Sabre Corpo (NASDAQ:SABR) was upgraded by analysts at Jefferies Group LLC from a "hold" rating to a "buy" rating in a report issued on Tuesday, MarketBeat.com reports. The brokerage currently has a $25.00 target price on the information technology services provider's stock. Jefferies Group LLC's price objective would indicate a potential upside of 40.29% from the company's previous close.

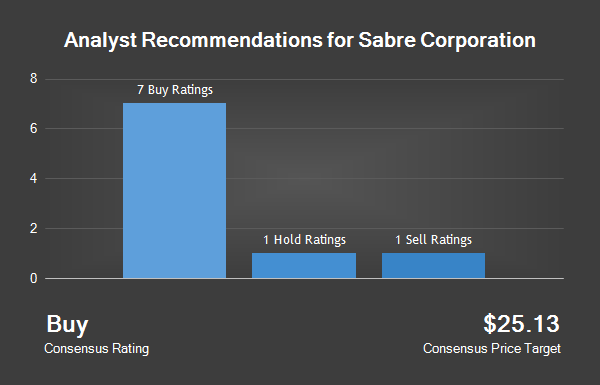

SABR has been the topic of several other research reports. Zacks Investment Research raised Sabre Corporation from a "hold" rating to a "buy" rating and set a $25.00 price objective on the stock in a report on Friday, June 9th. BidaskClub lowered Sabre Corporation from a "sell" rating to a "strong sell" rating in a research note on Saturday, July 8th. Cowen and Company reaffirmed an "outperform" rating and issued a $23.00 price target (down previously from $26.00) on shares of Sabre Corporation in a research note on Wednesday, August 2nd. Deutsche Bank AG boosted their price target on Sabre Corporation from $24.00 to $25.00 and gave the company a "buy" rating in a research note on Wednesday, May 3rd. Finally, TheStreet raised Sabre Corporation from a "c" rating to a "b-" rating in a research note on Monday, April 17th. Three investment analysts have rated the stock with a sell rating, one has assigned a hold rating and seven have assigned a buy rating to the company's stock. The stock has an average rating of "Hold" and an average target price of $25.11.

Shares of Sabre Corporation (NASDAQ:SABR) traded down 2.09% on Tuesday, reaching $17.82. 1,722,901 shares of the company's stock traded hands. The stock's 50-day moving average price is $21.05 and its 200-day moving average price is $22.17. The stock has a market capitalization of $4.97 billion, a price-to-earnings ratio of 37.59 and a beta of 0.71. Sabre Corporation has a 52 week low of $17.81 and a 52 week high of $29.45.

Sabre Corporation (NASDAQ:SABR) last announced its quarterly earnings data on Tuesday, August 1st. The information technology services provider reported $0.35 earnings per share for the quarter, topping the Thomson Reuters' consensus estimate of $0.32 by $0.03. Sabre Corporation had a return on equity of 46.16% and a net margin of 3.87%. The company had revenue of $900.66 million for the quarter, compared to analyst estimates of $895.05 million. During the same quarter last year, the firm earned $0.37 EPS. Sabre Corporation's revenue for the quarter was up 6.6% compared to the same quarter last year. Equities analysts predict that Sabre Corporation will post $1.36 EPS for the current year.

TRADEMARK VIOLATION NOTICE: "[[title]]" was first published by [[site]] and is owned by of [[site]]. If you are reading this news story on another website, it was stolen and reposted in violation of U.S. and international trademark and copyright law. The legal version of this news story can be read at [[permalink]].

In other news, insider Judson Wade Jones sold 3,822 shares of the business's stock in a transaction on Thursday, August 10th. The stock was sold at an average price of $17.92, for a total transaction of $68,490.24. Following the completion of the sale, the insider now owns 31,726 shares in the company, valued at $568,529.92. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, insider Hugh W. Jones sold 36,100 shares of the business's stock in a transaction on Friday, August 4th. The stock was sold at an average price of $20.12, for a total value of $726,332.00. Following the sale, the insider now owns 82,600 shares of the company's stock, valued at approximately $1,661,912. The disclosure for this sale can be found here. Insiders own 1.00% of the company's stock.

Several large investors have recently added to or reduced their stakes in SABR. Teachers Advisors LLC increased its stake in Sabre Corporation by 4.6% in the fourth quarter. Teachers Advisors LLC now owns 184,011 shares of the information technology services provider's stock worth $4,591,000 after buying an additional 8,050 shares during the last quarter. Gulf International Bank UK Ltd increased its stake in Sabre Corporation by 1.5% in the first quarter. Gulf International Bank UK Ltd now owns 55,018 shares of the information technology services provider's stock worth $1,165,000 after buying an additional 800 shares in the last quarter. Bank of Montreal Can increased its stake in Sabre Corporation by 142.3% in the first quarter. Bank of Montreal Can now owns 1,367,181 shares of the information technology services provider's stock worth $28,971,000 after buying an additional 802,918 shares in the last quarter. Fox Run Management L.L.C. bought a new stake in Sabre Corporation during the first quarter worth approximately $386,000. Finally, Beese Fulmer Investment Management Inc. increased its stake in Sabre Corporation by 24.6% in the first quarter. Beese Fulmer Investment Management Inc. now owns 101,999 shares of the information technology services provider's stock worth $2,161,000 after buying an additional 20,167 shares in the last quarter.

Sabre Corporation Company Profile

Sabre Corporation is a technology solutions provider to the global travel and tourism industry. The Company provides software and services to a range of travel suppliers and travel buyers. The Company operates through two business segments: Travel Network, and Airline and Hospitality Solutions. Travel Network is its global business-to-business travel marketplace and consists primarily of its global distribution system (GDS) and a set of solutions that integrate with its GDS to serve travel suppliers and travel buyers.