Traders moving assets to safer, lower yielding currencies appear to be playing a factor in the correction of the major crosses. The USD and JPY, which are seen as a safer bet than others currencies in times of market stress, will likely keep drawing demand as investors stay away from riskier assets.

Economic News

USD - U.S Dollar Soars against the EUR and GBP

The dollar rose against the EUR on Thursday, reversing the single currency's earlier gains, as investors grew more risk averse and sought safety in the dollar. By yesterday's close, the USD rose against the EUR, pushing the oft-traded currency pair to 1.3370. The dollar experienced similar behavior against the GBP and closed at 1.5900.

As the U.S economy stabilizes, currency traders have started to focus more on fundamentals such as economic growth and short-term interest rates. That shift, just getting underway, could take the shine off the soaring USD in the coming months. A stronger currency is important to the U.S. because it entices foreign investors to Treasury debt that finances the nation's record budget deficit. The downside is that it may restrain profit growth at companies with international sales by making U.S. exports more expensive.

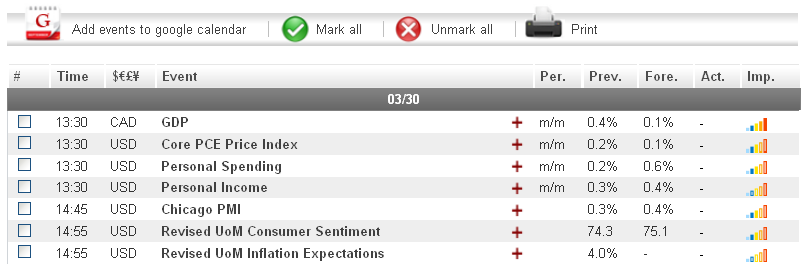

Looking ahead to today, the most important economic indicator scheduled to be released from the U.S. is the Revised UoM Consumer Sentiment at 12:55 GMT. Traders will be paying close attention to today's announcement as a stronger than expected result may boost the USD in the short-term. Traders should pay close attention to the market as there is an opportunity for traders to capitalize on the fluctuations which are likely to follow this release.

EUR - Euro Tumbles vs. Main Currency Rivals

The euro fell against most of its major currency pairs yesterday on Thursday as concerns about contagion from the euro zone debt crisis resurfaced, with investors wary on the common currency ahead of Spain's budget on Friday. By yesterday's close, the EUR fell 1% against the JPY to 109.00.The 16 nation currency experienced similar behavior against the USD and closed at around 1.3300.

Analysts said the euro was unlikely to break below its recent range of roughly between $1.30 and $1.35, with market players expecting a euro zone finance ministers' meeting to approve bolstering the region's rescue fund on Friday.

Looking ahead to today, the most important economic indicator scheduled to be released from Euro-Zone is German Retail Sales at 6:00 GMT. Analysts are forecasting this figure to increase from its previous reading. Traders should pay close attention to the market as there is an opportunity for traders to capitalize on the fluctuations which are likely to follow this release.

JPY - Yen Continues its Bullishness against Major Currencies

The Japanese Yen strengthened against most of its major counterparts yesterday, continuing to prove that for the time being that this is the solid currency that traders can rely on to provide them with steady profits. The Yen extended gains versus the Dollar on Thursday, to trade at about 109.00 amid a broad sell-off in the EUR. The JPY also saw bullishness against the USD and closed at around 82.10.

As for today, the JPY's trends will be affected by the rallies of its primary currency pairs. It seems the USD and EUR are expected to continue a volatile trading session today and their crosses with the JPY will likely be as well. Traders should keep a close look on the news coming from the U.S. and Europe as these economies will be the deciding factors in the JPY's movement today.

Gold - Gold Sinks on USD Strength

Gold prices slipped below $1,660 an ounce in Europe on Thursday, extending their retreat from two-week highs into a third session, as the dollar recovered from a near one-month low and crude oil prices turned lower.

Spot gold was down 0.4% at $1,656.50 an ounce. It has struggled for traction after a rally early in the week sparked by Federal Reserve hints that accommodative monetary policy is set to persist.

Looking ahead, traders are advised to watch carefully the global stock markets and the major economic indicators which will be published from the U.S. in order to predict the next movements in gold prices.

Technical News

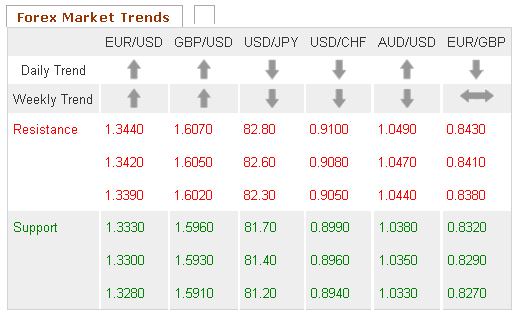

EUR/USD

A bearish cross on the daily chart's Slow Stochastic indicates that the pair may see downward movement. This theory is supported by the Williams Percent Range on the daily chart, which is currently at -20. Going short may be a wise choice for this pair.

GBP/USD

Most long term technical indicators show this pair trading in neutral territory, meaning that no major movements are forecasted at this time. Traders may want to take a wait and see approach, as a clearer picture may present itself in the coming days.

USD/JPY

Both the Relative Strength Index and Williams Percent Range on the daily chart have moved into the overbought zone, indicating that the pair could see downward movement in the coming days. Traders may want to go short in their positions ahead of a possible bearish correction.

USD/CHF

The daily chart's Williams Percent Range is currently in oversold territory, indicating that the pair could see an upward correction in the near future. In addition, the Slow Stochastic on the same chart has formed a bullish cross. Going long may be the wise choice for this pair.

The Wild Card

GBP/AUD

GBP/AUD sustained upward movement has finally pushed its price into the over-bought territory on the 8-hour chart's RSI. Not only that, but there actually appears to be a bearish cross on the Slow Stochastic pointing to an imminent downward correction. Forex traders have the opportunity to wait for the downward breach on the hourlies and go short in order to ride out the impending wave.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Safe Heaven Currencies Continue To Rise On High Risk Aversion

Published 03/30/2012, 08:04 AM

Updated 02/20/2017, 07:55 AM

Safe Heaven Currencies Continue To Rise On High Risk Aversion

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.