Overnight the US received a major boost for the economy, as GDP for the year exceeded expectations coming in at 2.8%; this despite the recent government shutdown which was forecast to have a major impact on GDP of roughly 0.6% for the quarter. S&P 500 futures reacted accordingly by dropping heavily after touching an all time high.

This drop might leave a few traders scratching their heads, and fair enough. If the economy is doing well why would we see a drop! The flip side of the coin is that the equity markets in their current state have been pumped up by Quantitve easing, and the worry for many traders out there is that once the FED starts to taper quantitative easing it will lead to a sell off in equity markets and index’s.

The possibility of tapering though will come into perspective better tonight when we have the monthly nonfarm payroll report which outlines job growth in the US. It’s expected to be quite weak on the back of uncertainty last month as a result of the government shutdown. However, if it is strong it could certainly lead the FED to talk up the idea of starting tapering as soon as the new year rolls around.

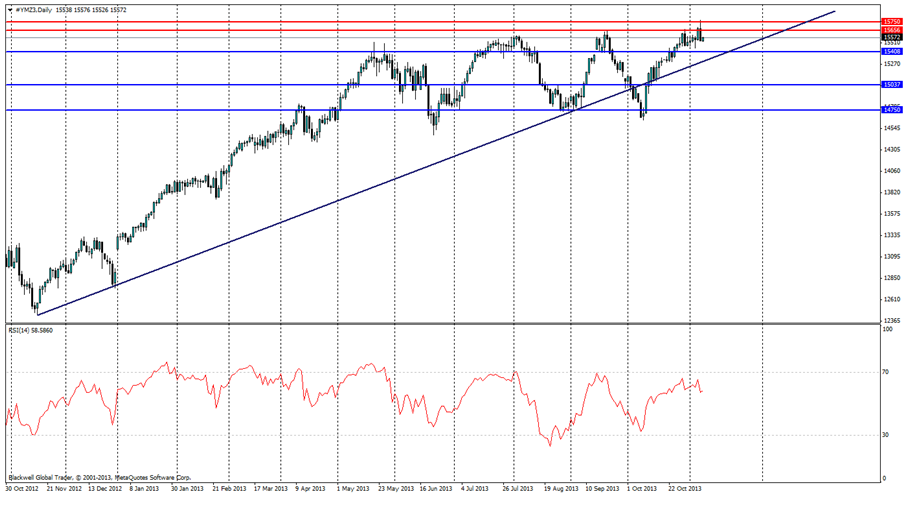

So if we are to see positive job numbers its likely we will see a fall in the index overall. Current resistance levels are very tight at 15656 and 15750, and are unlikely to be tested again in the near term. I believe it's important to watch the current bullish trend line and pay careful attention as the market dips down. The last breakout I believe was an over-stretch for the market, and the RSI show’s it was heavily oversold. Any future break out’s are more a possibility now than before, as the trend line runs close to the current all time high. Any breakout lower would have to break through major support levels at 15408,15037 and 14750. However if it trended through without aggressive overselling and crashed through the 15037 level and then continued lower through 14750 this would signal a bearish trend taking hold in the market. For now though watching tonight’s results will be important especially for the Index traders out there.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P 500: Still Room To Move?

Published 11/08/2013, 02:02 PM

Updated 05/14/2017, 06:45 AM

S&P 500: Still Room To Move?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.