I am not going to rail against television pundits and anchor that have been fearmongering on the market. Nor will I call out the hordes of negative financial websites that go in search of a reason to sell everyday. I won’t even go after the newsletter writers that blatantly data mine to find a statistic that fits their view of an impending crash. Free pass today.

Today is about facts. Facts from price action, plain and simple. The stock markets are markets because they clear buyers and sellers every micro second at a price. That price is truth. And the history of that price since this latest bull market began in October 2011 has a lot to say. And it is almost all positive.

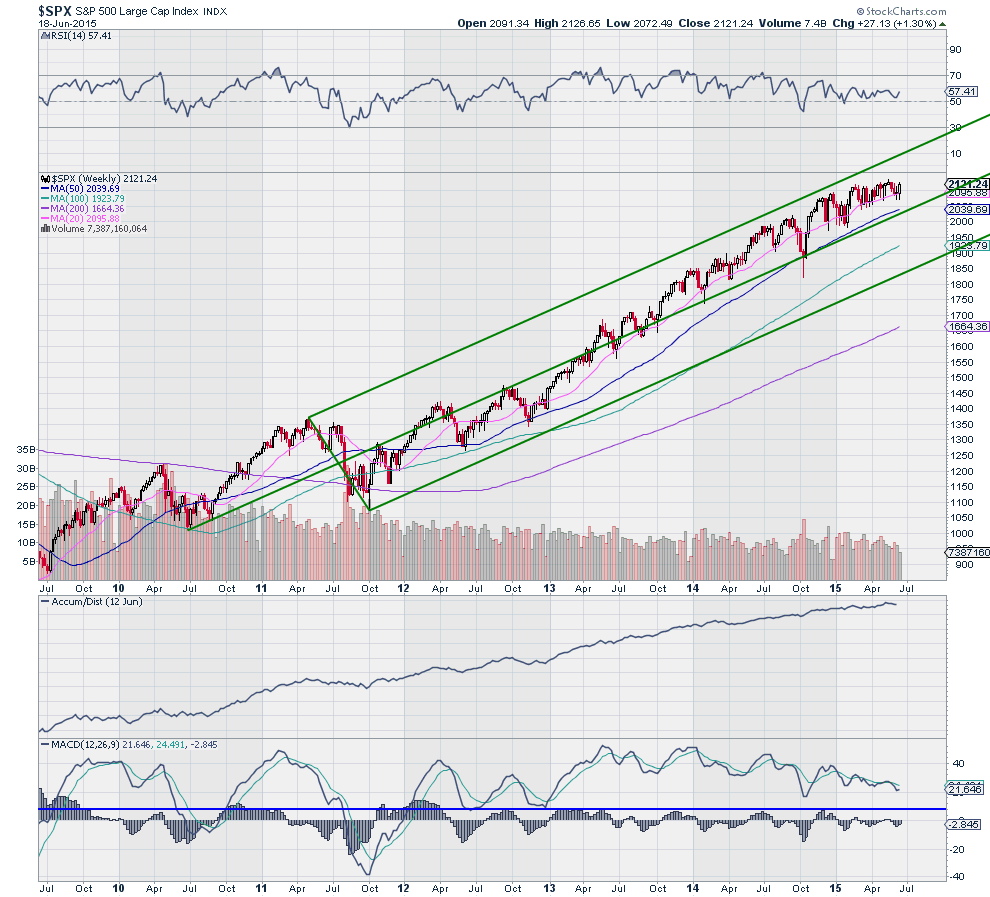

First fact, yes, you read that correctly, the bull market that began in October 2011. From the May 2011 high to the low of the pullback in October was a nearly 22% correction, resetting the bull clock. So the current run is still shy of 4 years.

Next fact. Since that started the trend has been and CONTINUES TO BE higher. The 4 rising and nearly parallel SMA’s attest to this. The Andrews Pitchfork also shows this. A pullback to the Median Line, around 2040 would not even dent the trend.

The momentum indicators are the only spot of a possible disconnect. Nut it only counts if you are looking for an excuse to be nervous. The RSI has been bullish since this bull market began and continues to be bullish. The MACD is positive but what give the nervous Nelly an excuse to yell that the sky is falling is the series of lower highs. But guess what? No significant pullback has occurred while the MACD has been over 8. How do I now this? Just by looking at evidence.

Possibly the most bullish indicator on the chart above (outside of the actual price) is the accumulation/distribution statistic. It just keeps going up.

So do what you want with your news sources be they television, websites or blogs. But if they are giving you their opinion and not just facts understand that what you are consumer is of entertainment value. Nothing more. Value facts, not opinions.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.