Customer retention giant Salesforce.com (NYSE:CRM) late Thursday posted better than expected third quarter earnings results and offered an upbeat outlook, sending its shares jumping higher in after-hours trading.

The San Francisco-based company reported adjusted Q3 net income of $0.24 per share, which was 3 cents better than Wall Street’s $0.21 per share estimate. Revenues rose 25.3% from last year to $2.14 billion, also beating analysts’ view of $2.12 billion.

Salesforce said that subscription and support revenues jumped 24% year-over-year to $1.98 billion, while professional services and other revenues were $161 million, up 39%.

Looking ahead, CRM forecast Q4 EPS of $0.24 to $0.25, which is in-line with Wall Street’s view of $0.25. Q4 revenues are expected at $2.267 to $2.277 billion, which would beat analysts’ $2.24 billion view.

For the full fiscal year 2018, Salesforce expects revenues of $10.1 to $10.5 billion, which would eclipse the consensus estimate of $10.07 billion.

The company commented via press release:

“We had outstanding execution in the third quarter, closing a record number of large transactions as more and more companies look to Salesforce as their trusted advisor to redefine their customer strategies,” said Keith Block, vice chairman, president and COO, Salesforce. “No other enterprise software company is delivering customer success at this scale — and certainly not at this pace.”

“We delivered another strong quarter of booked business on and off the balance sheet, which is now more than $12 billion, up 27% year-over-year,” said Mark Hawkins, CFO, Salesforce. “We are pleased to raise our fiscal full-year 2017 revenue guidance by $50 million to $8.375 billion at the high end of the range.”

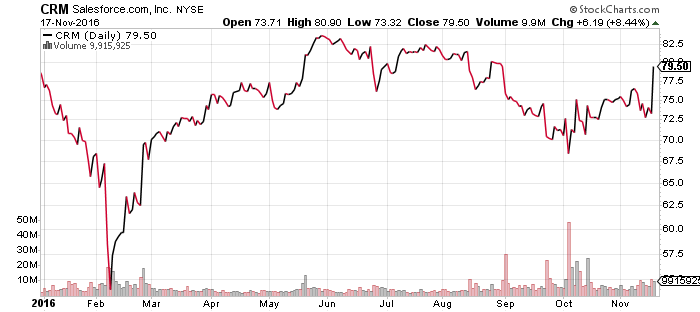

Salesforce shares rose $3.56 (+4.73%) to $78.75 in after-hours trading Thursday. Prior to today’s report, CRM had gained 3.31% year-to-date.