In this past weekend's missive we stated that:

"There is very little doubt that the confirming sell signal will occur by the end of this week, or, early next week at the latest. Enough deterioration has occurred within the market at this point that it is now just a function of time."

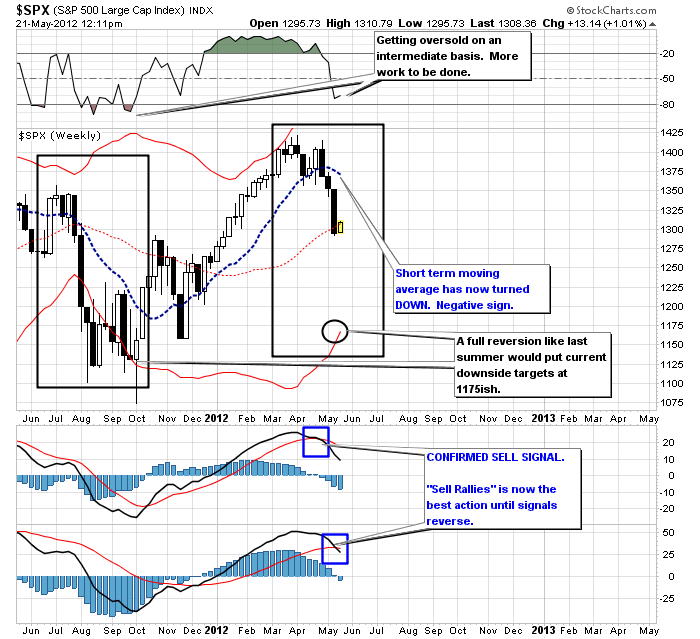

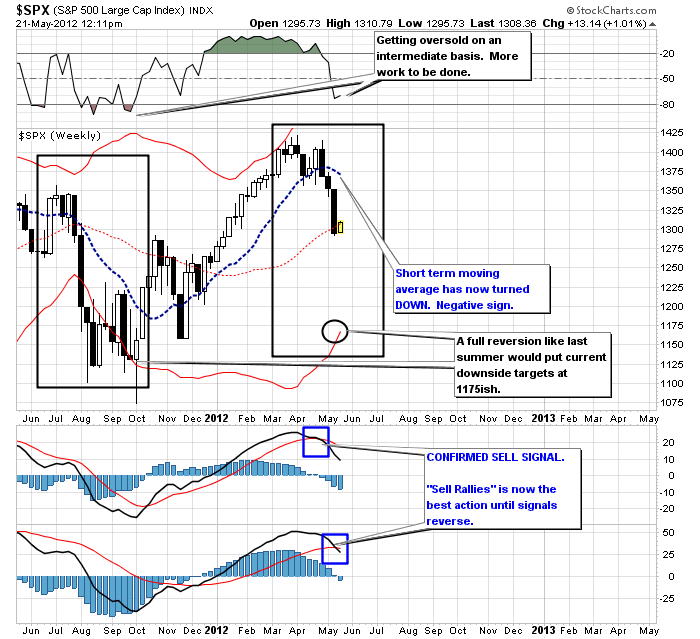

As of yesterday morning the recent initial sell signal was confirmed by a crossover in our longer term indicator as shown in the first chart.

Also, the expected oversold bounce is now officially engaged. This is NOT a buying opportunity — this rally should be used to sell and reduce exposure to portfolio equity risk. Our short term moving average has now turned down, and like last summer, will cross below our long term moving average by July. Last summer the market correction made a full 2-standard deviation correction (black box). In the current market environment a similar 2-standard deviation reversion would take the market to 1175ish today. However, I suspect that the lower band will be closer to 1200 by the time this correction cycle is complete.

