I continue to watch the discount between Australian equities, the local currency and the commodities market.

Iron ore printed a new decade low at US$42.97 a tonne yesterday (A$59.41 is also a decade low) as the December futures market trading in Singapore crossed into the US$30 handle for the first time. The Dalian futures hit CNY345 a tonne for January delivery, which is also a new low for this contract, suggesting China still won’t be tempted back into the market at any price.

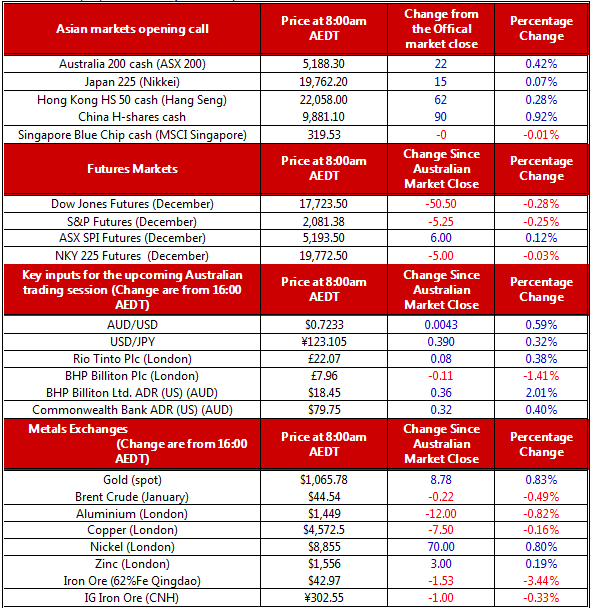

Brent fell to $44.54 a barrel, wiping out the residual gains from last week’s hype of production intervention at this week’s OPEC meeting – still one to watch.

Copper sits at $4,572 a tonne on the LME and it faces China manufacturing data today which is likely to show further slowing at SMEs. Copper pricing may see some structural changes from the announcement that production at nine of the largest Chinese copper producers will cut output by 200,000 tonnes in 2016 (approximately 5% of this year’s global output). These nine producers account for approximately 60% of China’s refined copper output and could see oversupply moving back towards equilibrium –this is, however, not happening in the interim.

Yet, AUD/USD continues to march higher, adding another 0.5% overnight to 72.32 cents. This means the pair added 1.2% since the last RBA) meeting. However, it’s against its other major peers that disconnect is even more pronounced. AUD added 0.8% versus the EUR last night (understandable considering the ECB meeting on Thursday) but is up 5.2% over since the last RBA meeting. It’s up 3.5% against the GBP and 3.3% against the CAD over the same period. Risk off currencies also haven’t stopped it with JPY losing 3.1% to the AUD. Since the last RBA, the CHF lost 5.5% over the same period despite the commodities turmoil, the CAPEX data, and a slowing housing market.

On a trade weight basis, the AUD has added 2.2% since the Melbourne Cup RBA meeting despite the commodities story. What’s more interesting is the AUD TWI as a ratio to iron ore is at its highest level since records began in 2008 at 1.04 – has the AUD truly broken away from being ‘the commodity currency’?

Australian equities lost 1.3% in November; however, the banking and financial services recovery (which added 1.3%) along with healthcare and energy sectors treading water moderated the collapse from the middle weeks.

Materials were the drag. This shows some correlation with global commodity markets; however, this was more down to the issues at BHP, which lost 22% in November, rather than the sector as a whole, which lost 10.3% in November. Fortescue Metals Group Ltd (AX:FMG) lost 7.3% while Rio Tinto Ltd (AX:RIO) lost a little less, copper and gold producers were down but by no more than 6% over the period. Considering the steep decline in copper, coal and iron ore, there is a breakdown here.

As we enter into the last month of the year, there will be plenty of talk of ‘Santa’ and his rally. I can’t deny that the market is primed for this scenario: light volumes, the very high probability macro events will go the way markets have positioned, plus the fact that managers will want to close the books on as high a note as possible all means December has upside.

2016 however will be very interesting – dividend policies, housing data (auction clearance rates hit 60% clearance rate last weekend – the lowest level since February), consumer sentiment, and trade will dominate Australian markets. It will be another busy year.

Ahead of the Australian Open

It may be one of the dullest RBA meeting today. Stevens and co have clearly ‘chilled out’ early and already gone on their Christmas holidays, having had a very busy year by their standards. I would be surprised if there are more than a dozen words that differ from the November statement.

Caixin manufacturing and non-manufacturing data will hit the wires at noon AEDT, while Australian housing data has a bit more sway these days as investors look to signs that the housing-led recovery has/is moderating.

Ahead of the open, we are calling the ASX up 0.4% to 5188.