Salesforce.com ( (NYSE:CRM) ) just released its first-quarter 2018 financial results, posting a GAAP loss of one cent per share and revenues of $2.39 billion.

Currently, CRM is a Zacks Rank #3 (Hold), but this ranking could change based on today’s results. The stock was down 0.79% to $87.06 per share in after-hours trading shortly after its earnings report was released.

Salesforce:

Beat earnings estimates. The company posted adjusted earnings of $0.06 per share (excluding 7 cents from non-recurring items), beating the Zacks Consensus Estimate of $0.05. This figure takes into account stock-based compensation expenses. Salesforce reported a GAAP loss of one cent per share and non-GAAP diluted earnings of $0.28 per share.

Beat revenue estimates. The company saw revenue figures of $2.387 billon, beating our consensus estimate of $2.351 billion.

Subscription and support revenues were up 24% to $2.2 billion, while professional services and other revenues were $187 million, an increase of 32%. Total revenue was up 25% year-over-year.

Deferred revenue on the balance sheet as of April 30, 2017 was $5.04 billion, an increase of 26% year-over-year, and 27% in constant currency.

Salesforce expects second-quarter revenue to fall in the range of $2.51 billion and $2.52 billion. GAAP diluted earnings per share is projected to be $0.00 to $0.01, while non-GAAP diluted earnings per share is projected to be $0.31 to $0.32.

The company also raised its full-year guidance and now expects annual revenues of $10.25 billion to $10.30 billion.

“With our outstanding first quarter results, we are thrilled to be raising our fiscal 2018 revenue guidance by $100 million and raising our GAAP and non-GAAP earnings per share expectations for the year,” said Marc Benioff, chairman and CEO, Salesforce. “Salesforce has once again been named the CRM market leader, and we continue to grow our share in CRM -- the fastest growing enterprise software market.”

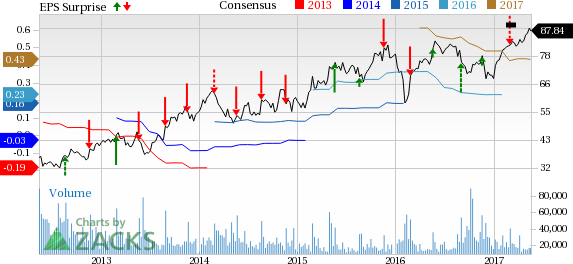

Here’s a graph that looks at Salesforce’s earnings performance history:

Salesforce.com is the market and technology leader in on-demand business services. The company's Salesforce suite of on-demand CRM applications allows customers to manage and share all of their sales, support, marketing and partner information on-demand. The Salesforce Platform, the world's first on- demand platform, enables customers, developers and partners to build powerful new on-demand applications that extend beyond CRM to deliver the benefits of multi-tenancy and The Business Web across the enterprise.

Check back later for our full analysis on CRM’s latest earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Stocks that Aren't in the News…Yet

You are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. Many of these companies are almost unheard of by the general public and just starting to get noticed by Wall Street.

They have been pinpointed by the Zacks system that nearly tripled the market from 1988 through 2015, with a stellar average gain of +26% per year. See these high-potential stocks now>>

Salesforce.com Inc (CRM): Free Stock Analysis Report

Original post

Zacks Investment Research