Generally the first three days of the month is when the mutual funds put new money to work, but overall Mondays have not been good and later this week is the January jobs number. We could be in for a hullabaloo of a week.

The Asian markets closed mostly lower and in Europe 6 out of 11 markets are trading lower. This week’s economic calendar includes 26 separate economic reports, 12 T-bill and T-bond auctions and announcements, 6 Fed governors speaking, an abundance of earnings and the January jobs report.

Today’s economic calendar starts out with the motor vehicle report, Gallup U.S. consumer spending measure, ISM mfg index, PMI manufacturing index, construction spending and earnings from several dozen companies.

Our view

China PMI, emerging market currencies, Turkey, Taiwan and Russia are all being affected negatively as the U.S. Federal Reserve continues to taper its monthly bond buying.

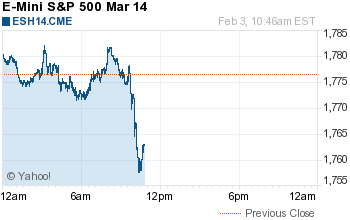

You can see it all over the place in the S&P futures [^GSPC:SNP]. Volatility has picked up and the 10-handle moves in the E-mini [ESH14:CME] have turned into 30- and 40-handle moves. It’s very reminiscent of the early stages of 2007 and we don’t think it’s going to slow anytime soon.

With January historically the worst month for stocks and with 11 months to go, we think it’s obvious what’s going on. After all, “How January goes, so goes the year” is an old market saying that keeps proving true. Lowry Research is saying:

* Jan 13 Short-term conventional sell signal still in force

* All short-term indicators are now deeply oversold

* The recent intense declines suggest that a selling climax may be near

* The question now is whether prices have been driven low enough to attract strong, persistent buying (e.g. a 90% upside day)

We do think it is possible to see some new buying at some point early in the new month. Generally the first three days of the month is when the mutual funds put new money to work.

But overall, Mondays have not been good and later this week is the January jobs number. We could be in for a heck of a week. As for today, we lean to selling rallies; that means 10-handle pops. For now, it seems like the 1791-1794 level is going to be tough to overcome.

As always, please pay attention to the 10-handle rule and please use stops.

- In Asia, 11 of 11 markets closed lower: Shanghai Comp.-0.82%, Hang Seng -0.46%, Nikkei -0.51%

- In Europe, 7 of 11 markets are trading lower: DAX -0.62%, FTSE -0.63%

- Morning headline: “World Stocks Lower Ahead of US Stock Market Open”

- Total volume: 2.39M ESH14 and 18.95K SPH14 contracts traded

- S&P Fair Value: 1776.74 (futures 1777.0 at 7:49 AM ET)

- Economic calendar: Motor vehicle report, Gallup U.S. consumer spending measure, ISM mfg index, PMI manufacturing index, construction spending and earnings from several dozen companies (click for list).

- E-mini S&P 500 1758.75-17.75 - -1.00%

- Crude 98.55-0.22 - -0.22%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 22141.609-106.189 - -0.48%

- Nikkei 225 14619.13-295.4 - -1.98%

- DAX 9203.36-103.12 - -1.11%

- FTSE 100 6477.13-33.31 - -0.51%

- Euro 1.3503