S&P has reached our lower target of 1854 yesterday to end the three wave downward correction that we mentioned in our last S&P analysis. Prices yesterday broke below 1867 which was the previous low and made a new low at 1854 just above the Fibonacci retracement we were expecting. The upward bounce from that level needs to be analyzed thoroughly as the form and pattern of the rise is very important to decide whether we are now in a new upward move to new all time highs and above 1900 or if we are to see a more complex downward correction of a larger degree.

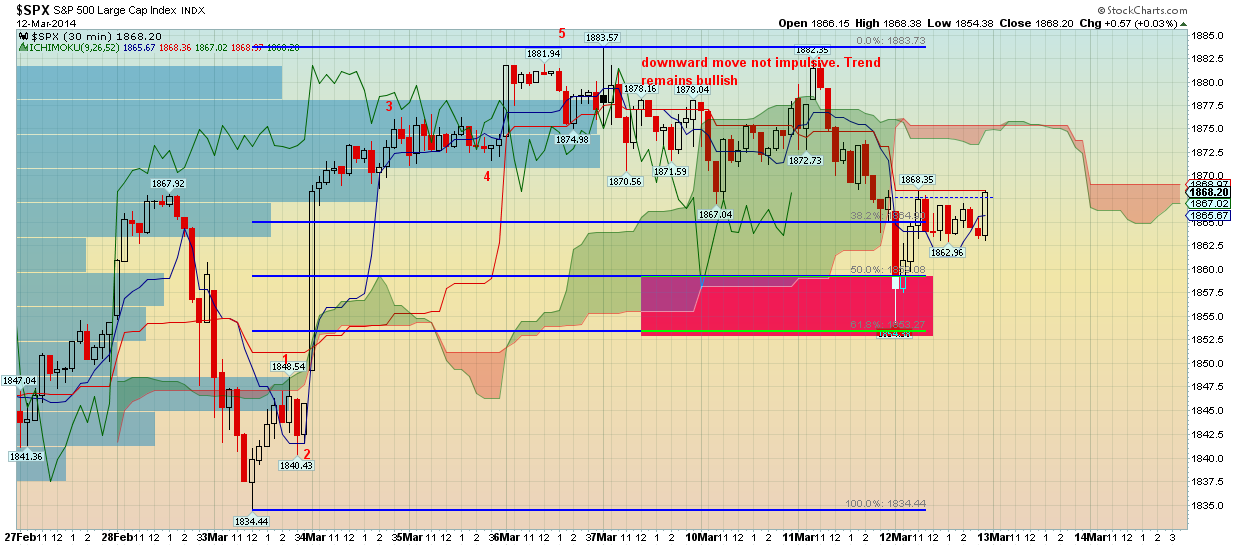

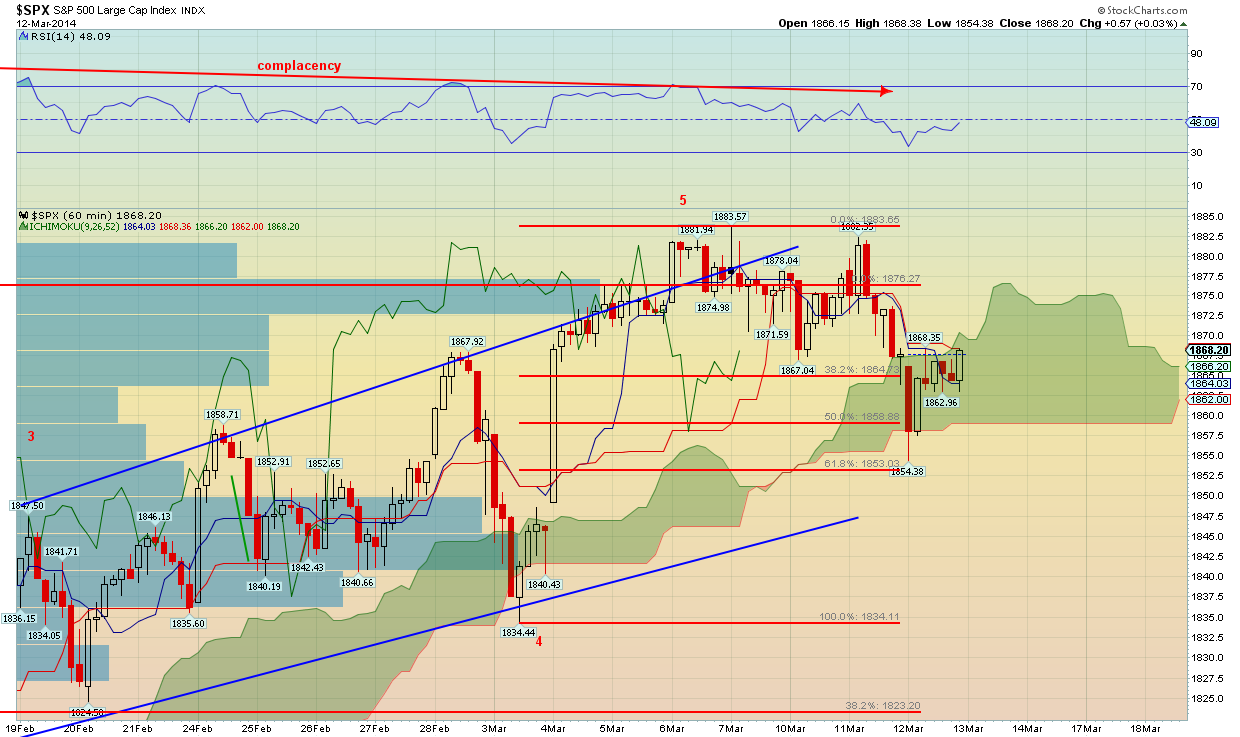

In the 30 minute chart above, SPX has broken below the Ichimoku cloud but has found support at the 61.8% retracement. The decline as shown in both charts is clearly a three wave downward move. This alone does not give too much chances of success to bears. Bulls have more chances to see the market rise towards the all time highs and further than seeing this decline continue lower.

Short-term trend has reversed upwards after the low at 1854 and short-term resistance is now found at 1875-77. Short-term support is found at 1862-1854-1844. The only worrying signs that put the bullish trend in danger come from Ukraine and Asian stock markets. With signs of growth slowing in China and Nikkei building up a bearish formation, we could see another sell-off in Asia that will negatively affect the rest of the equity markets. The rise from recent lows in NIKKEI is corrective and with an overlapping pattern. The NIKKEI futures have topped at 61.8% of the decline and are now testing the lower boundaries of the upward sloping channel. If this channel breaks, then we should expect a test of 14000 lows.

Concluding, technically and according to wave theory, SPX is supported and ready for a new upward move to new highs towards 1900. Fears regarding Ukraine and the tension in that area together with the bad technical view we have regarding NIKKEI are two important reasons to be cautious with any long position. We prefer to be neutral or marginally long with tight stops. We prefer to wait for the sell signal in SPX before front running. If however prices move towards 1880 and we see evidence of complacency, we can take a small short bet with 1886 stop.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.