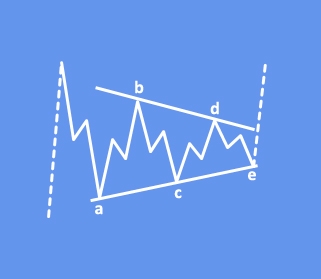

E-mini S&P 500 sold off this week to 2420 where lower side of a range turned out to be a very good support which sent prices back to the upper side of a trading range. As such, market is sideways making a corrective pause within uptrend which may continue to a new high next week, up to 2455 for wave 5 once triangle is finished. wave e is still missing.

A Triangle is a common 5-wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3.

Triangles can occur in wave 4, wave B, wave X position or in some very rare cases also in wave Y of a combination.

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All our work is for educational purposes only.