As diplomatic talks between the US, Russia, and Ukraine continue, investors are closely watching for potential opportunities in a reopened Russian market despite the significant risks that remain. The prospect of a ceasefire and improved relations between Moscow and Washington has triggered speculation about the future of sanctions and possible market access, fuelling interest in Russian assets that have been largely off-limits since the war began.

Russia’s Economy has Survived the War—But At What Cost?

When Russia launched its large-scale invasion of Ukraine in 2022, Western nations responded with some of the most severe economic sanctions in recent history. Russian banks were disconnected from SWIFT, hundreds of billions in foreign reserves were frozen, and Western corporations swiftly exited the Russian market, leaving assets that were either seized or restructured under Kremlin control. The aim was to economically isolate Russia and make it financially unfeasible for Putin to sustain a prolonged war.

Despite these measures, Russia’s economy has not collapsed. Instead, it has adapted by redirecting trade flows and significantly increasing government spending, particularly in the defence sector. In 2024, the country posted a 3.94% GDP growth rate, contradicting earlier projections of a deep recession. This unexpected economic resilience can largely be attributed to two key factors.

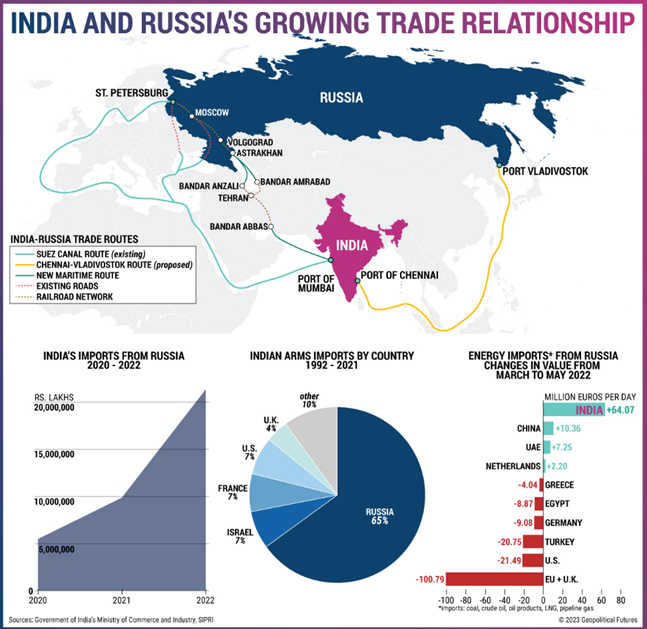

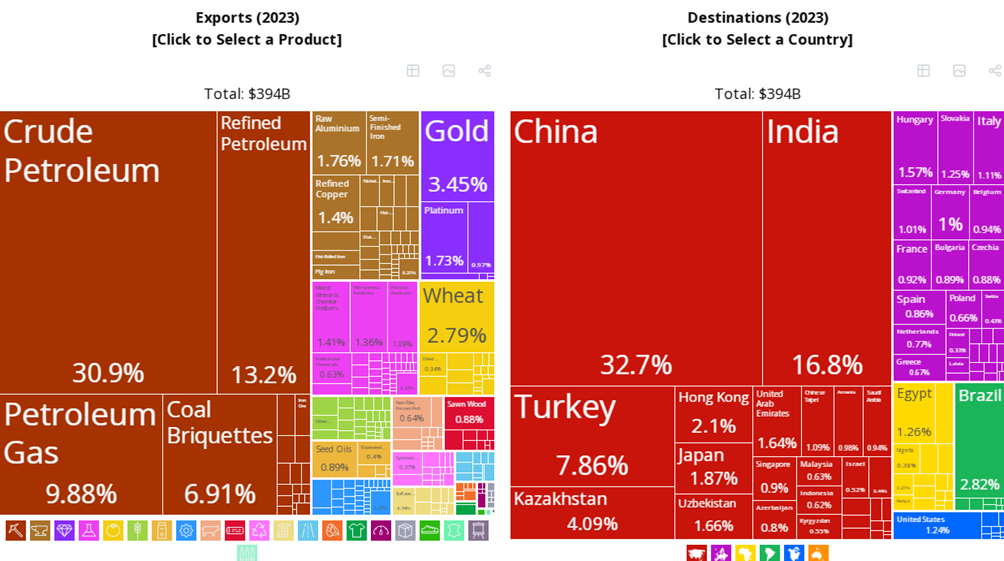

The first is energy exports. As the world’s third-largest oil producer, Russia has successfully shifted its supply to China, India, and other non-Western markets. Before 2022, India sourced only about 1% of its oil imports from Russia; today, that figure has surged to 35–40%. While Western sanctions aimed to cap Russian oil prices at $60 per barrel, Moscow has managed to bypass these restrictions by leveraging intermediary traders and shadow networks. The revenue generated from energy exports has allowed Russia to keep its budget deficit under 3%, preserving financial stability.

Investors Bet on Sanctions Relief Amid Trump-Putin Talks

With President Donald Trump actively pursuing a ceasefire between Russia and Ukraine, financial markets are closely watching for signs of sanctions relief and a gradual reopening of Russian markets. Investors see an opportunity in heavily discounted Russian assets, believing that if restrictions are eased, a rapid and substantial recovery could follow.

In London, traders have begun seeking exposure to Russian debt, particularly bonds from state-controlled energy giant Gazprom. Once considered off-limits, these securities are now viewed as potential high-reward investments. At the same time, investors from the Middle East are increasingly turning their attention to Russia’s energy and financial sectors, positioning themselves ahead of a possible shift in international policy.

