Salesforce.com, Inc. ( (NYSE:CRM) ) just released its third-quarter fiscal 2018 financial results, posting non-GAAP earnings of 39 cents per share and revenues of $2.68 billion.

Currently, CRM is a Zacks Rank #3 (Hold) and is down 1.05% to $107.66 per share in after-hours trading shortly after its earnings report was released.

Salesforce:

Beat earnings estimates. The company posted non-GAAP earnings of $0.39 per share, beating the Zacks Consensus Estimate of $0.37. Salesforce also reported GAAP earnings of $0.07 per share.

Beat revenue estimates. The company saw revenue figures of $2.68 billion, beating our consensus estimate $2.65 billion.

Salesforce’s revenue results marked a year-over-year increase of 25%. Deferred revenue of $4.39 billion was up 26% year-over-year. Subscription and support revenues were $2.49 billion, an increase of 25% from the prior-year quarter. Professional services and other revenues were $194 million, a gain of 20% from last year.

“Salesforce delivered a record third quarter, and we're on a path to exceed $20 billion faster than any enterprise software company in history,” said CEO Marc Benioff. “With this phenomenal growth, we are building a company for the ages, creating value for our Trailblazers – our customers, employees, investors and communities – while helping make the world a better place for decades to come.”

Management said that it expects fourth-quarter revenue in the range of $2.801 billion to $2.811 billion. Our current consensus estimate is calling for revenue of $2.79 billion. Non-GAAP diluted earnings per share is projected to be $0.32 to $0.33 per share, which is in-line with our current consensus estimate of $0.33.

The company also announced preliminary guidance for fiscal 2019. Salesforce expects revenue in the range of $12.45 billion to $12.50 billion, which would represent an increase of 19% to 20% from its fiscal 2018 projections. Our current consensus estimate is calling for revenues of $12.50 billion in fiscal 2019.

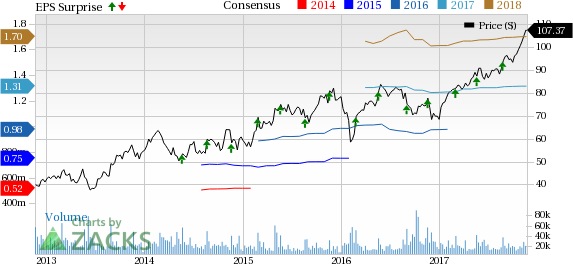

Here’s a graph that looks at CRM’s latest earnings surprise history:

Salesforce.com is the market and technology leader in on-demand business services. The company's Salesforce suite of on-demand CRM applications allows customers to manage and share all of their sales, support, marketing and partner information on-demand.

Check back later for our full analysis on CRM’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting today, and for the next month, you can follow all Zacks’ private buys and sells in real time. Our experts cover all kinds of trades: value, momentum, ETFs, stocks under $10, stocks that corporate insiders are buying up, and companies that are about to report positive earnings surprises. You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Salesforce.com Inc (CRM): Free Stock Analysis Report

Original post

Zacks Investment Research