Amazon.com Inc. (NASDAQ:AMZN) recently announced plans of hiring new positions in France this year.

The company will add 1,800 permanent contract jobs in France to meet the increasing demand for products, thereby further expanding footprint in Europe. These new additions will bring the total workforce of the country to approximately 9,300 by 2019-end.

The latest move aligns with Amazon’s motto of providing better services to customers, accommodating rapid growth and leveraging the area’s diverse high-technology talent pool.

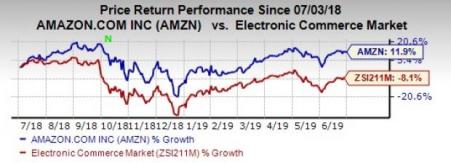

Coming to price performance, the company has outperformed the industry it belongs to on a 12-month basis. The company’s shares have gained 11.9% against the industry’s decline of 8.1% in the said period.

Expansion in France Continues

Over the past few years, the Seattle e-commerce giant Amazon has invested more than 2 billion euros ($2.26 billion) in France. France remains Amazon’s largest European market after Britain and Germany.

The company already has 20 sites in the country, including six logistics centers. The most recent facility, located in Bretigny-Sur-Orge near Paris, is expected to be operational this summer.

In a bid to expand the food retail business, it plans to launch a grocery delivery service in France.

In this regard, Amazon expanded partnership with French food retailer Casino this April. It installed pick-up lockers in Casino stores across France and ensured the availability of Casino-branded products, in turn expanding the grocery business in the European Union.

The latest step to recruit more personnel in France clearly demonstrates that Amazon is focused on expanding operations in the country and delivering enhanced services to more customers. Consequently, the company is likely to achieve growth targets going forward.

Bottom Line

France is witnessing rapid adoption of e-commerce technology. This is a key catalyst for the booming e-commerce market. Per a report from Statista, France is expected to generate revenues worth $49.9 billion in 2019.

Further, the report suggests that revenues are anticipated to hit $67.2 billion by 2023, witnessing a CAGR of 7.7% between 2019 and 2023. For 2019, user penetration in the market is projected at 77.4% and is likely to reach 84.7% by 2023.

Amazon believes that France’s solid economic potential and a strong technological outlook will act as a perfect springboard for future growth. The IT major’s profound expertise in providing financial services and other technological solutions aptly complement France’s journey toward digital transformation.

In a bid to maintain supremacy, Amazon has been expanding on a global basis. The company is investing more in fulfillment, technology and content. Although increased expenses could hurt the bottom line in the near term, we believe that these measures are necessary to maintain its dominance in this highly competitive market.

Zacks Rank and Stocks to Consider

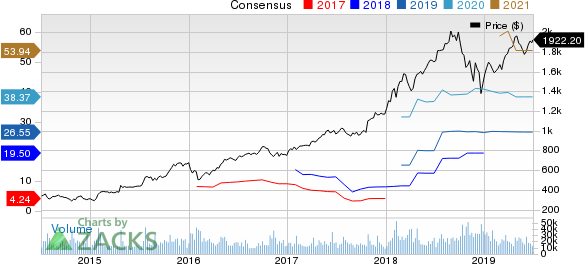

Currently, Amazon carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Autohome Inc. (NYSE:ATHM) , Match Group, Inc. (NASDAQ:MTCH) and Marchex, Inc. (NASDAQ:MCHX) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Autohome, Match Group and Marchex is currently projected at 20.9%, 15.2% and 15%, respectively.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Marchex, Inc. (MCHX): Free Stock Analysis Report

Autohome Inc. (ATHM): Free Stock Analysis Report

Match Group, Inc. (MTCH): Free Stock Analysis Report

Original post

Zacks Investment Research