Sanofi (PA:SASY) (NYSE:SNY) , in a bid to strengthen its blood disorder portfolio, is acquiring Bioverativ Inc. (NASDAQ:BIVV) , which is focused on developing therapies for hemophilia and other rare blood disorders.

Sanofi has offered $105 per share, a premium of almost 64% to the closing price of Bioverativ as on Jan 19, to acquire all outstanding shares in an all-cash deal amounting to $11.6 billion. The transaction is approved by both boards.

We remind investors that Bioverativ was part of Biogen Inc. (NASDAQ:BIIB) before the latter spun it off in February 2017.Bioverativ began trading on Nasdaq from Feb 2.

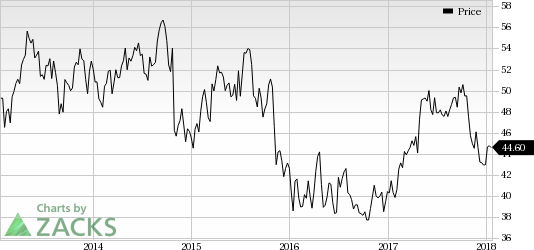

Shares of Sanofi were down almost 3% in pre-market trading on Jan 22, presumably due to the high cost of acquisition while shares of Bioverative were up 62.6%. Meanwhile, the company’s shares have increased 11% in the past year, underperforming the industry’s gain of 24% in the same time frame.

The acquisition should be beneficial for Sanofi as it can leverage the expertise of Bioverativ in rare blood disorder therapies, especially haemophilia. Moreover, the deal is line with Sanofi’s long-term outlook to strengthen its presence in specialty care and leadership in rare diseases.

Bioverativ’s Eloctate and Alprolix are the standard of care for the treatment of hemophilia A and B, respectively. The company generated sales of $847 million in 2016.

The deal also strengthens Sanofi’s pipeline by adding a phase III candidate for cold agglutinin disease and other early stage candidates in hemophilia and other rare blood disorders, including sickle cell disease and beta thalassemia.

Sanofi is currently developing its RNA-based therapy, fitusiran, for treating haemophilia. The company can now use Bioverativ’s clinical expertise and existing commercial platform to advance the candidate’s development. We note that Sanofi, earlier this month, gained global development and commercialization rights to fitusiran after it restructured its rare disease alliance with Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY) .

Per the press release, the current haemophilia market stands at $10 billion, which is expected to grow 7% annually until 2022. Adding two standard of care products to its portfolio will certainly boost Sanofi’s prospect in this lucrative market.

Sanofi expects the acquisition to be accretive to earnings per share in 2018 and an addition of add another 5% to it in 2019.

Zacks Rank

Sanofi carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Sanofi (SNY): Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

BIOVERATIV INC (BIVV): Free Stock Analysis Report

Original post

Zacks Investment Research