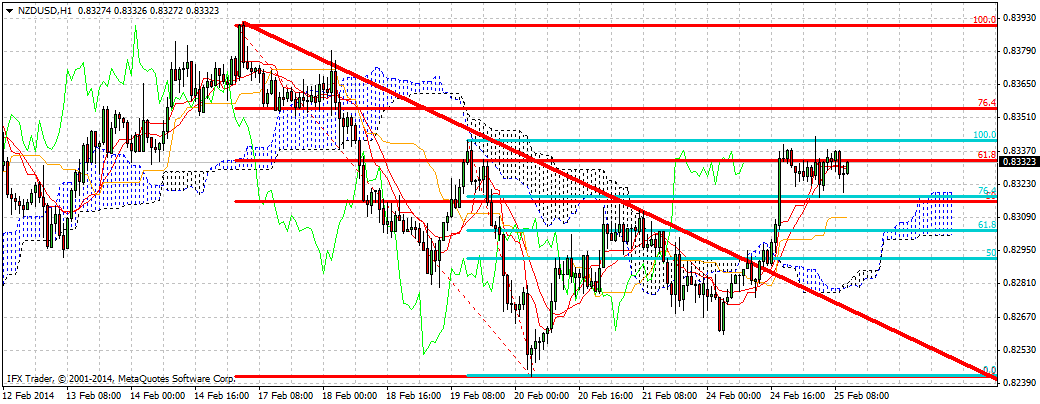

The following two pairs have the same bearish patterns according to Elliott wave theory, that makes them great selling candidates as the bearish potential is big and prices have reached important resistance levels. Both pairs have made 5 waves down and three waves up near the 61,8% Fibonacci retracement. The upward move from their recent lows is most probably corrective and we should expect a new downward move to start.

NZD/USD" title="NZD/USD" height="242" align="bottom" border="0" width="474">

NZD/USD" title="NZD/USD" height="242" align="bottom" border="0" width="474">

Confirmation that this upward move is corrective will come once the intermediate low is broken, thus there is no higher highs and higher lows pattern in play. Both pairs have reached the 61,8% Fibonacci retracement and this is where they both find this resistance difficult to overcome. CADJPY has already given reversal signs near the 61,8% retracement and now needs to break the blue upward sloping trend line support.

CAD/JPY" title="CAD/JPY" height="242" align="bottom" border="0" width="474">

CAD/JPY" title="CAD/JPY" height="242" align="bottom" border="0" width="474">

If you want to see how we trade FX pairs live, become a member today. Thank you for taking the time to catch up on my thinking.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.