For the first time since Russia’s large-scale invasion of Ukraine in 2022, a US president has directly engaged with President Vladimir Putin. The phone call between Trump and the Russian leader was more than a diplomatic formality—it signalled a pivotal moment with potential repercussions for global financial markets. Since the outbreak of the war, Western governments have imposed some of the most severe economic penalties in modern history, effectively severing ties with Moscow. Now, with Trump advocating for a ceasefire, speculation is growing that the US may scale back sanctions, setting the stage for Russia’s financial reintegration.

Although the ceasefire negotiations remain fragile, they have sparked cautious optimism among some investors. Ukraine has agreed to a 30-day truce, but Moscow has voiced scepticism, arguing that such a pause could allow Kyiv to regroup and fortify its defences. The Kremlin has made it clear that any long-term settlement must align with its strategic interests and that continued Western military aid to Ukraine is a critical sticking point. Despite these complexities, the prospect of a resolution—however uncertain—has already driven renewed interest in Russian assets, with hedge funds and brokers quietly exploring potential re-entry into one of the most scrutinised markets in the world.

This shift in diplomatic engagement has also impacted market sentiment. On Polymarket, traders initially assessed a 62% likelihood of a ceasefire before July. However, following Trump’s conversation with Putin on 19 March, that probability declined to 53%, reflecting increased uncertainty over Moscow’s actual intentions. Putin dismissed Trump’s request for a 30-day ceasefire in Ukraine, agreeing only to scale back strikes on energy infrastructure while insisting that military aid and intelligence support to Kyiv be halted. Trump described the conversation as a step forward, while European allies responded by pushing to expedite arms deliveries to Ukraine.

The second key factor is an enormous surge in military spending, transforming Russia into a wartime economy where arms production and defence contracts drive industrial activity.

While these measures have helped Russia sustain economic stability, they have also introduced significant long-term challenges. Inflation has soared as domestic demand outstrips supply, prompting the Russian Central Bank to hike interest rates to 21% in an effort to contain price pressures. Labour shortages have worsened due to military mobilisation, leaving numerous industries struggling to fill positions. Furthermore, Russia has grown increasingly reliant on China for trade and financial transactions, with the Chinese yuan now playing a dominant role in its economy.

Despite growing optimism in financial markets, major obstacles remain. Even if Trump moves to lift US sanctions, the European Union may be far less inclined to follow suit. European leaders remain steadfast in their support for Ukraine and could resist fully reintegrating Russia into the global economy, creating a policy rift that would complicate investment opportunities. Hedge funds and private investors seeking exposure to Russian assets are already exploring alternative routes, such as non-deliverable forwards (NDFs) and indirect trading avenues through Kazakhstan and the UAE. However, legal and reputational risks remain significant, as financial institutions must navigate a shifting and highly complex sanctions regime.

