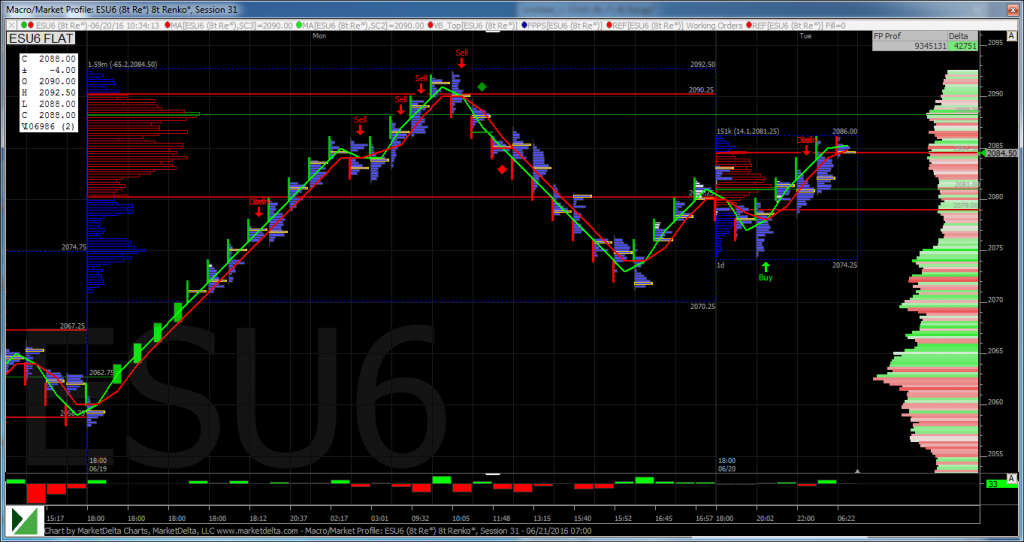

After opening Monday up 25.50 handles at 2084.25, the S&P futures ran up, making a high at 2092.50 in the first hour. From there the index made a series of lower highs and lower lows into the last hour when it plunged lower trading to 2071.25 in the closing minutes. A day that seemed so bright had such a nasty close as it was announced that two Brexit polls would be released at 4:00 pm CST leaving traders unable to buy into the gap-up in a frame of mind to sell as risk would be removed from the table.

After the close two polls were released showing mixed results. What we are gathering from all this is that voters are very uncertain, which creates an uncertain market. But for the moment no one seems to be afraid anymore. There is a large undecided factor, and it seems that as voters in Great Britain are becoming more educated concerning an exit, the move to maintain the status quo is gaining traction. As I said Monday, I suspect there will be a whole pile of headline risk this week. As the Asian markets were an hour from opening last night Morgan Stanley) released a note stating:

“Brexit could push global GDP growth below 3%, re-entering danger zone for global recession (recession threshold 2.5%).”

The ESU jumped up nearly ten handles after the Brexit polls were released and it seems that the “perceived” threats are subsiding. What I don’t know is if the S&P is paying attention as it seems that equity traders just are not concerned about the risks any longer.

Don't Fall In Love

In the U.S., forex brokers are raising leverage minimums this week and even futures brokers are doubling the usual required margin for an entire complex of instruments. Even if equity traders are shrugging off the risk, it seems that risk managers are very much alarmed by the possibilities. How much longer can the S&P hold up as it has once again failed the 2100 level?

I don’t know, but what does seem obvious is that we cannot trade on conviction but rather by what price and volume are telling us. MrTopStep thinks it’s best to limit if not eliminate overnight holdings, to use tight stops and as always, don't fall in love with your positions.

Today we're looking to see if sellers can create a lower high from yesterday and then push to make a lower low. Meanwhile, buyers have to keep a steady grind throughout the day to push the index back to the 2092 area. One thing that was lacking yesterday was any real buy programs, and at the close, the MOC was flat. I think that the institutions are sitting on the sidelines until after the vote. This means that speculation will likely lead to swings in both directions while lacking the large money to provide conviction to these markets. Likely more algo and HFT driven this week than anything else.

Our View: Our view on Tuesday was to sell the early rally then buy late strength, which worked well in theory. Today, I again think that selling the early rally is the best bet without buying the weakness. The market seems to be comfortable with the headline risk and uncertainty, which will eventually catch up to them, and sell stops will be run. We suggest trading smaller and not holding overnight, except on small positions with profit cushions and stops in place.

As always, please use protective buy and sell stops when trading futures and options.