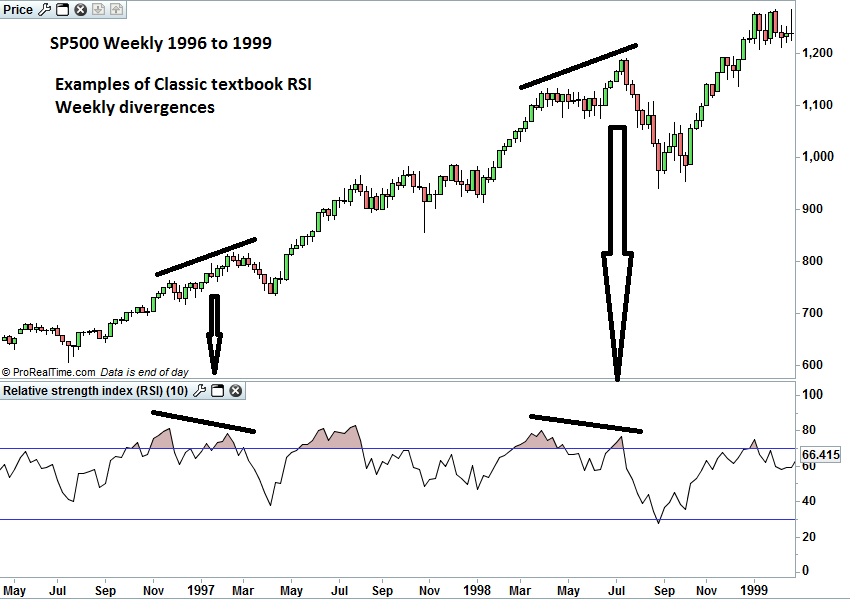

S&P500 is showing a potential topping pattern. This is 'Bearish Weekly Momentum'. What is interesting is this is a classic 'textbook' divergence. We don't see these very often, usually they are far more convoluted.

A 'textbook' divergence would see momentum moving to an extreme high (or low) level as the price of the instrument trends to a new high (or low), then a correction in both price and momentum, with momentum correcting to a level between 50-65 (or 35-50 for a low), followed by a move in price back to a new extreme high (or low) with momentum moving to overbought levels above 70 (or below 30 for oversold) but only able to make a lower peak (or higher trough) than before. Thus momentum fails to confirm the new high in price (or the new low), before correcting again.

Going back over the SP500 over the past 25 years I have only been able to find 3 examples of this (2 at tops and 1 at a base). These can be seen below.