Enterprise application software, SAP SE (DE:SAPG) (NYSE:SAP) and technology giant International Business Machines Corporation (NYSE:IBM) launched a jointly developed solution for the retail and consumer packaged goods industries. The solution will help to boost profitability as well as improve consumer experience.

This is the first industry-focused solution that the two companies have launched since they formed a digital transformation partnership last year. Going forward, the companies also have plans to collaborate on SAP Model Company services – an end-to-end reference solution that accelerates the time to value and can be modified to cater to a specific line-of-business and industry.

The co-developed solution will be able to radically improve planning and execution in a physical store by leveraging near real-time data.

The collaboration between these two technology behemoths will bring together unique data sources, including IBM's cognitive capabilities on SAP Cloud Platform. Using IBM's cognitive services, IBM Metro Pulse offers details about weather, traffic, events and demographics and helps in addressing major industry challenges like on-shelf availability and demand-forecasting accuracy. This data will then flow through SAP Cloud Platform to unlock insights that can be executed upon in the right away. Thus, the solution will aid in decision making, using unique, near real-time market-demand signals, live business and a digital core to facilitate execution.

However, it seems that in recent quarters, dull prospects of the global IT industry, as well as flat customer spending projections are affecting SAP’s performance. SAP’s business, being spread across the globe, is also vulnerable to the political, economical and regulatory risks. Over the past few quarters, many of the company’s emerging markets have faced general economic slowdowns, which adversely impacted their purchasing power.

Also, currency fluctuations in many of its key markets are also adding to this Zacks Rank #4 (Sell) company’s woes.

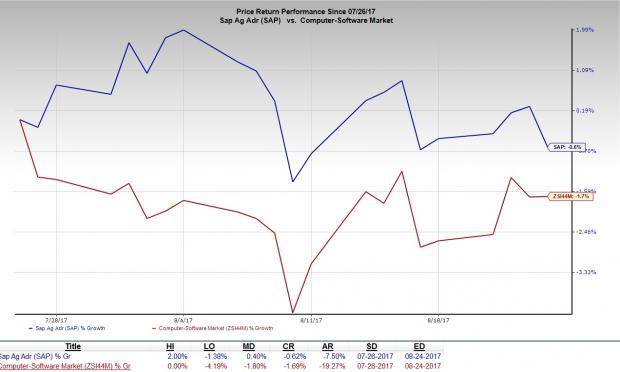

Over a month, the company’s stock has yielded a negative return of 0.6%, outperforming the industry’s decline of 1.7%. We believe that resiliency of its Cloud and Software business, presence of a large business network and strategic partnerships would help the company lure more clients, thus boosting its top line.

Stocks to Consider

Some better-ranked stocks in the industry are Oracle Corporation (NYSE:ORCL) and Xplore Technologies Corp (NASDAQ:XPLR) . While Xplore Technologies sports a Zacks Rank #1 (Strong Buy), Oracle carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Oracle came up with an average positive earnings surprise of 5.1% for the last four quarters, having beaten estimates twice over the last four quarters.

Xplore Technologies has an excellent earnings beat history, having surpassed estimates each time over the trailing four quarters. It has an average positive earnings surprise of 102.5%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

International Business Machines Corporation (IBM): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

SAP SE (SAP): Free Stock Analysis Report

Xplore Technologies Corp (XPLR): Free Stock Analysis Report

Original post

Zacks Investment Research