Sallie Mae (NASDAQ:SLM) reported second-quarter 2017 core earnings of 16 cents per share, in line with the Zacks Consensus Estimate. The bottom line however increased 33% from the prior-year quarter.

Earnings growth was supported by an increase in net interest income. The private education loan portfolio and deposits grew considerably. However, these positives were offset by lower non-interest income, higher expenses and rise in provision for loan losses.

Sallie Mae reported core earnings (primarily adjusted for derivatives) of $69 million, up 35% from the year-ago quarter.

Increased Net Interest Income Offsets Higher Expenses

Net interest income for the second quarter was $269.9 million, up 27% year over year. The improvement was mainly driven by an increase in the portfolio size of private education loans. Net interest margin expanded 7 basis points (bps) year over year to 5.91%.

Non-interest income came in at $7 million, reflecting a 55% decrease from the prior-year quarter, primarily reflecting loss on derivatives and hedging activities and lower other income.

The company’s total expenses increased 17.2% year over year to $111.4 million. The rise was mainly due to increased compensation and benefits expenses, higher FDIC assessment fees and other expenses.

Efficiency ratio, on a non-GAAP basis, declined to 39.7% in the quarter from 41.8% in the year-ago quarter. A lower ratio indicates improved profitability.

Credit Quality Worsens

Provision for loan losses was $50.2 million, up 20.2% year over year.

Delinquencies as a percentage of private education loans in repayment were 2.2%, reflecting an increase from 2.1% in the year-ago quarter.

Growth in Deposit and Loans

As of Jun 30, 2017, deposits of Sallie Mae Bank were $13.8 billion, up from $11.9 billion as of Jun 30, 2016. Increases in broker deposits along with retail and other deposits contributed to the rise.

As of Jun 30, 2017, the private education loan portfolio was $15.5 billion, up 27.2% year over year. Loan origination climbed 2% year over year to $431 million in the reported quarter. Average yield on the loan portfolio was 8.33%, up 35 bps year over year.

Strong Capital Position

As of Jun 30, 2017, Sallie Mae Bank’s Tier 1 capital to risk-weighted assets and common equity Tier 1 capital were both 12.5%. Capital ratios exceeded the “well capitalized” industry benchmark in regulatory requirements.

2017 Outlook

The company estimates core earnings per share in the range of 71–72 cents for this year. Operating efficiency ratio on a non-GAAP basis is expected in the range of 38–39%. Private education loan originations are projected at $4.9 billion.

Our Viewpoint

Results of Sallie Mae highlight consistent focus on increasing private education loan assets, maintaining a solid capital position by introducing multiple complementary new products and improving efficiency. We believe economic recovery and a declining unemployment rate will assist Sallie Mae in maintaining its leading position in the student lending market. Further, its focus on solidifying its presence in the consumer banking business space bodes well for the upcoming quarters.

However, we remain cautious owing to consistently increasing expenses. Sallie Mae also faces concentration risk due to extreme dependence on broker deposits.

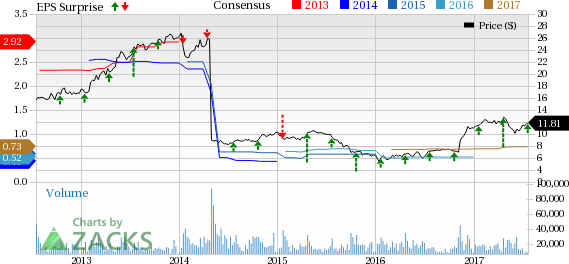

SLM Corporation Price, Consensus and EPS Surprise

Currently, Sallie Mae carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the finance space, Ally Financial Inc. (NYSE:ALLY) is slated to release results on Jul 27 while Trustmark Corp. (NASDAQ:TRMK) and Fifth Third Bancorp (NASDAQ:FITB) will release their earnings on Jul 25 and Jul 21

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Trustmark Corporation (TRMK): Free Stock Analysis Report

SLM Corporation (SLM): Free Stock Analysis Report

Ally Financial Inc. (ALLY): Free Stock Analysis Report

Original post

Zacks Investment Research