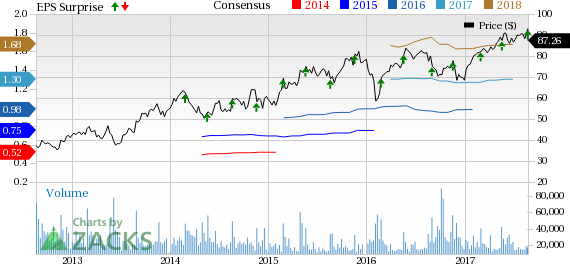

Continuing its earnings streak for the sixth quarter in a row, Salesforce.com Inc. (NYSE:CRM) posted splendid second-quarter fiscal 2018 results, wherein the top and bottom lines not only fared better than the Zacks Consensus Estimate, but also came ahead of management’s guided ranges. Quarterly revenues and earnings also marked year-over-year improvement.

The world’s leading CRM platform provider reported non-GAAP earnings of 33 cents per share, which came ahead of the Zacks Consensus Estimate of 31 cents, as well as the company’s guidance range of 31-32 cents. Moreover, the figure compared favorably with the year-ago quarter’s earnings of 24 cents, mainly driven by strong top-line growth and efficient cost management, partially offset by increased number of outstanding shares.

Looking at the last quarter’s strong results and encouraging outlook for the next quarter and fiscal 2018, we believe that the stock will likely see upside movement during today’s trading session. Notably, the stock has outperformed the industry to which it belongs to in the year-to-date period. Salesforce has returned 35.8% during the said time frame compared with the industry’s gain of 22.4%.

Before discussing the fiscal second-quarter results in detail, here are some important business highlights of the quarter.

Q2 Business Highlights

Tremendous increase in Salesforce partner certifications has been fueling the company’s top-line results. During its fiscal second-quarter conference call, Salesforce announced that its partner certification witnessed growth of five times over the last four years, and more companies are willing to invest in Salesforce activities. Accenture (NYSE:ACN) has emerged as one of the biggest examples for this. Notably, Accenture is currently a global leader in the Salesforce implementation service space, with over 11,000 skilled consultants.

A number of big organizations, including Amazon (NASDAQ:AMZN) , 21st Century Fox, Jefferies Investment Bank and Samsung (KS:005930), picked Salesforce solutions during the quarter to drive their digital transformation.

Furthermore, during the fiscal second quarter, Salesforce broke through the $10-billion run rate and named itself the first company in the history of enterprise cloud software industry to have achieved this milestone so fast, including its closest rivals like Microsoft (NASDAQ:MSFT) , Oracle (NYSE:ORCL) and SAP SE (NYSE:SAP) .

Amazon Partnership Stoking International Growth

The company still generates only about 30% of total revenues from international operations, which is much lower than its rivals like Microsoft or Oracle composition of around 50%. Nonetheless, Salesforce noted that its partnership agreements with Amazon’s Amazon Web Services (AWS), entered over the past year, have been helping it expand its international operations.

Earlier, the company used to run its software at its own data centers which was curbing its growth potentials. However, last year the company decided to utilize the AWS data center’s geographical reach to expand its international business. In addition, Salesforce has planned to invest about $400 million on AWS’ cloud platform, over the next four years.

Most recently, Salesforce entered into an agreement with AWS to run its software in the latter’s Canadian data center. This has opened up fresh prospects in the Canadian market. Similarly, Salesforce is planning to do similar thing in Australia, in order to tap the growing opportunity in the Asia-Pacific region.

During the fiscal second quarter, the company won several deals due to its international expansion initiatives. Companies like Toshiba, Nomura, Queensland Urban Utilities and Australia Post picked Salesforce’s solutions to fuel digital transformation.

Having discussed the fiscal second-quarter business highlights, let’s now turn to the financial results.

Revenues

Salesforce continued to witness solid growth in revenues. The company’s revenues of $2.562 billion not only jumped 25.8% year over year, but also beat the Zacks Consensus Estimate of $2.514 billion. Furthermore, reported revenues came above the guided range of $2.51-$2.52 billion (mid-point: $2.515 billion).

The improvement is primarily attributable to rapid adoption of the company’s cloud-based solutions. Also, higher demand for the Salesforce ExactTarget Marketing Cloud platform, part of the Salesforce1 Customer Platform, drove the year-over-year upside in revenues.

Now, coming to its business segments, revenues at Subscription and Support climbed about 25.6% from the year-ago quarter to $2.369 billion. Professional Services and Other revenues surged almost 28.3% to $193.1 million.

