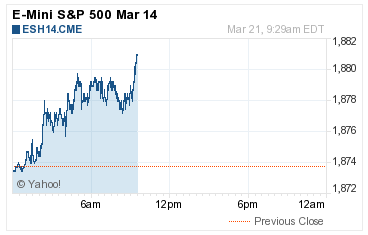

China was up, Europe was up and the S&P 500 was up. What happened? The S&P sold off all day. Why? The mutual funds are selling the winners and marking up the losers.

Liquidation and Candy Crush

The S&P [CME:SPM14] looked great after the open and subsequent rally above, but the same selling that began earlier in the week showed up again. Big names like Biogen Idec Inc (NASDAQ:BIIB) closed down $5.85 or -1.88%. Facebook Inc. (NASDAQ:FB) was down $4.51 or -6.94%, Twitter [TWTR] down $3.45 or 7.21%, Google Inc. (NASDAQ:GOOG) down $26.75 or -2.31% and Tesla Motors Inc. (NASDAQ:TSLA) was off -3.39%.

This type of selling going into a quarter end is not that unusual, but it’s supposed to be mixed with marking up some of the losing stocks. So far all we have seen is the sell side. While we hate to cry wolf, my gut is telling me the time is nearing for a larger pullback. The overall price action is turning negative again and the up a day / down a day price action is wearing out the markets.

Timing is everything

No one knows for sure when the S&P is going to correct, but as the markets move into the second quarter we think it may be time to consider some downside puts for protection. Yesterday we started looking at the CME S&P 500 options, the puts in particular. At 09:05:02 TRADINGDATA2 quoted up the CME SPK 1175 p 430@445 , SPK 1750 put 285@300 and the SPK 1725s are 200@210.

The idea is to find a cheap way to play for a down move and know exactly what you’re risking going into the trade. In most cases we call these option trades lotto tickets: You can make a lot of money fast, and if you lose you know exactly what you’re risking.

Timing really is everything, and up to this point every selloff has led to a higher high. False starts have been a major bear killer over the last few years. Is the current selloff real? That’s the million-dollar question. What we can say is that the markets were spooked by a number of events: the King IPO down almost 16%, Citigroup Inc (NYSE:C) not passing the stress test, all the selling in the stocks above and troop movements on the Ukrainian border.

The Asian majors closed mostly higher and in Europe 9 of 12 markets are trading lower . On today’s economic calendar are the GDP numbers, jobless claims, Cleveland Fed President Sandra Pianalto’s speech to the RISE student conference at the University of Dayton, Ohio, pending home sales, EIA natural gas report, Kansas City Fed Manufacturing Index, 7-year note auction , Fed balance sheet, money supply and Chicago Fed President Charles Evans’s speech on the economy and monetary policy in Hong Kong.

T+3

As of this morning there are exactly 3 trading days left in the first quarter. The mutual funds have been selling the big names all week. Is this the beginning of the end? We don’t think so, but that doesn’t mean the coast is clear. We nailed it Tuesday and Wednesday and we called for selling the early rallies yesterday, but if you were buying the “breaks” you either got out fast or got run over.

Our view is the markets are weak but the S&P has been down 5 out of the last 6 or down 4 in a row (Mar 19 -11.6, Mar 20 +13.4, Mar 21 -9.1, Mar 24 -7.6, Mar 25 -9.8, Mar 29 -16.7). It has tested and bounced off of support at 1842 in the June Emini futures three of the last six trading days, including yesterday evening. With this in mind we think the S&P is due for an up day.

As always, keep an eye on the 10-handle rule and please use stops when trading futures and options.

- In Asia, 7 of 11 markets closed higher: Shanghai Comp. -0.83%, Hang Seng -0.24%, Nikkei +1.01%

- In Europe 9 of 12 markets are trading lower: DAX +0.08%, FTSE -0.36%

- Morning headline: “S&P Futures Seen Higher; IFM Announces $14 to $18 Billion Ukraine Bailout”

- S&P Fair Value: 1844.61 (futures 3.61 lower at 1841.0 as of 6:50AM CT)

- Total volume: 1.89mil ESM and 10.4K SPM traded

- Economic calendar: GDP, jobless claims, Cleveland Fed President Sandra Pianalto speaks, pending home sales, EIA Natural Gas Report, Kansas City Fed Manufacturing Index, 7-year note auction, Fed balance sheet, money supply, Chicago Fed President Charles Evans speaks.

- E-mini S&P 5001881.75+8.00 - +0.43%

- Crude98.55-0.22 - -0.22%

- Shanghai Composite0.00N/A - N/A

- Hang Seng22080.26+245.811 - +1.13%

- Nikkei 22514696.03+73.141 - +0.50%

- DAX9451.21+2.63 - +0.03%

- FTSE 1006588.32-16.98 - -0.26%

- Euro1.3744