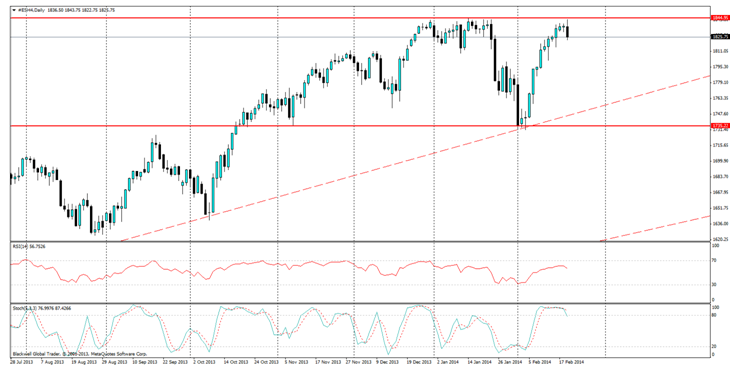

The S&P 500 climbed last night, as it usually does, before sharply pulling back upon touching its ceiling in the market place. It seems the 1845 level is a very strong resistance level and markets do not like the idea of it touching in this current climate. And I don’t blame the markets either, given the conditions currently for tapering and emerging markets being unsettled.

The heavy resistance at the 1845 level is not unusual as the index has constantly tested it since the start of this year as it looks to push 1850 – a level that people see as the next step for the bull market to keep going. Will it get there? I don’t think so, given how sharply markets have sold off when it gets close. One thing that is certain is that opportunities are abound in falling markets, and we could be seeing the beginnings of one.

Resistance is strong, but it's not unjustified. A quick glance at market sentiment with most investing websites or portals will certainly show the vast majority of people are starting to see red in the not too near future. The bounce we recently had to the 1735 support level is seen by many as a precursor before we start to see a bearish market, as people look for a bounce and bulls to push it back up before accepting the fate of the market on the next major fall. Either way, the FOMC meeting minutes today will certainly help push the S&P 500 lower, as board members have remained hawkish over tapering, and want to push through with it still. And now also, if things keep improving in the employment markets, they may also look to raise interest rates.

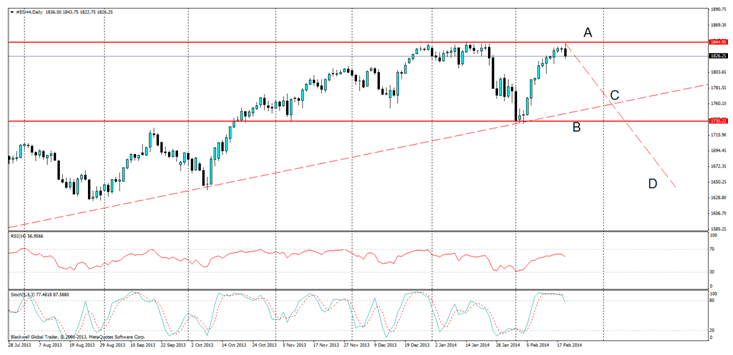

So what are possible scenarios for the S&P 500?

A) A break out through the 1850 level higher

B) A push lower to the 1735 level

C) A drop lower to the trend line before pulling back up.

D) A bearish run on the market through the 1735 level.

Currently I believe that C is the most likely scenario, a drop to the trend line. B is the second most likely followed by D. Overall, A is the least likely of them all. C seems the most likely because markets are unlikely to just plunge, they will look to find levels of support and consolidate before taking a massive dive, unless there is some catalyst for it.

With the advent of tapering and some of the FED members being hawkish in the long run, I see no reason why equity markets can't have a ‘correction’ of significance. Just today, I read that Soros was putting down large put options on the S&P 500 and that carries some weight as well. But for the most part, the resistance is there to stay and looks solid in the current market climate, and I will most likely be watching closely at the prospect of further movements lower.