Geographically, the company witnessed constant currency revenue growth of 24%, 31% and 27% in the Americas, EMEA and APAC, respectively, on a year-over-year basis.

Margins

Salesforce’s non-GAAP gross profit came in at $1.967 billion, up 26.1%. Additionally, gross margin expanded 20 basis points (bps) to 76.8%, primarily due to solid revenue growth, which was partially offset by increased investment in infrastructure development, including the expansion of the international data centers.

Non-GAAP operating expenses flared up 22.3% from the prior-year quarter to $1.585 billion. However, as a percentage of revenues, operating expenses decreased to 61.9% from 63.7% in the year-ago quarter. This was primarily because of efficient cost management.

Salesforce posted non-GAAP operating income of $381.3 million compared with the year-ago figure of $263.6 million, while operating margin advanced 200 bps to 14.9%. The year-over-year increase in non-GAAP operating margin was mainly driven by improved gross margin and lower operating expenses as a percentage of revenues.

Non-GAAP net income grew 41.4% year over year to $240.9 million, while net income margin expanded 100 bps to 9.4%. The benefit from improved gross margin and lower operating expenses as a percentage of revenues on net income margin was partially offset by elevated interest and other expenses.

Balance Sheet & Cash Flow

Salesforce exited the reported quarter with cash and cash equivalents, and marketable securities of $3.50 billion compared with $3.22 billion in the previous quarter. Accounts receivable were $1.569 billion compared with $1.439 million at the end of the fiscal first quarter. Total deferred revenue, as of Jul 31, 2017, was $4.82 billion, up 26% on a year-over-year basis.

During the first half of fiscal 2018, the company generated operating cash flow of $1.561 billion. Moreover, Salesforce generated free cash flow of $1.276 billion in the first half.

Guidance

Buoyed by better-than-expected fiscal second-quarter results, the company provided an encouraging guidance for the fiscal third quarter and raised its outlook for the full fiscal as well. For the fiscal third quarter, the company anticipates revenues in the range of $2.64-$2.65 billion (mid-point: $2.645 billion), representing a year-over-year increase of 23-24%.

The guided range is higher than the Zacks Consensus Estimate of $2.61 billion. Further, the company expects non-GAAP earnings per share in the band of 36-37 cents. On a GAAP basis, the same is anticipated to come between 4 cents and 5 cents. The Zacks Consensus Estimate is currently pegged at 35 cents.

Furthermore, the company raised its revenues and earnings outlook for fiscal 2018. Revenues are now anticipated to come in the range of $10.35-$10.40 billion (mid-point $10.375 billion), up from the previous projection of $10.25-$10.35 billion (mid-point $10.3 billion), representing 23-24% year-over-year increase. It also comes above the Zacks Consensus Estimate of $10.28 billion.

By completing this target, the company will achieve the $10-billion mark in revenues faster than any other enterprise software company.

Similarly, Salesforce now projects non-GAAP earnings to lie between $1.29 and $1.31, while GAAP earnings are expected to be in the range of 7-9 cents. This compares with the previous guidance range of $1.28-$1.30 on non-GAAP basis and 6-8 cents on GAAP basis. The Zacks Consensus Estimate is currently pegged at $1.30, in line with the mid-point of management’s non-GAAP guidance range.

Our Take

Salesforce reported strong fiscal second-quarter results, wherein both top and bottom lines fared better than the Zacks Consensus Estimate, as well as marked significant year-over-year improvement. The company continues to witness solid growth in revenues. The robust revenues were primarily backed by growth across all its business segments and the Salesforce ExactTarget Marketing Cloud platform.

Going ahead, the company’s upbeat outlook for the full fiscal signifies that it will continue to witness growth throughout the fiscal. Additionally, the fiscal third-quarter revenue outlook is impressive. We are also encouraged by the fact that the company will achieve $10 billion in sales in fiscal 2018.

The higher number of deal wins and geographical contributions during the reported quarter were encouraging. We consider the rapid adoption of the Salesforce1 Customer Platform will be a positive. Overall, the company’s diverse cloud offerings and considerable spending on digital marketing remain catalysts. Additionally, strategic acquisitions and the resultant synergies are anticipated to prove conducive to growth over the long run.

In view of increasing customer adoption and satisfactory performances, market research firm, Gartner, acknowledged Salesforce as the leading social CRM solution provider. Also, just recently Forbes named Salesforce the most innovative company in the world again. We believe that the rapid adoption of Salesforce’s platforms indicates solid growth opportunities in the ever-growing cloud computing segment.

Salesforce currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

SAP SE (SAP): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Original post

Zacks Investment Research