- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

S&P: Another Downward Correction Very Possible

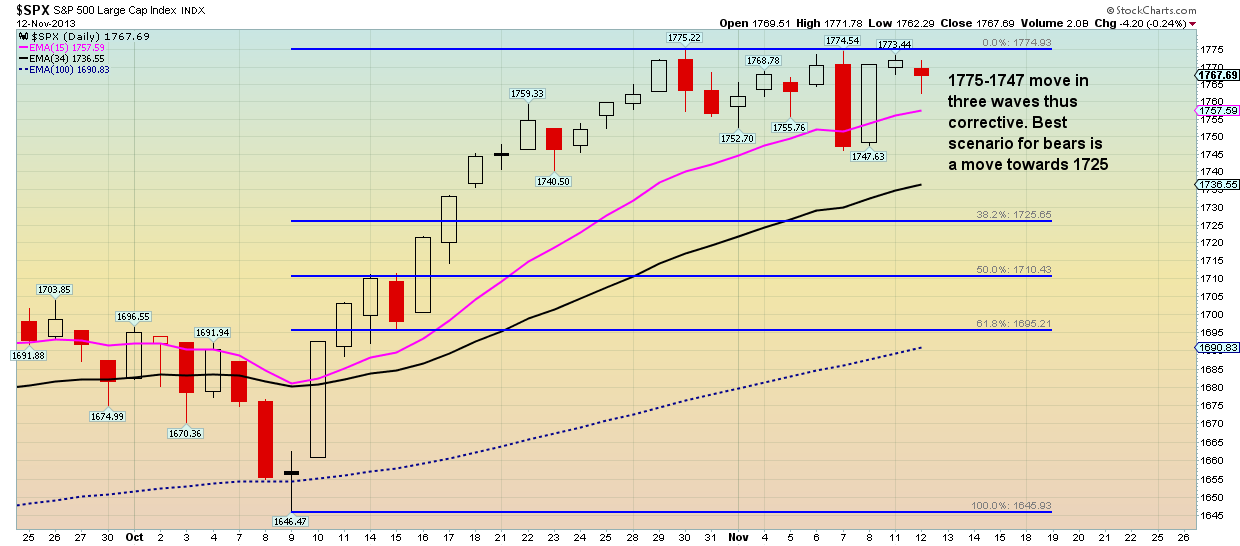

The S&P is trading near its highs in the vicinity of 1765-75 area. The current decline to 1747 was in three waves and this implies that there is no impulsive move down. This doesn’t cancel the possibility of another leg down. We believe that the correction is not over yet, and we should expect prices to at least reach the 38% Fibonacci retracement at 1725.

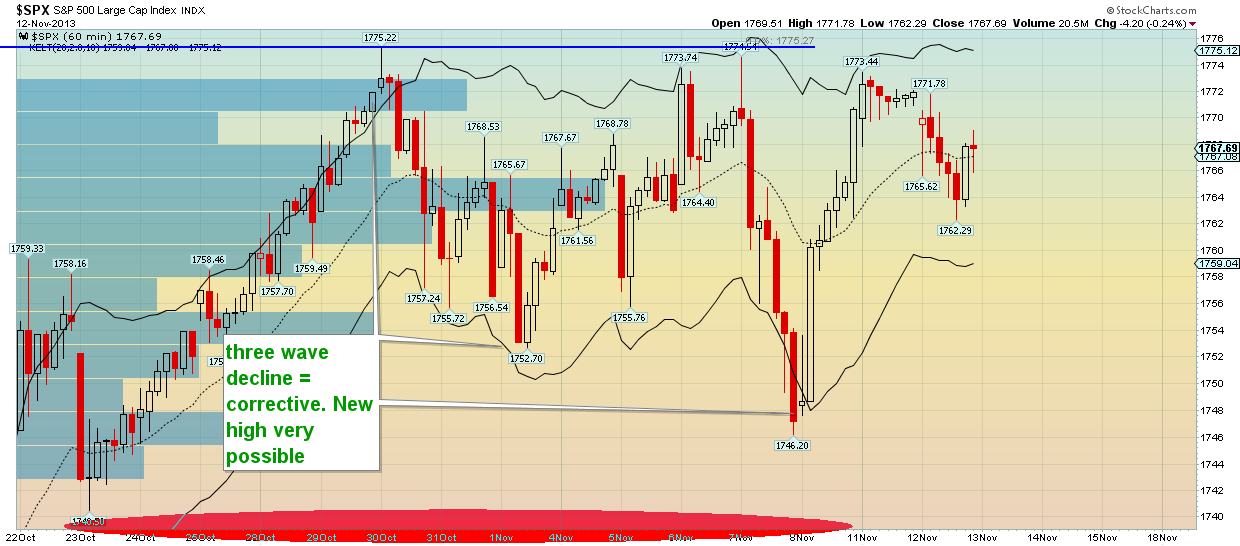

The recent decline as shown above is clearly corrective. However, if prices break below 1760-55 support, we could see 1746 being tested and increased probability of another new lower low towards 1725-30. We may be bearish for the short term, but we are looking for long positions if a larger correction takes place and our longer term support level is not broken. Trend is currently neutral for the short term, but bullish for the intermediate and longer term.

Our view is that we could expect the index to make a move towards the 38% retracement at 1725 or even lower towards 1700, and still this we could label it as buy opportunity. Short term stop for bulls will definitely need to be the 1746 low although a sell signal will be given if prices break below 1755-60. We do not feel the risk reward favors bulls at 1770 area, but we would prefer to take a short bet expecting the correction to complete in lower price levels.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.