We knew it was going to be fun, and it will continue to be so. As the world anticipates the big VP debate tonight and gears up for Obama's return to the podium and response to being pummeled in his debate last week, the US stock market seems to have reached an intermediate top.

Depending on one's charting preferences, it can be argued, as I've illustrated in this chart, that the S&P 500 has already broken below the trendline support. The long term perspective supports the argument that the market is peaking, although additional upside before the big sell-off is likely.

Barring anything particularly positive and surprising, and especially if the market is disappointed by the election, I think the market is topping. My long term analysis suggests that it should be at or below the two previous peaks in 2000 and 2007, somewhere in the 1525 range. The bottom could be quite low, especially if things really unravel. Based upon the last two sell-offs and what I perceive to be the trend line dating back to 1992 I suggest that bottom would materialize somewhere between 700 and 900.

Of course this is less prediction than observation. As I've written before, I am trying to understand why the market should move higher.

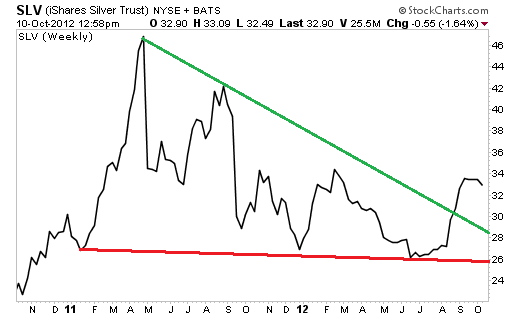

I am long both gold and silver and as written here recently, believe gold will trend higher. Silver should as well, but it is plagued by its industrial uses. Hence it appears a bit schizophrenic at times. I am concerned though for both metals, but especially silver, that in the aftermath of the election we will see a sell-off of silver as a risk asset. If this occurs, I think it will be an opportunity to acquire more and set oneself up for potentially significant gains.

Silver, here the iShares Silver Trust (NYSE: SLV), peaked earlier in 2011 than gold did, but surged in concert with the yellow metal in August 2011. Silver subsequently got pummeled. However, it has recovered nicely in the past month or two.

I think the bottom for SLV would be back to the previous low, around $26.00 per share. That is the worst case scenario. I think economic circumstances will worsen especially if the election goes the way I think it will, not necessarily the way I want it to, but both silver and gold will ultimately rise while the equity markets fall.

Finally, my alter-ego Steve Gunn over at DividendsandIncomeDaily.com wrote an article Tuesday on Chinese railroad operator Guangshen Railway (NYSE: GSH). It's a good piece, if I do say so myself, which was predicated on the dividend and the need for railways in China, slowdown or not. The article was written Monday, and although not published until after the close Tuesday, I'd like to think it is responsible for the stock being up more than 8% in the last two days. Anyway, please check out that article and the others written by the very accomplished and good looking Mr. Gunn.

Until next time...

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P 500 Tops, Silver Ambles, Guangshen Railway Spikes

Published 10/11/2012, 03:56 AM

Updated 07/02/2024, 02:13 PM

S&P 500 Tops, Silver Ambles, Guangshen Railway Spikes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.