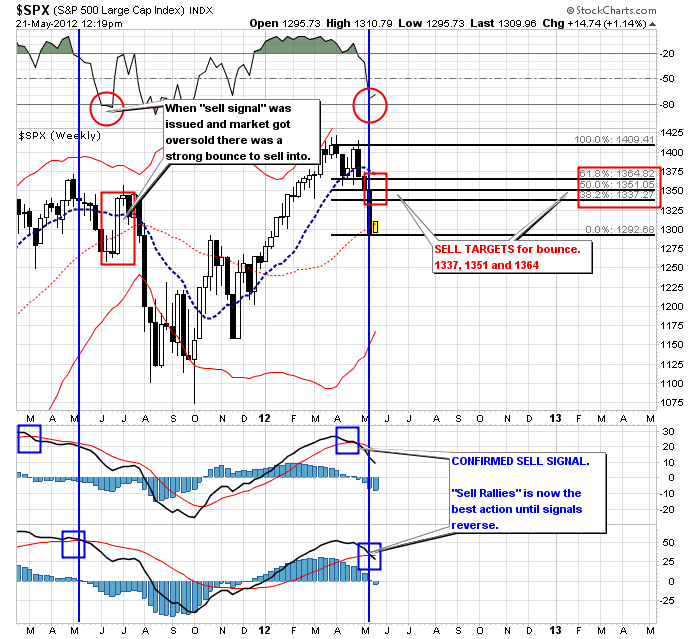

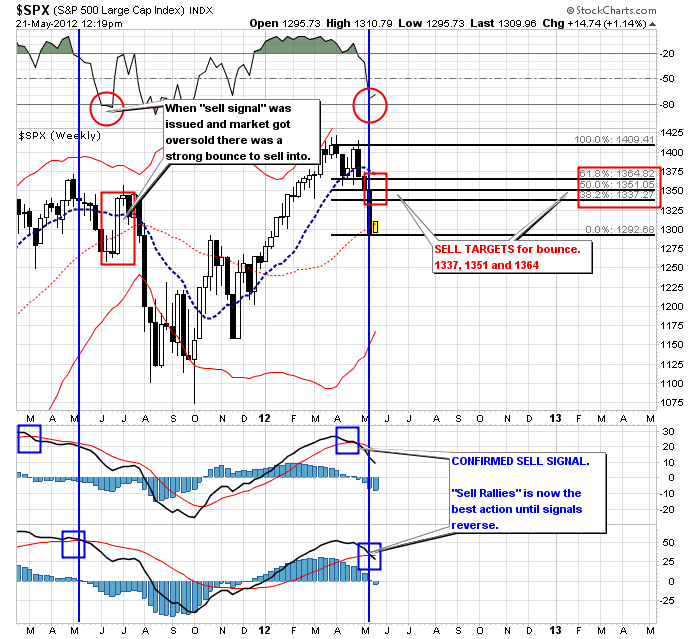

The next chart details the correction process in a little more detail. Last summer after the "confirmed sell signal" was issued the market proceeded to reach "oversold conditions" in a brutal 6 week sell off. The current magnitude of the selloff has likewise gotten the markets to an oversold state which is why, like last summer, we expected a fairly strong countertrend bounce. Currently, using Fibonacci retracement analysis, we can find three potential areas that the bounce could obtain: 1337, 1351, and 1364.

It is important not to become hung up on exact numbers. These are general areas to begin reducing equity exposure during the rally. Begin reducing exposure to equities as the market approaches the first level and continue to do so as the market rally ensues.

As stated this past weekend the guidelines to implement in your portfolio, based on your current position, are as follows:

Situation A) I Am Overweight Equities

1. Reduce equity exposure on any rally to align with model.

2. Sell losers/laggards and rebalance winning positions back to original allocation weightings.

3. Hold cash raised from the liquidation until correction is complete.

4. Raise fixed income allocation to 35% of portfolio.

Situation B) I Am Underweight Equities

1. Keep equity exposure at current levels.

2. On a rally sell losers/laggards completely. Rebalance winning trades back to original allocation weightings.

3. Hold cash until correction is complete.

4. Adjust bonds to 35% of portfolio.

Situation B) I'm All Cash

1. When correction is complete, and the next buy signal is generated, align equity exposure with model.

2. Raise bonds to 35% of portfolio.

The currently rally can fizzle out at any moment. We are walking along a very thin tightrope with Europe with any misstep a potential to rout the financial markets. The easiest path currently for the market is down. Until that changes, which will be indicated by our current "sell" signal reversing, our job is to "sell rallies" and be patient.

Patience is the basis of successful long term investing because in order to be truly successful with your investments in the long term you must have a strong investment discipline to mitigate risks, rational expectations of performance and the patience to wait for the right opportunities to present themselves.

Finally, always remember Warren Buffet's investment rules.

1) Never lose money

2) Refer to rule #1

"There is very little doubt that the confirming sell signal will occur by the end of this week, or, early next week at the latest. Enough deterioration has occurred within the market at this point that it is now just a function of time."

As of yesterday morning the recent initial sell signal was confirmed by a crossover in our longer term indicator as shown in the first chart.

Also, the expected oversold bounce is now officially engaged. This is NOT a buying opportunity — this rally should be used to sell and reduce exposure to portfolio equity risk. Our short term moving average has now turned down, and like last summer, will cross below our long term moving average by July. Last summer the market correction made a full 2-standard deviation correction (black box). In the current market environment a similar 2-standard deviation reversion would take the market to 1175ish today. However, I suspect that the lower band will be closer to 1200 by the time this correction cycle is complete.

The next chart details the correction process in a little more detail. Last summer after the "confirmed sell signal" was issued the market proceeded to reach "oversold conditions" in a brutal 6 week sell off. The current magnitude of the selloff has likewise gotten the markets to an oversold state which is why, like last summer, we expected a fairly strong countertrend bounce. Currently, using Fibonacci retracement analysis, we can find three potential areas that the bounce could obtain: 1337, 1351, and 1364.

It is important not to become hung up on exact numbers. These are general areas to begin reducing equity exposure during the rally. Begin reducing exposure to equities as the market approaches the first level and continue to do so as the market rally ensues.

As stated this past weekend the guidelines to implement in your portfolio, based on your current position, are as follows:

Situation A) I Am Overweight Equities

1. Reduce equity exposure on any rally to align with model.

2. Sell losers/laggards and rebalance winning positions back to original allocation weightings.

3. Hold cash raised from the liquidation until correction is complete.

4. Raise fixed income allocation to 35% of portfolio.

Situation B) I Am Underweight Equities

1. Keep equity exposure at current levels.

2. On a rally sell losers/laggards completely. Rebalance winning trades back to original allocation weightings.

3. Hold cash until correction is complete.

4. Adjust bonds to 35% of portfolio.

Situation B) I'm All Cash

1. When correction is complete, and the next buy signal is generated, align equity exposure with model.

2. Raise bonds to 35% of portfolio.

The currently rally can fizzle out at any moment. We are walking along a very thin tightrope with Europe with any misstep a potential to rout the financial markets. The easiest path currently for the market is down. Until that changes, which will be indicated by our current "sell" signal reversing, our job is to "sell rallies" and be patient.

Patience is the basis of successful long term investing because in order to be truly successful with your investments in the long term you must have a strong investment discipline to mitigate risks, rational expectations of performance and the patience to wait for the right opportunities to present themselves.

Finally, always remember Warren Buffet's investment rules.

1) Never lose money

2) Refer to rule #1