We stated here last week that the picture emerging from the Q4 earnings season was no better or worse than what we had seen in the last few quarters. While that statement is still fairly accurate with respect to guidance and estimate revisions, in some respects the Q4 earnings season is an improvement over the last few quarters.

Specifically, total earnings for the S&P 500 are on track to reach a new all-time quarterly record and even earnings growth for the quarter is in on track to be the highest of the year (even after accounting for easy comparisons). Earnings surprises started off on the weak side, but even those are running at the best pace of the year.

But all of this has done little to impress the market, which has been dealing with the emerging market angst in the evolving post-QE world. My sense is that investors have finally started paying attention to the earnings picture. The picture is definitely not terrible, but it’s not consistent with a stock market that till a few weeks back was making new highs every day either.

Companies have been guiding lower quarter after quarter, prompting earnings estimates to keep moving for almost two years now in only one direction – down. The market didn’t care much about this, with an ever helpful Fed keeping hopes of an eventual earnings ramp-up alive. But the Fed has started to get out of the QE business just as the economic picture has started looking up. Not many people are worried about Europe anymore and few would bet on a hard landing for China despite the Turkish bath for the rest of the emerging market world.

All in all, the economic backdrop had raised hopes that we may finally start seeing positive and reassuring commentary from management teams, which will translate into greater confidence in estimates for 2014 Q1 and beyond. But barring a few exceptions, we are not seeing that, as the overall tone of management guidance still remains negative. What we have seen thus far doesn’t inspire much confidence about the rest of this earnings season.

Estimates for full-year are coming down as well, with total earnings for the year now expected to be up +8.9%, down from +9.1% last week.

The 2013 Q4 Scorecard

With respect to the Scorecard for 2013 Q4, we have seen results from 219 S&P 500 members accounting for 58% of the index’s total market capitalization. Total earnings for these 219 companies are up +12.0% from the same period last year, with 70.8% beating earnings expectations with a median surprise of +3.0%. Total revenues for these companies are up +1.8%, with 51.1% beating revenue expectations with a median surprise of +1.0%.

The +12.0% ‘headline’ total earnings growth rate definitely looks fairly robust, particularly when compared to the growth rate for this same group of 219 companies in the last few quarters. Easy comparisons for three companies – Bank of America (BAC), Verizon (VZ), and Travelers (TRV) – account for a big part of the strong Q4 earnings growth. Exclude these three and total earnings growth for the S&P 500 companies that have reported drops by half. Performance on the revenue front is modestly below what we have been seeing in recent quarters, but not by much.

The composite picture for Q4 – combining the results for the 219 companies that have reported already with the 281 still to come – is for earnings growth of +9.6% on +0.7% higher revenues and 79 basis points higher margins. This will be the highest quarterly growth pace of 2013, with easy comparisons playing a non-trivial role propping up the growth rate. But it’s not all easy comparisons, as total earnings for the index are on track to reach a new all-time quarterly record.

Trends on the estimate revision front have been negative for a while, but we could afford to overlook such details in the Fed-inspired rally. It will be interesting to see if investors will continue to shrug estimate cuts in the post-QE world.

Key Points

- Total earnings for the 219 S&P 500 companies that have reported results are up +12.0%, with 70.8% beating earnings expectations. Revenues for these companies are up +1.8%, with a revenue ‘beat ratio’ of 51.1%.

- Easy comparisons for Bank of America, Verizon and Travelers account for most of the growth thus far. Excluding these three companies, the earnings growth rate drops to +6%, which is comparable to what this same group of companies have achieved in recent quarters. The beat ratios started out weak and are still a tad bit weak relative to recent quarters, but have caught up quite a bit lately.

- Total Q4 earnings for ALL S&P 500 companies, combing the 219 that have reported with the 281 still to come, are expected to be up +9.6%, which reflects +0.7% revenue growth and modest gains in margins. This compares to +5.1% earnings growth in Q3.

- Total earnings in Q4 are on track to reach a new all-time quarterly record, surpassing the record reached just the preceding quarter.

- Easy comparisons, particularly for the Finance sector, account for a big part of the Q4 growth. Total earnings for the Finance sector are expected to be up +25.3%. Excluding Finance, total earnings growth for the S&P 500 drops to +6.4%.

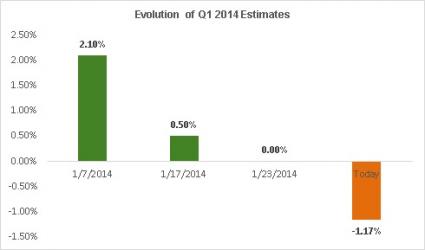

- Guidance has overwhelmingly been negative in recent quarters and the trend has largely remained in place in the Q4 reporting season as well. As a result, estimates for 2014 Q1 and beyond have been coming down as the earnings season has unfolded.