has trended up from $3.66 to $4.03.

Encouragingly, SAP Ariba, the company’s business network, which supervises business-to-business commerce, has a leading market share, closely followed by IBM and Oracle (NYSE:ORCL) Corporation (NYSE:ORC) L). Ariba established itself as the largest procurement network and currently handles 2.7 million clients who purchase or sell goods and services worth over $900 billion. The recent partnership with IBM is expected to help the company lure in more clients for the upcoming quarters, thus boosting top-line performance.

Stock to Consider

A better-ranked stock in the industry is Avid Technology, Inc. (NASDAQ:AVID) , currently carrying a Zacks Rank #2 (Buy). The stock boasts a positive average surprise of 155.0% for the trailing four quarters, having beaten estimates twice. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

International Business Machines Corporation (IBM): Free Stock Analysis Report

Avid Technology, Inc. (AVID): Free Stock Analysis Report

SAP SE (SAP): Free Stock Analysis Report

Original post

Zacks Investment Research