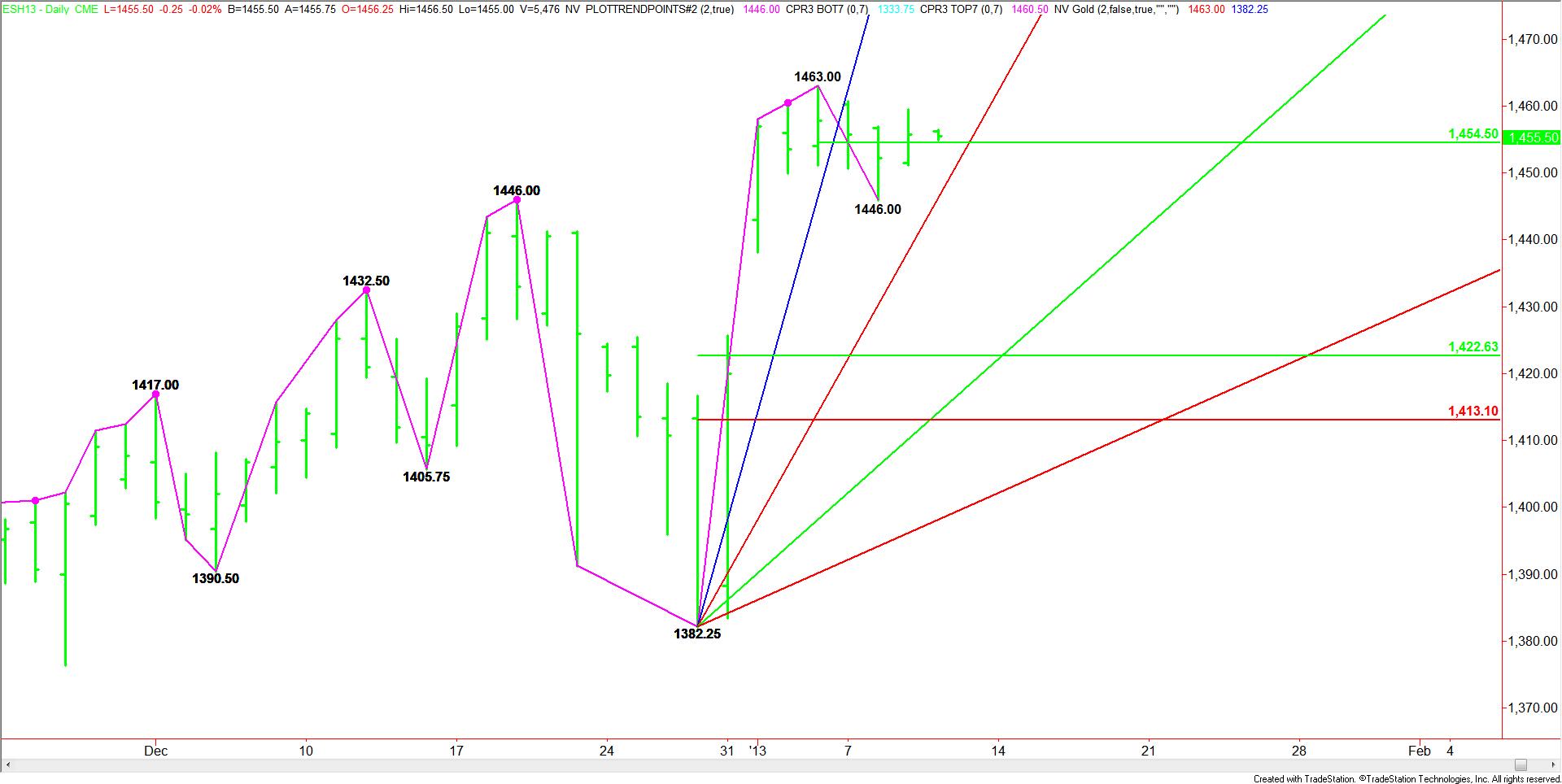

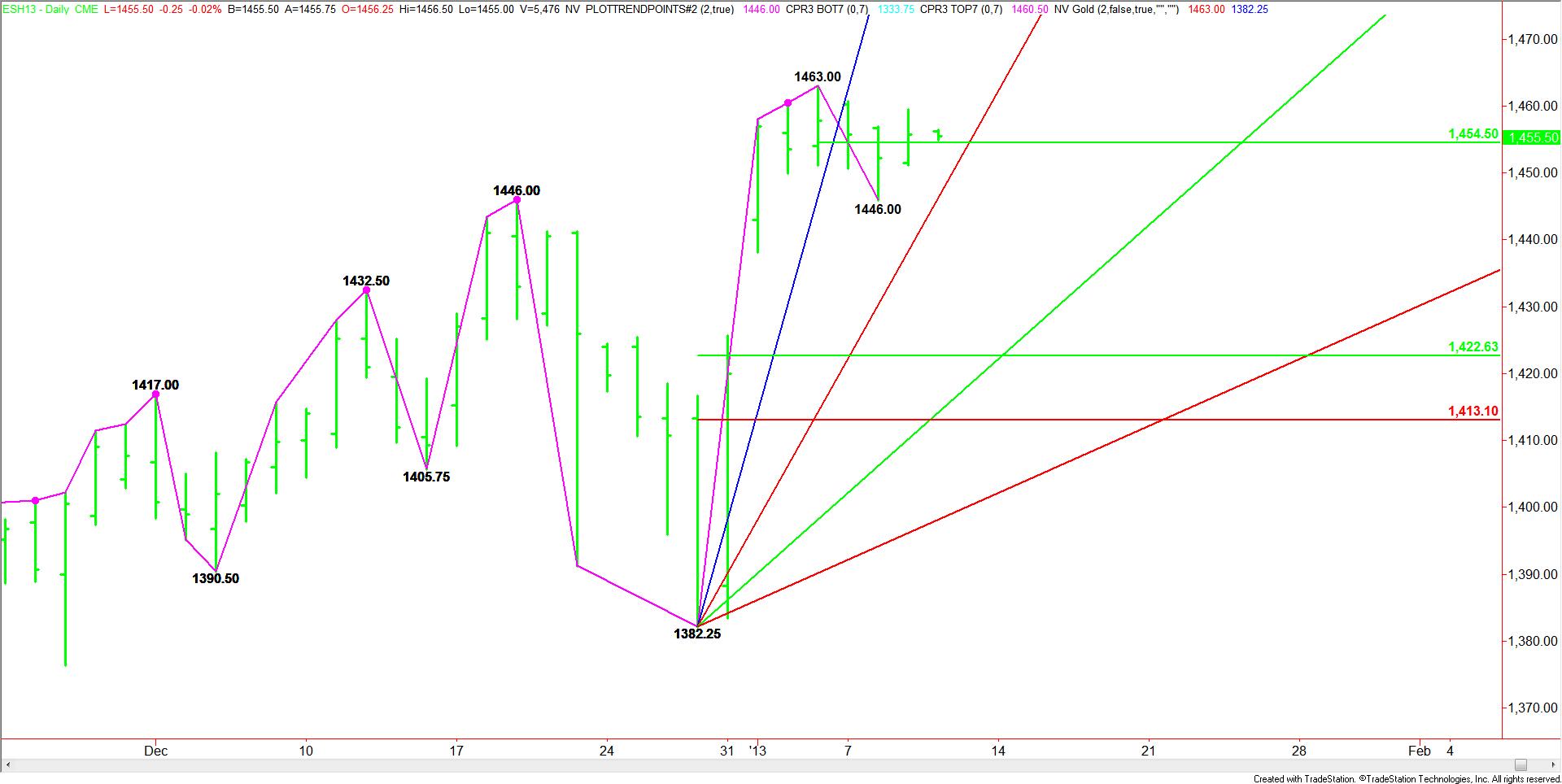

The March E-mini S&P 500 held steady on Wednesday on the heels of solid earnings from Alcoa (AA) and on the outlook for an improving economy. Overbought conditions may have led to the tentative trade, however, as investors still appear to be hesitant about buying strength.

Many factors could be contributing to the current uncertainty. It may be the gap below the market which some technical traders feel has to be filled before the market moves higher. It may be the fear of the unknown since no one is sure what lurks above 1463.00. Fundamentally, there is some uncertainty about the possibility of a prolonged discussion regarding the raising of the U.S. debt ceiling. Any or all of these factors may be combining to keep a lid on prices.

Technically, the main trend is up. The new short-term range is 1463.00 to 1446.00. The mid-point of this range is 1454.50. This price is likely to act like a pivot with the market gaining strength above it and showing signs of weakness below it.

After breaking through a steep uptrending Gann angle four days ago, the logical assumption was for the market to test the next angle. This angle comes in on Thursday at 1446.25. Since it forms a cluster with the minor bottom at 1446.00, traders should watch this zone carefully. Since the main trend is up, the first test of this zone is likely to produce a technical bounce. If sellers can muster enough energy to take control of the market then look for a failure in this zone to trigger an acceleration to the downside.