The ruble has also faced volatility amid changing geopolitical dynamics. Since the start of the year, it has climbed nearly 36% against the US dollar, fuelled by speculation that Trump’s discussions with Putin could pave the way for sanctions relief. However, trading volumes remain low, with international ruble transactions still averaging around $50 million per week—well below pre-war levels. Some investors have turned to Kazakhstan’s tenge as an indirect means of gaining exposure to the Russian currency, though limited liquidity continues to pose challenges.

Russian Markets Gradually Reopen to Foreign Investors

As Western investors weigh their options, the Kremlin is carefully shaping the terms of Russia’s financial reintegration. On 17 March, President Putin signed a decree permitting the US hedge fund 683 Capital Partners to purchase Russian securities from a select group of foreign stakeholders. This decision is widely viewed as an experiment, allowing Russia to cautiously reintroduce foreign capital while maintaining strict oversight of the process.

The decree also authorised two Russian funds, Cepheus-2 and Modern Real Estate Funds, to acquire these securities in the future without requiring further presidential approval. This indicates that Moscow is open to limited foreign investment but under conditions that favour Russian financial institutions. Even if sanctions are lifted, Western firms may struggle to regain the same level of market access they once enjoyed, as Russia has spent the past three years strengthening its economic ties with China and India.

A crucial factor in this evolving landscape is the increasing dominance of the Chinese yuan in Russia’s economy. With the ruble experiencing fluctuations and Western financial networks restricted, Russian businesses and individuals are conducting more transactions in yuan than ever before. As a result, China has not only solidified its position as Russia’s largest trading partner but also emerged as a key stabilising force in Russia’s financial system. If Western investors regain entry into the Russian market, they will likely find themselves competing with well-established Chinese and Indian financial players, who have taken over sectors that were once led by European and American firms.

A High-Stakes Investment Landscape

While some investors view Russia as a volatile but potentially lucrative opportunity, others remain wary of the long-term sustainability of re-entering its markets. Political uncertainty casts a shadow over any investment decision, as ceasefire negotiations remain fragile and Russia’s strategic intentions in Ukraine remain ambiguous. Should hostilities escalate or new geopolitical conflicts arise, sanctions could be swiftly reinstated, leaving investors vulnerable to abrupt losses.

Reputational concerns also weigh heavily, as involvement in Russian markets could attract scrutiny from Western regulators, shareholders, and the public. Financial institutions must carefully assess the potential fallout from engaging with a country still subject to extensive international sanctions and led by a figure accused of war crimes. Even if some restrictions are eased, Russia’s economic landscape has been profoundly reshaped, with heavy state intervention and wartime expenditures distorting market fundamentals, making long-term investments highly unpredictable.

Another key challenge is the policy divergence between the US and the EU. If Trump moves forward with sanction rollbacks while Europe maintains its restrictions, it could lead to a fragmented investment environment where only select investors gain access to Russian assets. This uneven distribution of opportunities introduces additional complications, particularly for multinational firms navigating multiple regulatory regimes.

Conclusion

Russia’s economic resilience has defied expectations, but not without significant trade-offs. The country has shifted into a wartime economy, sustained by defence spending and energy exports, while becoming increasingly reliant on China for trade and financial support. Investors are closely monitoring ceasefire discussions, hoping diplomatic progress will open the door for Russia’s reintegration into the global economy.

The prospect of sanctions relief has revived interest in Russian assets, with hedge funds and institutional investors positioning themselves for a potential market recovery. Yet the risks remain substantial. Geopolitical instability, legal uncertainties, and reputational exposure make investing in Russia a precarious gamble.

In the coming months, it remains to be seen whether Russia will reopen to international investors or continue to face challenges related to political and economic factors. The trajectory of its economy will be shaped by a combination of geopolitical dynamics, the stability of the region, and the risk appetite of global investors.