- Gold, franc, yen and oil spike higher after Israel strikes Iran

- But gains are pared after retaliatory response seen to be limited

- Stocks head deeper into the red after disappointing tech earnings

Markets on alert as ME tensions re-escalate

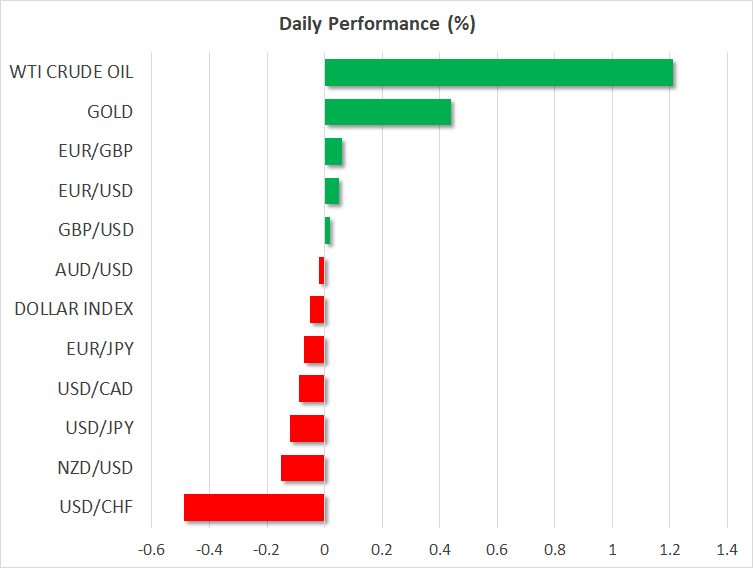

After days of speculation about a possible retaliatory action, Israel launched strikes on Iranian targets overnight, in direct response to Iran’s missile and drone attack last Saturday. Safe havens rallied as the reports started coming in, with gold briefly climbing above $2,400/oz towards last week’s record high and the Swiss franc and Japanese yen gaining across the board.

Oil prices jumped, pushing WTI and Brent crude futures up by around 4.0%. But the moves didn’t last as the panic began to ease as more details emerged about the Israeli strikes, with Iran even downplaying the attack.

Israel is thought to have carried out a missile strike on military facilities near the Iranian city of Isfahan, while Iran said it shot down three drones. Iraq and Syria may also have been targeted.

However, despite this dangerous re-escalation in the region, Iranian officials have said Tehran has no plans for immediate retaliation, and this has gone some way in calming geopolitical jitters in the markets.

Stocks hit by earnings, geopolitical and Fed worries

It seems that the intense pressure applied by the US and its allies on Israel to not overreact to last weekend’s events have had some impact, while Iran also appears keen to avoid an all-out war.

At any other time, this would probably have come as a huge relief for investors, but markets are grappling with so many things right now that risk appetite has been in short supply this week.

Equity markets are facing the prospect of just one rate cut in the US this year as a fresh round of hawkish commentary by Fed officials on Thursday pushed cumulative rate cut bets down to 40 basis points.

New York Fed Chief John Williams became the second FOMC member in as many days to entertain the possibility of a rate hike, while regional presidents Bostic and Kashkari doubted if rates would have to be cut at all in 2024.

Moreover, earnings announcements from chipmakers have raised concerns about the demand outlook, casting a shadow over tech earnings just as the Q1 reporting season gets underway. Even Netflix’s surprisingly strong subscriber numbers couldn’t lift spirits as investors were less than impressed by the company’s revenue guidance for the second quarter.

The S&P 500 closed lower for the fifth straight session on Thursday, while the Nasdaq is facing weekly losses of 5%.

Dollar takes a backseat as yen comes to life

In FX markets, the US dollar failed to shine as a safe haven, but US Treasuries did, which likely weighed on the greenback as yields declined. The dollar had been looking somewhat overbought lately so that also potentially encouraged investors to turn to the franc and yen instead.

However, it’s unclear how much of the yen’s gains today are down to the rush to safety and how much are being driven by renewed bets of rate hikes by the Bank of Japan.

Speaking at the G20 summit in Washington, Governor Ueda told reporters that if the weaker yen pushes up import costs, interest rates might need to rise again.

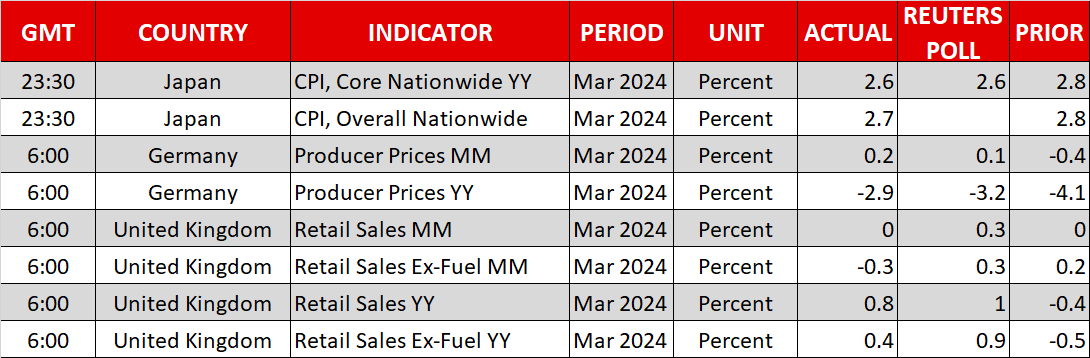

The euro and pound were surprisingly steady against the dollar on Friday, with the latter showing little reaction to worse-than-expected retail sales data out of the UK.