Based on the longer-term range of 1382.25 to 1463.00, the major downside target remains 1422.75 to 1413.25. This zone is a value-area and should attract strong buying once tested.

Many factors could be contributing to the current uncertainty. It may be the gap below the market which some technical traders feel has to be filled before the market moves higher. It may be the fear of the unknown since no one is sure what lurks above 1463.00. Fundamentally, there is some uncertainty about the possibility of a prolonged discussion regarding the raising of the U.S. debt ceiling. Any or all of these factors may be combining to keep a lid on prices.

Technically, the main trend is up. The new short-term range is 1463.00 to 1446.00. The mid-point of this range is 1454.50. This price is likely to act like a pivot with the market gaining strength above it and showing signs of weakness below it.

After breaking through a steep uptrending Gann angle four days ago, the logical assumption was for the market to test the next angle. This angle comes in on Thursday at 1446.25. Since it forms a cluster with the minor bottom at 1446.00, traders should watch this zone carefully. Since the main trend is up, the first test of this zone is likely to produce a technical bounce. If sellers can muster enough energy to take control of the market then look for a failure in this zone to trigger an acceleration to the downside.

Based on the longer-term range of 1382.25 to 1463.00, the major downside target remains 1422.75 to 1413.25. This zone is a value-area and should attract strong buying once tested.